Buy-Sell Agreement Basics for Wealth Managers

The Importance of Buy-Sell Agreements for Wealth Management Firms, and Why It Might Be Time To Revisit Yours

Over the next several weeks, we will be publishing a series of blog posts discussing the importance of buy-sell agreements and other adjacent topics for RIA owners. Ownership is perhaps the single greatest distraction for advisors looking to grow with their firm, but it can also be an opportunity to align interests and ensure continuity of the firm in a way that is accretive for the firm’s founders, next generation management, and clients. As highlighted in the Charles Schwab 2021 RIA Benchmarking Study, planning for a successful transition of ownership — whether through internal succession or a strategic sale – continues to be a key differentiator among top RIA performers.

Most wealth management firms are closely held, so the value of the firm is not set by an active market. They are typically owned by unrelated parties, whereas closely held businesses in other industries are often owned by members of the same family. In recent years, the profitability and value of many wealth management firms have increased substantially as assets under management have risen with the markets and a proliferation of capital aimed at the wealth management sector has bid up multiples. As a result of these dynamics, there is usually more than enough cash flow to fund the animosity when disputes arise, and what might be a five-figure settlement in some industries is a seven-figure trial for an RIA.

Avoiding expensive litigation is one reason to focus on your buy-sell agreement, but for most firms, the more compelling reasons revolve around transitioning ownership to perpetuate the firm and provide liquidity for retiring partners. Clients increasingly seem to ask us about business continuity planning—and for good reason. In times of succession, tensions can run high. Having a clear and effective buy-sell agreement is imperative to minimizing costly and emotional drama that may ensue in times of planned or unplanned transition.

Buy-Sell Agreement Basics

Simply put, a buy-sell agreement establishes a process by which shares of a private company transact. Ideally, it defines the conditions when the buy-sell agreement is triggered, describes the mechanism by which the shares are priced, addresses the funding of the transaction, and satisfies all applicable laws and regulations.

A buy-sell agreement establishes a process by which shares of a private company transact.

These agreements aren’t necessarily static. In wealth management firms, buy-sell agreements may evolve over time with changes in the scale of the business and breadth of ownership. When firms are new and more “practice” than “business,” these agreements may serve more to assign who gets what if the partners decide to go separate ways.

As the business becomes more institutionalized, and thus, more valuable, a buy-sell agreement – properly rendered – is a key document to protect the shareholders and the business (not to mention the firm’s clients) in the event of a dispute or other unexpected changes in ownership. Ideally, the agreement also serves to provide for more orderly ownership succession, as well as a degree of certainty for shareholders that allows them to focus on serving clients and running the business instead of worrying about who gets what benefit of ownership.

The irony of buy-sell agreements is that they are usually drafted and signed when all the shareholders think similarly about their firm, the value of their interest, and how they would treat each other at the point they transact their stock. The agreement is drafted, signed, filed, and forgotten. Then an event occurs that invokes the buy-sell agreement, and the document is pulled from the drawer and read carefully. Every word is parsed, and every term scrutinized because now they are not simply co-owners with aligned interests but rather buyers and sellers with diametrically opposed interests.

Triggering Events

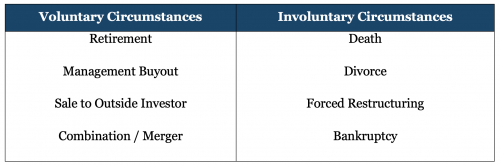

Buy-sell agreements govern the process and terms of a transaction if certain defined events occur. These “triggering events” can stem from voluntary or involuntary circumstances.

Many buy-sell agreements call for an independent appraisal upon a triggering event to establish the price at which shares will transact. In cases where ownership is more fluid, some agreements require an annual appraisal to establish the price at which all transactions will take place.

Voluntary Circumstances

At any point in time, one generation of business owners is preparing for retirement, having planned (or frequently not planned) for a successful ownership transition from one generation of business leaders to the next. A buy-sell agreement is one of the most important steps to ensure a successful, planned transition of ownership, and as such, it should complement your succession plan.

A buy-sell agreement is one of the most important steps to ensure a successful, planned transition of ownership.

An effective succession plan could call for the sale of the retiring partner’s stake to current management or an outside investor group or may require the sale of the entire firm to a strategic buyer.

If your exit strategy includes a sale to an insider, it should specify the terms and define the process for determining the price that shares are transacted at as an owner exits to retire. This is often a point of contention as young partners and retiring partners have inherently opposed objectives. A retiring partner will want to exit at the highest share price possible while the continuing partners are ultimately financing this repurchase.

Because many wealth management firms are highly valuable, successors are often financially stretched to take over the founder’s interest in the firm. By establishing the process through which price is determined and the terms at which the shares will be transacted, a buy-sell agreement mitigates any potential drama. As such, a buy-sell agreement is foundational for your firm’s succession plan.

If your exit strategy is to sell your firm to an outside buyer, you should be aware of your opportunities and make it explicitly known to your firm that this is your intention. For example, you should know the different incentives of potential buyers and what options exist with financial or strategic buyers.

You should make sure that your buy sell agreement makes sense in the context of your other operating agreements. A buy-sell agreement should specify the process by which a sale to an outside investor group is agreed to. We once worked with a client whose operating documents required unanimous consent to bring on a minority partner, as this required an amendment to the operating agreement, while the sale of a majority of the Company just required the consent of a super majority.

Knowing your exit strategy options will help clarify what is needed from your succession plan and your buy-sell agreement going forward.

Involuntary Circumstances

Buy-sell agreements guard against undesirable transitions in ownership from a potential partner to an unaffiliated party; they also define a set price per share to ensure a fair transaction. In the case of death, disability, divorce, and bankruptcy, current partners will ultimately need to redeem the shares of their colleague.

For instance, in the event of the death of a shareholder, a buy-sell agreement can protect the deceased’s family, ensuring such shares are bought at a fair price and in a timely manner. It can also protect your company from the inheritors of a deceased owner, who may want to benefit from the firm’s earnings but are not able to contribute to the growth of the business. Life insurance policies for owners are advised to protect your firm in case of an untimely death or a disabling scenario. A life insurance policy will secure your firm’s ability to repurchase shares in the case of the death or disability of an owner.

A buy-sell agreement will outline the process through which a price is set and the transaction is financed.

Additionally, if an owner files bankruptcy, the firm will need to repurchase his or her stake to avoid the shares being acquired by the owner’s creditors. In the case of a divorce, an owner’s shares may legally transfer to his or her spouse, in which case ownership would be seeded to the ex-spouse. A buy-sell agreement will outline the process through which a price is set and the transaction is financed.

Our Recommendation

We recommend revisiting your buy-sell agreement to ensure that it makes sense in the context of your firm’s vision and in partnership with its other governing documents. If you do not currently have a buy-sell agreement in place, we highly encourage you to draft one with the help of legal counsel and an independent valuation expert. Doing so will help ensure the continuity of you firm, align incentives, and may even help avoid costly litigation down the road. If you plan on reviewing your buy sell agreement and other governance matters, please give us a call.

RIA Valuation Insights

RIA Valuation Insights