Asset Managers Underperform the S&P

Tariff Meltdown Presents Opportunity

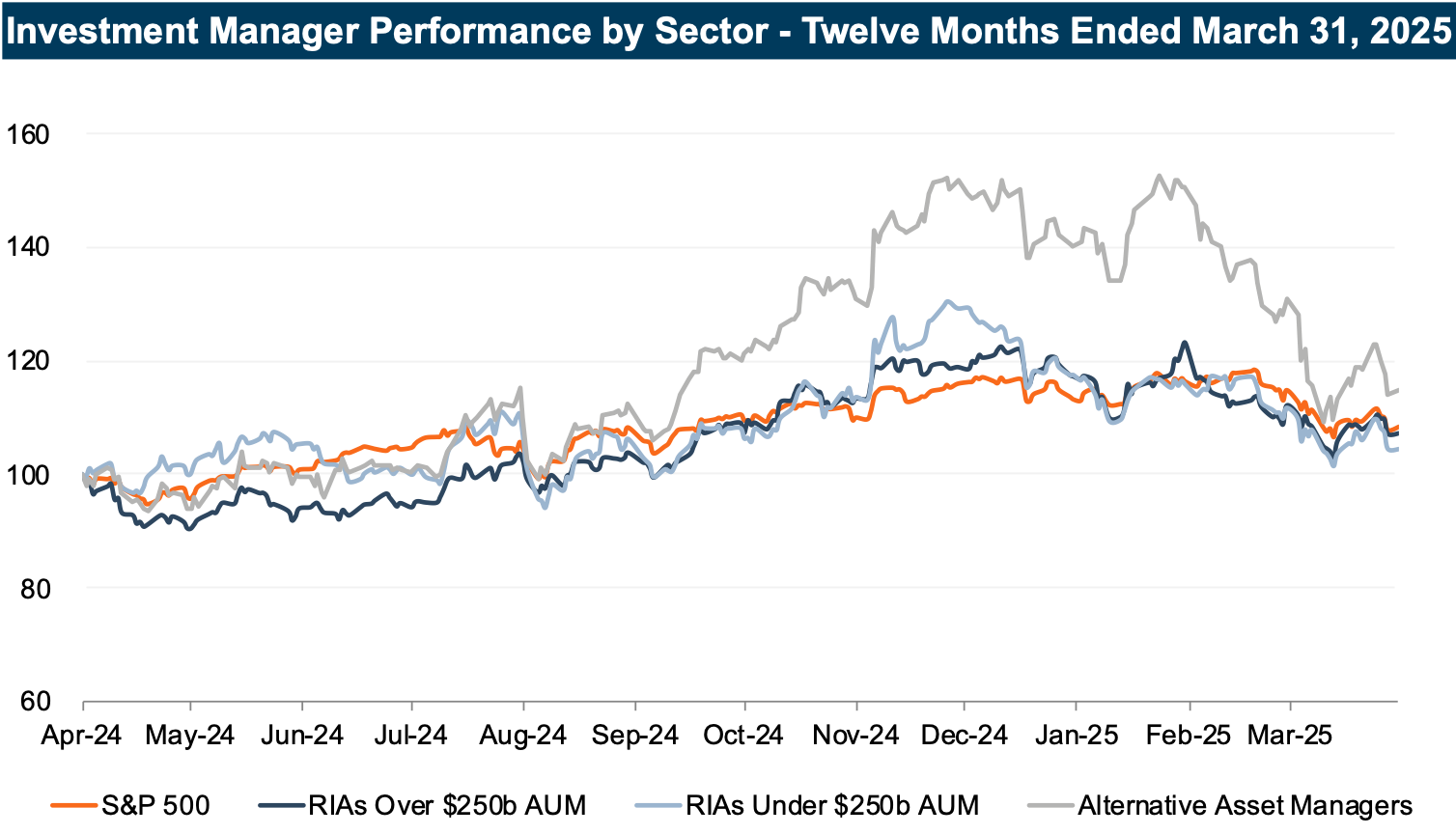

Amid stabilizing interest rates and inflation, the asset management industry (and the stock market as a whole) experienced moderate growth over the past year. Our index of publicly traded asset management firms generally tracked the movement in the broader market, with stock prices for smaller asset managers (AUM under $250 billion) up 4.4% and large asset managers (AUM over $250 billion) up 7.2% over the year ended March 31, 2025, while the broader market (S&P 500) was up 8.5%. Alternative asset managers performed particularly well, as we discussed in a recent blog post.

