Asset / Wealth Management Stocks See Mixed Performance During Third Quarter

After a Strong Summer, Public Asset Managers See Stock Prices Dip as Market Pulls Back in September

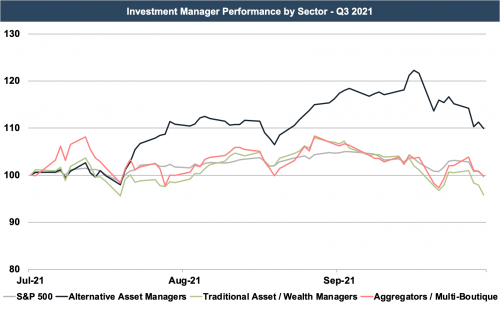

RIA stocks saw mixed performance during the third quarter amidst volatile performance in the broader market. In September, the S&P 500 had its worst month since March 2020, and many publicly traded asset and wealth management stocks followed suit.

Performance varied by sector, with alternative asset managers faring particularly well over the last quarter. Our index of alternative asset managers was up 10% during the quarter, reflecting bullish investor sentiment for these companies based in part on long-term secular tailwinds resulting from rising asset allocations to alternative assets.

The index of traditional asset and wealth managers declined 4% during the quarter, with performance reflecting the pullback in the broader market. RIA aggregators experienced a volatile quarter, but ended flat relative to the prior quarter end. The performance of RIA aggregators may be reflective of mixed investor sentiment towards the aggregator model. While the opportunity for consolidation in the RIA space is significant, investors in aggregator models have expressed mounting concern about rising competition for deals and high leverage at many aggregators which may limit the ability of these firms to continue to source attractive deals.

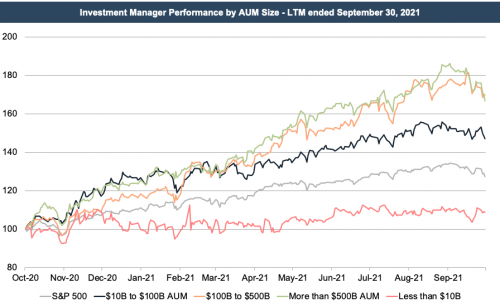

Performance for many of these public companies continued to be impacted by headwinds including fee pressure, asset outflows, and the rising popularity of passive investment products. These trends have especially impacted smaller publicly traded asset managers, while larger scaled asset managers have generally fared better. For the largest players in the industry, increasing scale and cost efficiencies have allowed these companies to offset the negative impact of declining fees. Market performance over the last year has generally been better for larger firms, with firms managing more than $100B in assets outperforming their smaller counterparts.

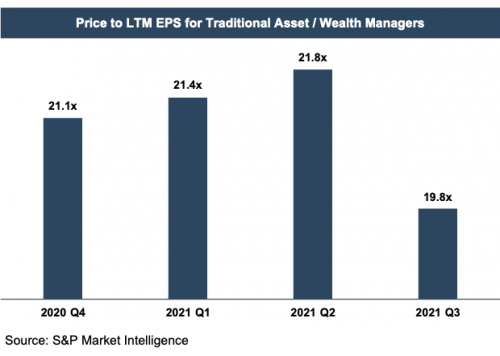

As valuation analysts, we’re often interested in how earnings multiples have evolved over time, since these multiples can reflect market sentiment for the asset class. After steadily increasing over the second half of 2020 and first half of 2021, multiples pulled back moderately during the most recent quarter, reflecting the market’s anticipation of lower or flat revenue and earnings as the market pulled back and AUM declined.

Implications for Your RIA

The value of public asset and wealth managers provides some perspective on investor sentiment towards the asset class, but strict comparisons with privately-held RIAs should be made with caution. Many of the smaller publics are focused on active asset management, which has been particularly vulnerable to the headwinds such as fee pressure and asset outflows to passive products. Many smaller, privately-held RIAs, particularly those focused on wealth management for HNW and UHNW individuals, have been more insulated from industry headwinds, and the fee structures, asset flows, and deal activity for these companies have reflected this.

The market for privately held RIAs has remained strong as investors have flocked to the recurring revenue, sticky client base, low capex needs, and high margins that these businesses offer. Deal activity continues to be significant, and multiples for privately held RIAs remain at or near all time highs due to buyer competition and shortage of firms on the market.

Improving Outlook

The outlook for RIAs depends on several factors. Investor demand for a particular manager’s asset class, fee pressure, rising costs, and regulatory overhang can all impact RIA valuations to varying extents. The one commonality, though, is that RIAs are all impacted by the market.

The impact of market movements varies by sector, however. Alternative asset managers tend to be more idiosyncratic but are still influenced by investor sentiment regarding their hard-to-value assets. Wealth manager valuations are somewhat tied to the demand from consolidators while traditional asset managers are more vulnerable to trends in asset flows and fee pressure. Aggregators and multi-boutiques are in the business of buying RIAs, and their success depends on their ability to string together deals at attractive valuations with cheap financing.

On balance, the outlook for RIAs has remained strong despite volatility over the prior quarter. AUM remains at or near all-time highs for many firms, and it’s likely that industry-wide revenue and earnings are as well. Given this backdrop, many RIAs are well positioned for strong financial performance in the fourth quarter.

RIA Valuation Insights

RIA Valuation Insights