Asset Management Firms See Strong Performance in 2021

The asset management industry fared well in 2021 against a backdrop of rising markets and improved net inflows. Strong performance in equity markets was a major contributor to this performance. The S&P 500 index was up nearly 30% during the year, suggesting that many asset management firms saw significant increases in AUM driven by market movement and ended the year with assets (and run rate revenue) at or near all-time highs.

As asset management firms are generally leveraged to the market, market movements tend to have an amplified effect on asset management firm fundamentals. Our index of publicly traded asset/wealth management firms reflected this in 2021, with the index generally outperforming the S&P 500 throughout the year and ending the year up just over 30%. While multiples saw modest improvement over this period, much of this outperformance was driven by rising fundamentals.

Our index of asset/wealth management aggregators also improved significantly during 2021, ending the year up nearly 40% driven by strong performance in the underlying businesses in which aggregators invest. Alternative asset managers led the way, however, with this index increasing nearly 90% during 2021 driven by strong net inflows due to increasing investor demand for alternative assets.

Return of Organic Growth

While market movement is often the dominant contributor to changes in AUM over a particular time period, it affects all asset managers in a particular asset class more or less equally and is (to some extent) outside of a manager’s control. Organic growth, on the other hand, can be influenced by the quality of a firm’s marketing and distribution efforts and can be a real differentiator between asset management firms over longer time periods.

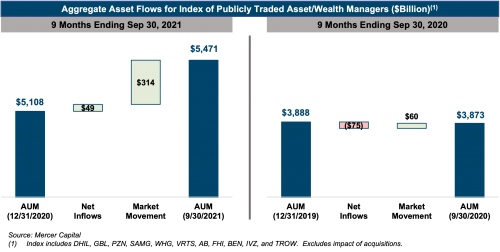

Many asset managers have struggled with organic growth in recent years, in part due to rising fee sensitivity and the influence of passively-managed investment products. Despite these headwinds, organic growth for our index of publicly traded asset/wealth management companies improved modestly during the nine months ending September 30, 2021 relative to the same period in 2020 (see chart below).

In aggregate, these firms saw net outflows of $75 billion during the first three quarters of 2020, compared to aggregate net inflows of $49 billion during the first three quarters of 2021. While this improvement in organic growth is modest in absolute terms, the switch from net outflows to net inflows is a positive sign for the industry, indicating that these firms were able to grow AUM on an aggregate basis even in the absence of market movement.

Fund Flows by Sector

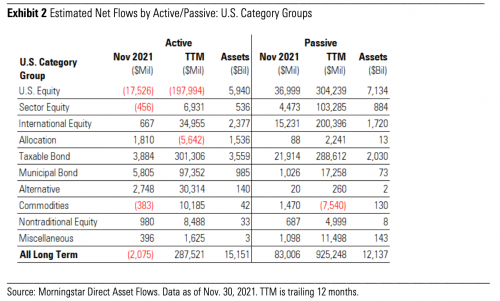

While overall organic growth improved in 2021, there were significant variances by asset class. Fund flow data from Morningstar (table below) shows that total inflows across active funds for the year ended November 30, 2021 were approximately $287 billion (relative to aggregate outflows of $188 billion in 2020). The aggregate inflows in 2021 were concentrated in fixed income, alternative assets, and international equity funds, while US equity funds shed nearly $200 billion in assets over the period. For perspective, all categories of actively managed funds except taxable bonds and municipal bonds saw net outflows in 2020.

Notably, passively managed funds continued to outpace active funds in terms of net new assets in 2021. This trend will likely continue to pose a challenge for many types of active asset managers in attracting new assets.

Improving Outlook

The outlook for asset managers depends on several factors. Investor demand for a particular manager’s asset class, recent relative performance, fee pressure, rising costs, and regulatory overhang can all impact RIA valuations to varying extents. Alternative asset managers tend to be more idiosyncratic but are still influenced by investor sentiment regarding their hard-to-value assets. Aggregators and multi-boutiques are in the business of buying RIAs, and their success depends on their ability to string together deals at attractive valuations with cheap financing and on the performance of the underlying businesses.

On balance, the outlook for asset managers has generally improved with market conditions over the last year. AUM has risen with the market over this time, and it’s likely that industry-wide revenue and earnings have as well. Modest improvements in organic growth are also a positive sign for active asset managers that bodes well for continued strong performance in 2022.

RIA Valuation Insights

RIA Valuation Insights