Changes in Fundamentals

While market movement is often the dominant contributor to AUM changes over a particular period, it’s a variable that’s largely outside a manager’s control. On the other hand, organic growth can be influenced by the quality of a firm’s marketing and distribution efforts and can be a real differentiator between asset management firms over longer periods.

Many asset managers have struggled with organic growth in recent years, partly due to rising fee sensitivity and the influence of passively managed investment products. However, the bull market has offset these headwinds to organic growth. As underlying equities grow in value, products offered by asset managers grow in value, and thus, the base on which fees are collected increases. As such, market growth has been the primary driver of AUM growth for asset managers during this time period.

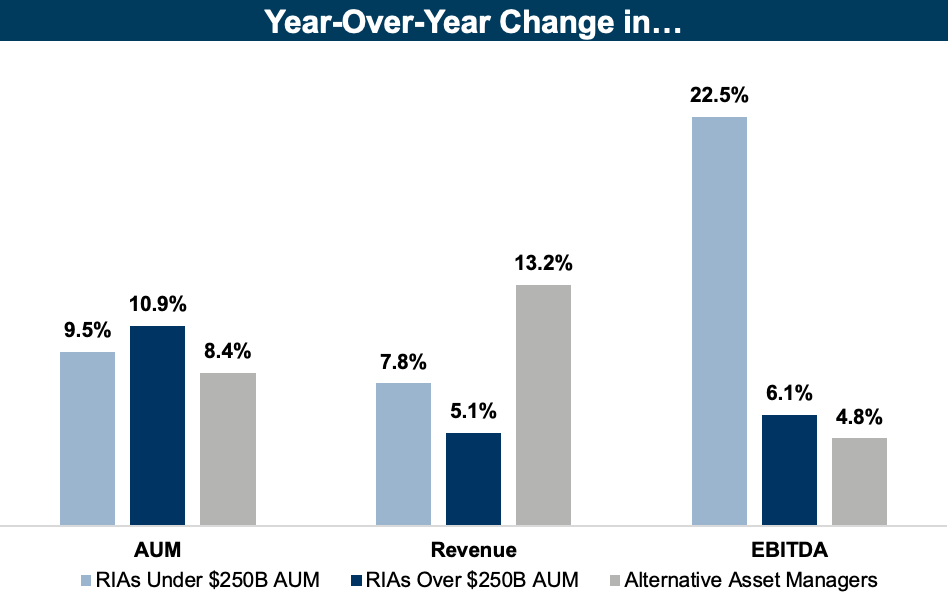

The graph below demonstrates the AUM, revenue, and EBITDA growth among publicly traded RIAs for the twelve months ended March 31, 2025.

Although much of AUM growth has been driven by factors outside of asset managers’ control in recent years, companies have some control over the pricing of products and company cost structure. An asset manager’s ability to convert managed assets to distributable cash flow to shareholders depends not just on their ability to track an index but also on their ability to run a company. As shown above, the smallest public RIAs (those with AUM under $250B) boasted earnings growth well in excess of their larger peers despite slightly lower AUM growth.

