Asset Manager and Mutual Fund Valuations Continue their Decline through Year-end

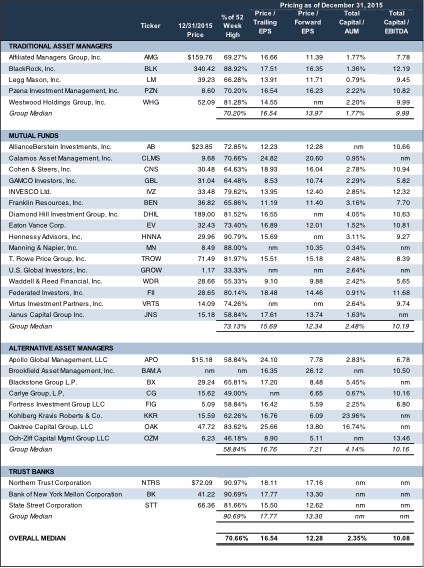

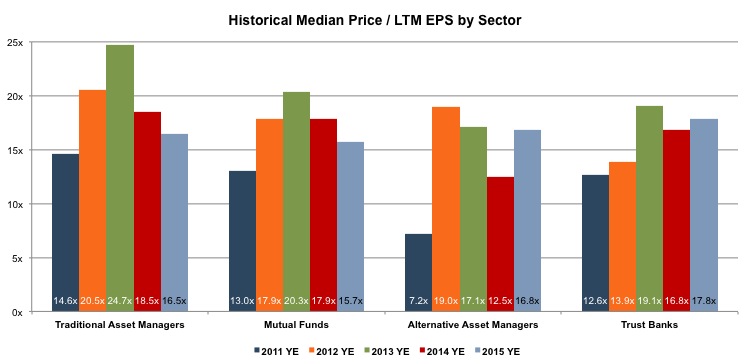

A quick look at year-end pricing of publicly traded asset managers reveals a continued skid in multiples for traditional RIAs and mutual funds with modest advancement for the alternative managers and trust banks.

Earnings multiples are essentially a function of risk and growth, so a decline in cap factors for the traditional managers and mutual funds means one of two things must be happening: either the cost of capital is increasing or the growth outlook for asset managers is stalling. Despite the Fed’s recent actions, WACC’s are generally declining in most industries. There is no reason to assume the cost of capital is now higher in asset management than a year or two ago, so the trend in multiples suggests that the growth outlook for RIA earnings continues to be revised downward.

Given that traditional asset managers and mutual funds are so highly levered to market conditions, some consider RIA valuations as a de facto futures contract on the broader indices. If that’s the case, a continued contraction in multiples could portend a pullback or lack of upside for the stock market in general. The market activity on the first trading day of this year tends to confirm this suspicion.

Since most of the group is currently trading at a 30% discount to their 52 week high, the market is clearly bearish on the prospects for many of these businesses moving into the new year. Meanwhile, more optimistic investors will view this as a buying opportunity for companies that have gotten a lot cheaper in recent months.

Mercer Capital’s RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry.

RIA Valuation Insights

RIA Valuation Insights