Asset Management Without a Net

This Time, There Is No Fed “Put”

Dressed for any economic climate: Freightliner is ramping up production of its new Cascadia truck as cyclicals come under pressure (photo c/o Freightliner.com).

When the economic mood soured in 2008, I called an older friend to get his thoughts on the credit crisis and what it would mean. “Jerry” had spent his career running a large heavy truck distributor, and he had visceral experience in more than a few economic cycles. Jerry told me two things on that phone call that have stuck with me.

“My manufacturer’s rep called last week and asked me ‘what would I have to give you to put some of my trucks on your lot.’ I answered: A lobotomy.” Jerry then explained that most people are blinded by their own optimistic leanings to underestimate how bad things can get in a recession, and how long they can last.

As September of 2022 came to a close, asset management is experiencing one of the most challenging years in history.

As September of 2022 came to a close, asset management is experiencing one of the most challenging years in history. Losses are both deep and widespread. The consequence is a tough quarterly letter to pen to investors, a hit to revenue, and an even bigger impact on profitability.

A few notes on where things stand:

- U.S. equities experienced their third straight quarterly loss, which hasn’t happened since 2008.

- The S&P 500 has lost a quarter of its value this year. The Nasdaq is down a third.

- Many indexes hit new lows on September 30.

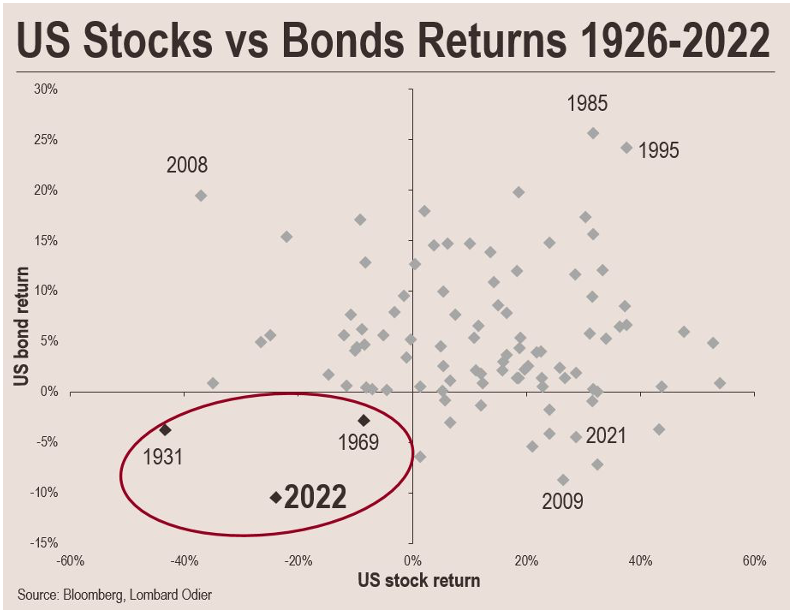

- Bonds are having their worst year since 1976, with the U.S. Core Bond index falling 16% through September 30.

- Asset correlations are high, leaving no path for escape through diversification. The classic 60/40 portfolio is said to be having its worst year since 1980. Even TIPS (Treasury Inflation Protected Securities) are down YTD.

- 30-year U.S. mortgage rates are hovering around 7% for the first time since before the credit crisis.

- The U.S. dollar has surged against other major currencies, eclipsing parity with the euro and threatening parity with the British pound. The dollar has also blasted through previous resistance levels with the Japanese Yen and the Chinese Yuan.

- Currency fluctuations are straining economies and asset prices globally.

The breadth of the financial market strain is not without precedent, but you have to look far back to find a market as bad or worse for so many investors. Asset correlation was a tremendous issue in the credit crisis, and this bear market is seeing deep drawdowns across most asset classes. This doesn’t bode well for industry margins, as AUM declines coupled with fee pressure hit revenues, and inflationary increases in RIA expenses don’t offer a cushion for profitability.