Outflows from Active Funds Moderate

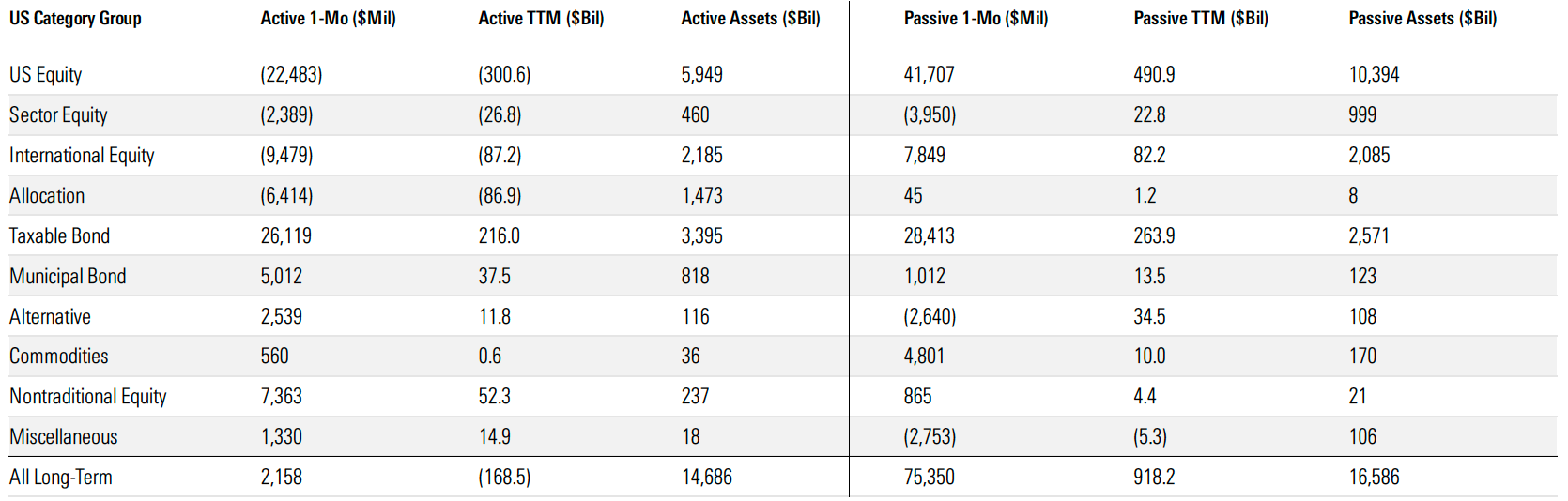

While asset managers generally saw net inflows over the past twelve months, there were significant variances between active and passively managed funds. Fund flow data from Morningstar (table below) shows that total outflows across active funds for the year ended February 28, 2025, were approximately $168.5 billion. The aggregate outflows over the past year were most severe for U.S. equity, international equity, and allocation funds, with these asset classes shedding a combined $474.7 billion in assets. On the other hand, actively managed fixed income, commodity, and alternative investment funds generally experienced inflows on par with passively managed funds of the same category.

Passively managed equity funds continued to outpace active funds in terms of net new assets over the past year. The Morningstar data shows that total inflows across passively managed funds for the year ended February 28, 2025, were approximately $918.2 billion, with nearly all asset classes reporting net inflows. Over the past year, investors have demonstrated a preference for passively managed equity funds but a relative indifference between active versus passive management for other asset classes.

