Buy-Sell Agreements for Investment Management Firms

An Ounce of Prevention is Worth a Pound of Cure

What’s under there? Ferrari 250GT SWB, abandoned for decades, sold at auction last year for $23 million. (Photo Credit: classicdriver.com)

The classic car world is full of stories of “barn finds” – valuable cars that were forgotten in storage for decades, found and restored and sold for mint. One of the most famous is pictured above, a Ferrari 250 GT SWB California Spyder once owned by a French actor and found in a barn on a French farm in 2014. The car was one of 36 ever made and one of the most valuable Ferraris in existence. Once the Ferrari was exhumed, it was lightly cleaned and sold, basically as found, for $23 million at auction. As difficult it is to imagine such a valuable car being forgotten, what we see more commonly are forgotten buy-sell agreements, collecting dust in desk drawers. Unfortunately, these contracts often turn into liabilities, instead of assets, once they are exhumed, as the words on the page frequently commit the signatories to obligations long forgotten. So we encourage our clients to review their buy-sell agreements regularly, and have compiled some of our observations about how to do so in the whitepaper below. You can also download it as a PDF at the bottom of this page. We hope this will be helpful to you; call us if you have any questions.

Introduction

Almost every conversation we have with a new RIA client starts something like this: “We hired you because you do lots of work with asset managers, but as you get into this project you need to understand that our firm is very different from others.” Our experience, so far, confirms this sentiment of uniqueness that is not at all unique among investment managers. Although there are twelve thousand or so separate Registered Investment Advisors in the U.S. (not to mention several hundred independent trust companies and a couple thousand bank trust departments), there seems to be a comparable number of business models. Every client who calls us, though, has the same issue on their plate: ownership.

Ownership can be the single biggest distraction for a professional services firm, and it seems like the RIA community feels this issue more than most. After all, most asset managers are closely held (so the value of the firm is not set by the market). Most asset managers are owned by unrelated parties, whereas most closely-held businesses are owned by members of the same family. A greater than normal proportion of asset management firms are very valuable, such that there is more at stake in ownership than most closely held businesses. Consequently, when disputes arise over the value of ownership in an asset management firm, there is usually more than enough cash flow to fund the animosity, and what might be a five figure settlement in some industries is a seven figure trial for an RIA.

Avoiding expensive litigation is one reason to focus on your buy-sell agreement, but for most firms the more compelling reasons revolve around transitioning ownership to perpetuate the firm. Institutional clients increasingly seem to query about business continuity planning, and the SEC has of course recently proposed transition planning guidelines. There are plenty of good business reasons to have a robust buy-sell agreement in any closely held company, but in RIAs there are client and regulatory reasons as well.

| SEC Proposed Rule | |

| Every SEC-registered investment adviser must adopt and implement a written business continuity and transition plan that reasonably addressed operational risks related to a significant disruption or transition in the adviser’s business. | |

| Business Continuity Planning | Transition Planning |

| Maintenance of critical operations/systems, as well as protection, backup and recovery of data | Policies and procedures to safeguard, transfer, and/or distribute client assets during a transition |

| Alternate physical office locations | Policies and procedures to facilitate prompt generation of client specific information necessary to transition each account |

| Communication plans for clients, employees, vendors and regulators | Information regarding the corporate governance structure of the adviser |

| Identification and assessment of third-party services critical to the operation | Identification of any material financial resources available to the adviser |

Key Elements of the SEC’s Proposal: “Adviser Business Continuity and Transition Plans,” 206 (4)-4

Buy-Sell Agreement Basics

Simply put, a buy-sell agreement establishes the manner in which shares of a private company transact under particular scenarios. Ideally, it defines the conditions under which it operates, describes the mechanism whereby the shares to be transacted are priced, addresses the funding of the transaction, and satisfies all applicable laws and/or regulations.

These agreements aren’t necessarily static. In investment management firms, buy-sell agreements may evolve over time with changes in the scale of the business and breadth of ownership. When firms are new and more “practice” than “business,” these agreements may serve more to decide who gets what if the partners decide to go separate ways. As the business becomes more institutionalized, and thus more valuable, a buy-sell agreement – properly rendered – is a key document to protect the shareholders and the business (not to mention the firm’s clients) in the event of an ownership dispute or other unexpected change in ownership. Ideally, the agreement also serves to provide for more orderly ownership succession, not to mention a degree of certainty for owners that allow them to focus on serving clients and running the business instead of worrying about who gets what benefit of ownership.

The irony of buy-sell agreements is that they are usually drafted and signed when all of the shareholders think similarly about their firm, the value of their interest, and how they would treat each other at the point they transact their stock. The agreement is drafted, signed, filed, and forgotten. Then an event occurs that invokes the buy-sell, and the document is pulled from the drawer and read carefully. Every word is parsed, and every term scrutinized, because now there are not simply co-owners with aligned interests – but rather buyers and sellers with symmetrically opposed interests.

Our Advice: Key Considerations for Your Buy-Sell Agreement

At Mercer Capital we have read hundreds, if not thousands, of buy-sell agreements. While we are not attorneys and do not attempt to draft such agreements, our experience has led us to a few conclusions about what works well and what doesn’t. By “working well”, we mean an enduring agreement that efficiently manages ownership transactions and transitions in a variety of circumstances. Agreements that don’t work well become the subject of major disputes – the consequence of which is a costly distraction.

The primary weaknesses we see in buy-sell agreements relate to issues of valuation: what is to be valued, how, when, and by whom. The following issues and our corresponding advice are drawn from our experience of agreements that performed well and those that did not. While we haven’t seen everything, we have been more involved than most in helping craft agreements, maintaining compliance with valuation provisions, and resolving disagreements.

