Bull Markets Breed Complacency for Investors AND RIA Management Teams

Know Why Your Firm is Growing

No substitute for paying attention (photo from daimler.com).

Forty-three years ago, Mercedes Benz began offering anti-lock brakes as an option on its top-end S-class sedan. ABS had been the norm for commercial airliners and some commercial vehicles for years, but it took considerable development from supplier Bosch to make the feature “affordable” for passenger cars (equivalent to about $4500 today). Anti-lock brakes improved stopping distances in hard braking and wet conditions dramatically. Initially, however, it also increased the accident rate.

As with “self-driving” or semi-autonomous features being developed today like automatic braking and lane-keeping, the early days of ABS found Mercedes owners a little too secure in the capabilities of their vehicles. Overconfidence leads to complacency, and complacency leads to accidents. Long before Tesla drivers were photographed asleep in their moving vehicles, Mercedes drivers were rear-ending cars (because they overestimated their brakes) and getting rear-ended (because they overestimated the brakes of the car behind them).

The speed with which equity markets have recovered over the past year has the potential to lead to a similar level of complacency, and RIA management teams would be well advised to keep both hands on the wheel.

The risk we not infrequently see is that lengthy periods of strong market performance necessarily lead to upward trends in AUM and revenue that mask underlying problems. Just as institutional asset management clients learned decades ago to evaluate portfolio performance on a relative basis, rather than absolute return, RIA management teams need to look a step or two beneath the surface to understand why their firm is growing.

Gauging performance for an RIA is often thought of in terms of the portfolio, particularly for product companies that specialize in particular strategies. Even though performance, in theory, should drive AUM flows, capital markets are fickle, and so can be customer behavior. So, we prefer to start with a decomposition of AUM history, and then explore the “why” from there.

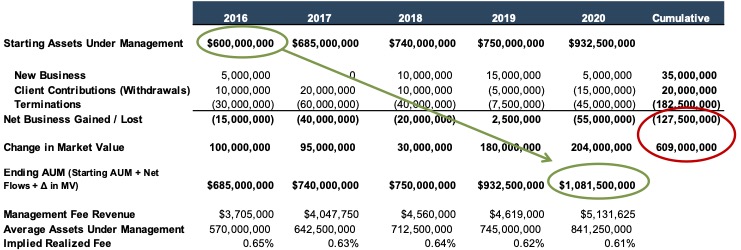

Consider the following dashboard that breaks down the revenue growth of an example RIA. Over a five-year period, this RIA boasted aggregate revenue growth of nearly 40%, increasing from $3.7 million to $5.1 million. AUM growth was even more substantial, nearly doubling from $600 million to $1.1 billion. Revenue grew every year, which would lead one to have great confidence in the future of the firm.

Looking deeper, though, we notice a couple of unsettling trends. The five-year period of measurement, 2016 through 2020, represents a bull market from which this RIA benefited substantially. Cumulative gains from market value were over $600 million, more than the total growth in AUM and masking the loss of clients over the period examined (net withdrawals and terminations of over $100 million). Markets cannot always be counted on for RIA growth, so client terminations, totaling $183 million over the five-year period, or nearly one-third that of beginning AUM in 2016, is cause for concern. This subject RIA only developed $35 million in new accounts over five years, and we notice what appears to be an accelerating trend of withdrawals from remaining clients.

Further, there appears to be loss in value of the firm to the marketplace. Realized fees declined four basis points over five years. Had the fee scheduled been sustained, this RIA would have booked another $336 thousand in revenue in 2020, all of which might have dropped to the bottom line. Small changes in model dynamics have an outsized impact on profitability in investment management firms, thanks to the inherent operating leverage of the model. But the materiality of these “nuances” can be lost in more superficial analysis of changes in revenue or changes in total AUM.

So, we would ask, what’s going on? Did this RIA simply ride a rising market while neglecting marketing? Are clients concerned about something that is causing them to leave? Does this RIA suffer from more elderly client demographics that accounts for the runoff in AUM? If the RIA handles large institutional clients, did some of those clients rebalance away from this strategy after a period of outperformance? Is their realized fee schedule actually declining, or is it not? Is the firm negotiating fees with new or existing clients to get the business? Did a particularly lucrative client leave? What is happening to the fee mix going forward?

Decomposing changes in revenue for an investment management firm can prompt a lot of questions which say more about the performance of the firm than simply the growth in revenue or AUM. Yet when we ask for this information from new clients, it isn’t unusual for us to hear that they don’t compile that data. All should. Some drivers have too much confidence in new technology, and some RIA managers have too much faith in the upward lift of the market. The risk to both is the same: ending up in the ditch.

RIA Valuation Insights

RIA Valuation Insights