Click here to expand the image above

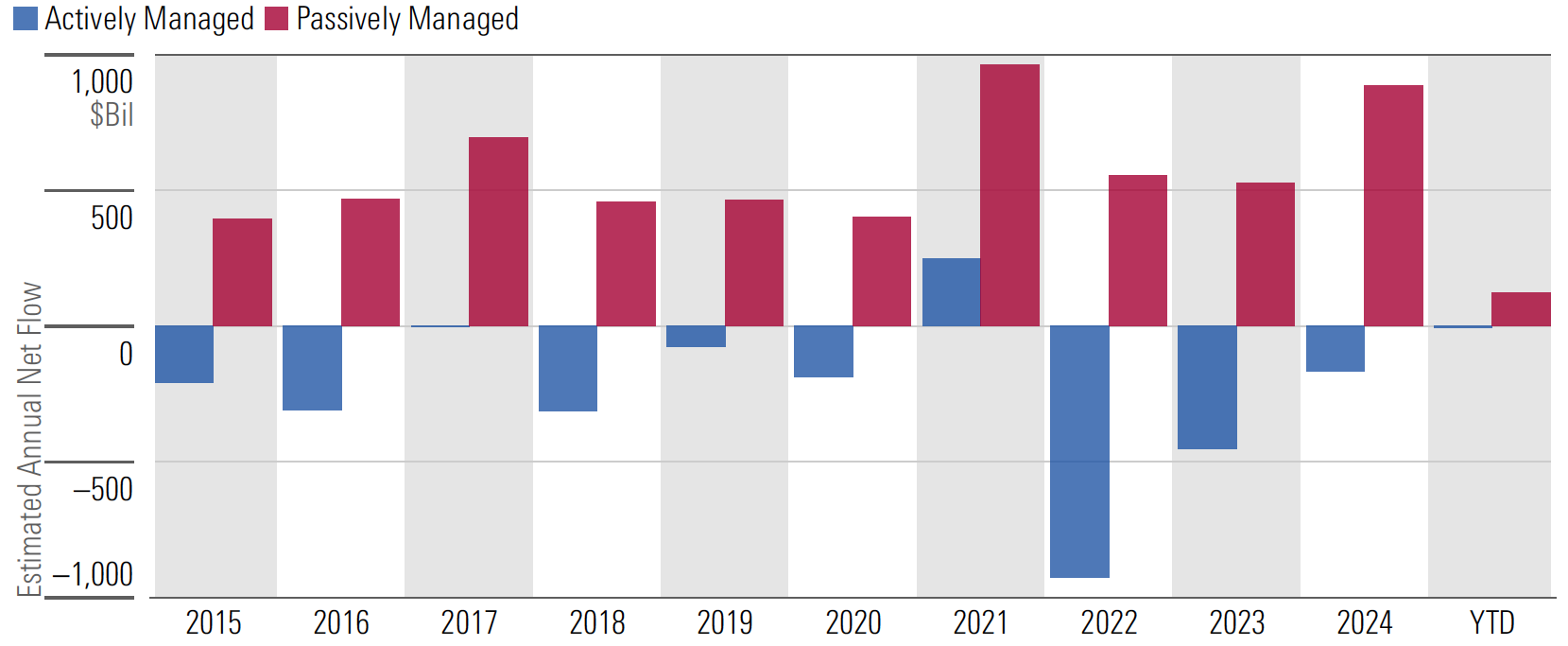

As presented in the following chart, the trend towards passive management isn’t a fad — it’s supported by long-term data. Certain years, such as 2022, particularly disfavored active managers. However, even in years with net inflows to actively managed funds, passively managed funds experienced stronger inflows. The relative underperformance of active managers, when compared to their benchmarks over the past ten years, has driven investors to low-fee passive funds. This trend continues to pose a challenge to asset managers with index-based products, which public managers have replicated at a lower fee rate. The recent movement of assets toward certain categories of actively managed funds would suggest that offering fixed income and alternative investment products presents an opportunity for active managers to capture market share.

Outlook: Tariffs Shock an Otherwise Steady Market

The outlook for asset managers depends on several factors. Investor demand for a particular manager’s asset class, recent relative performance, fee pressure, rising costs, and regulatory overhang can all impact RIA valuations to varying extents. Alternative asset managers tend to be more idiosyncratic but are still influenced by investor sentiment regarding their investments. As inflation and interest rates have stabilized (for now), speculators have turned their attention to American trade policy.

Recent tariff announcements have instigated a market drawdown as investors brace for an ongoing trade war. Mass sell-off of T-bills has led to volatility in the bond market, which has traditionally been seen as a haven during uncertain equity markets. As I write this in the second week of the quarter, it’s impossible to predict how markets will look over the coming weeks. In the short term, a cheaper equity market will reduce the base on which asset managers collect revenue, which will prospectively decrease revenue. As the dust settles, we will examine the Q2 asset manager performance in our July market update.

Many asset managers depend on a market outside their control to influence AUM growth. In times like these, RIAs would be wise to focus on what they can control. Understanding the drivers of firm value can help ensure the business is on track for success. Establishing a sound succession plan can provide a competitive advantage over peers.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, PE firms and alternative managers, and related investment consultancies.

RIA Valuation Insights

RIA Valuation Insights