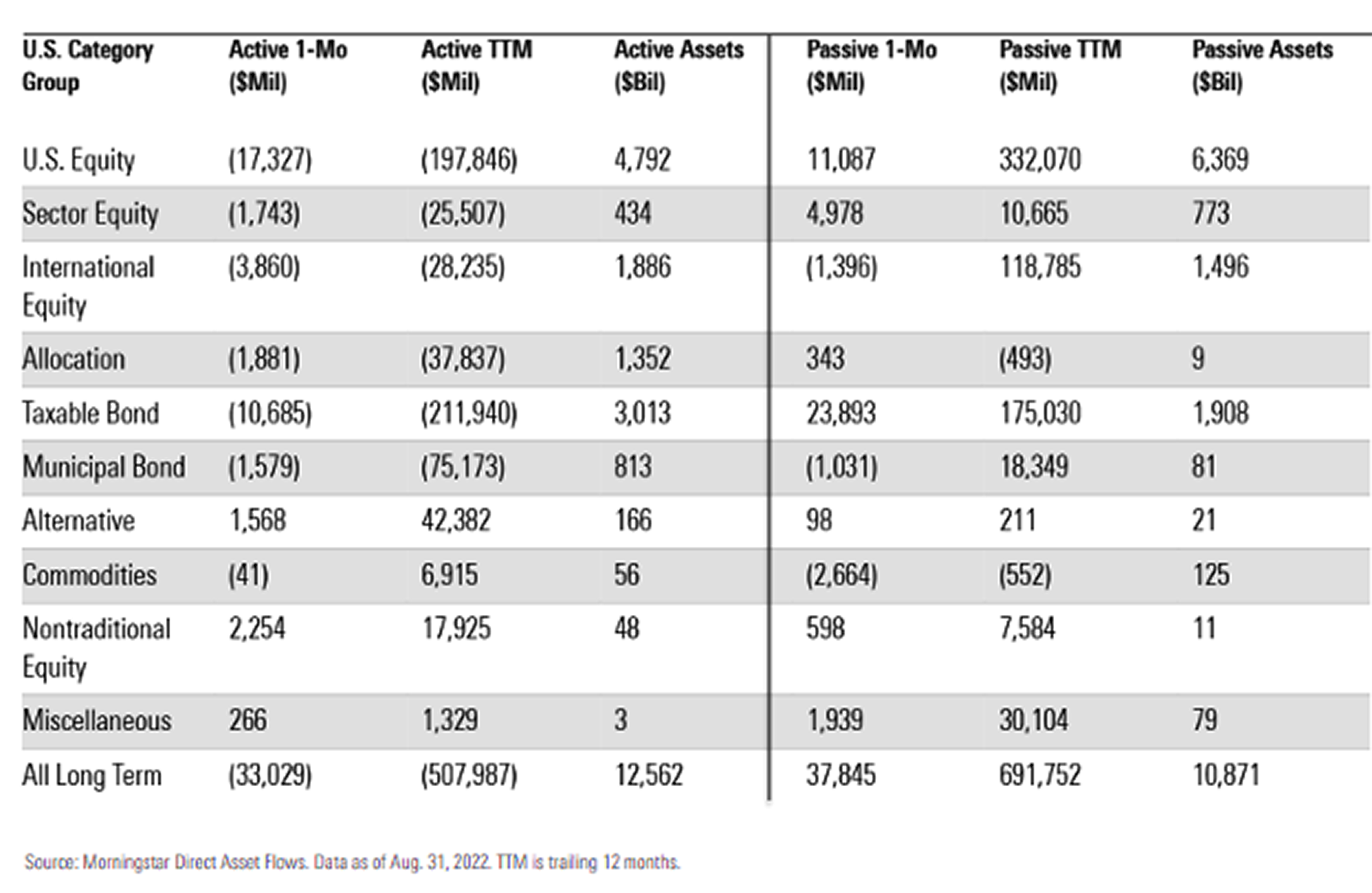

According to Morningstar, U.S. fund flows have been net negative so far in 2022, after a reasonably strong performance in 2021. Risk asset flows like equity and high yield have been hit particularly hard, both domestic and foreign. With a few exceptions active funds continued to lose AUM to passive funds, after better performance in 2021. Fixed income has lately been attracting more AUM than we’ve seen in recent memory, as the risk-off mood of the market manifested in asset rotation. Also for the first time in recent memory, there appears to be a pivot from growth to value.

One bright spot for asset managers in 2022 is that many more active managers are beating passives. So far in 2022, Morningstar reports that nearly two-thirds of large cap value PMs are beating the Russell 1000 value index, and just over half of large blend managers are beating the S&P 500. Unfortunately, this “beat” means being less down than the index, and despite the win passive strategies are having more success in attracting funds.

Perhaps the best metaphor for the moment is a video of Cathie Wood, CEO of Ark Invest, offering an open letter to the Federal Reserve. Wood accused the Fed of misappropriating data to rationalize policy errors which she believes will over-correct and cause damaging deflation. Wood has personal experience with asset deflation; her Ark Innovation Fund (ARKK) ended the third quarter with a year-to-date loss of more than 60%.

Unfortunately for Wood and others who worry the Fed is moving too far, too fast, Fed Chair Jerome Powell has repeatedly stated that the Federal Reserve understands the damage potentially caused by their rapid increase in short term interest rates, but that they think it’s worth it to contain inflation. In other words, no matter how far asset prices fall, this time there will be no Fed “put.”

RIA Valuation Insights

RIA Valuation Insights