1. Decide What You Mean By “Fair”

A standard refrain from clients crafting a buy-sell agreement is that they “just want to be fair” to all of the parties in the agreement. That’s easier said than done, because fairness means different things to different people. The stakeholders in a buy-sell at an investment management firm typically include the founding partners, subsequent generations of ownership, the business itself, non-owner employees of the business, and the clients of the firm. Being “fair” to that many different parties is nearly impossible, considering the different motivations and perspectives of the parties:

- Founding owners. Aside from wanting the highest possible price for their shares, founding partners are usually desirous of having the flexibility to work as much or as little as they want to, for as many years as they so choose. These motivations may be in conflict with each other, as ramping down one’s workload into a state of partial retirement and preserving the founding generation’s imprint on the company requires a healthy business, which in turn necessarily requires consideration of the other stakeholders in the firm. We read one buy-sell agreement where the founder had secured his economic return by requiring the company, in the event of his death, to redeem his shares at a value that did not consider the economic impact of his death (the founder was a significant rainmaker). One can only imagine, at the founder’s death, how that would go when the other partners and employees of the firm “negotiated” with the estate – as if a piece of paper could checkmate everything else in a business where the assets of the firm get on the elevator and go home every night.

- Subsequent generation owners. The economics of a successful RIA can set up a scenario where buying into the firm can be very expensive, and new partners naturally want to buy as cheaply as possible. Eventually, however, there is symmetry of economic interests for all shareholders, and buyers will eventually become sellers. Untimely events can cause younger partners to need to sell their stock, and they don’t want to be in a position of having to give it up too cheaply. Younger partners also tend to underestimate the cost of building their own firm instead of buying into the existing one; other times, they don’t.

- The firm itself. The company is at the hub of all the different stakeholder interests, and is best served if ownership is a minimal consideration in how the business is run. Since hand-wringing over ownership rarely generates revenue, having a functional shareholder’s agreement that reasonably provides for the interests of all stakeholders is the best case scenario for the firm. If firm leadership understands how ownership is going to be handled now and in the future, they can be free to do their jobs and maximize the performance of the company. At the other end of the spectrum, buy-sell disputes are very costly to the organization, distracting the senior-most staff from matters of strategy and client service for years, and rarely ending with a resolution that compensates for lost business opportunities which may never even be identified.

- Non-owner employees. Not everyone in an investment management firm qualifies for ownership or even wants it, but all RIAs are economic eco-systems in which all employees depend on the presence of a stable and predictable ownership.

- Clients. It is no surprise that the SEC made ownership continuity planning part of its recent proposed regulations for RIAs. The SEC may not care, per se, who gets the benefits of ownership of an investment management firm, but they know that the investing public is best served by asset managers who have provided for the continuity of investment management in the event of changes in the partner base. Institutional clients are often very interested in continuity plans, so it is to the benefit of RIAs to have fully functioning ownership models with buy-sell agreements that provide for the long term health of the business. As the profession ages, we see transition planning as either a competitive advantage (if done well) or a competitive disadvantage (if disregarded) – all the more reason to pay attention.

The point of all this is to consider whether or not you want your buy-sell agreement to create winners and losers, and if so, be deliberate about defining who wins and who loses. Ultimately, economic interests which advantage one stakeholder will disadvantage some or all of the other stakeholders, dollar for dollar. If the pricing mechanism in the agreement favors a relatively higher valuation, then whoever sells first gets the biggest benefit of that, to the expense of the other partners and anyone buying into the firm. If pricing is too high, internal buyers may not be available and the firm may need to be sold (truly the valuation’s day of reckoning) to perfect the agreement. At relatively low valuations, internal transition is easier and business continuity is more certain, but the founding generation of ownership may be perversely encouraged to not bring in new partners, stay past their optimal retirement age, or push more cash flow into compensation instead of shareholder returns as the importance of ownership is diminished. Recognizing and ranking the needs of the various stakeholders in an RIA is always a balancing act, but one which is probably best done intentionally.

Buy-Sell Agreements and Contract Theory

The 2016 Nobel Prize in Economics was awarded to Professors Oliver Hart (Harvard) and Bengt Holmstrom (MIT) for their work in developing contract theory as a foundational tool of economics. The notion of contract theory organizes participants in an economy into principals (owners) and agents (employees), although the principal/agent relationship can be applied to many economic exchanges.

Agents act on behalf of principals, but those actions are at least partially unobserved, so contracts must exist to incentivize and punish behavior, as appropriate, such that principals can be reasonably assured of getting the benefit of compensation paid to agents. The optimal contract to accomplish this weighs risks against incentives. The problem with contracts is that all of them are incomplete, in that they can’t specify every eventuality. As a consequence, parties have to be designated to make decisions in certain circumstances on behalf of others.

Contract theory has application to the design of buy-sell agreements in the ordering of priority of stakeholders in the enterprise. If the designated principal of the enterprise is the founding generation, then the buy-sell agreement will be written to protect the rights of the founders and secure their ability to liquefy their interest on the best terms and pricing. Redemption from a founder’s estate at a premium value would be an example of this type of contract.

If, on the other hand, the business is the designated principal of the enterprise, and all the shareholders are treated as agents, then the buy-sell agreement might create mechanisms to ensure the long term profitability of the investment management firm, rewarding behaviors that grow the profits of the business (with greater ownership percentages or distributions or performance bonuses) and punish agent actions that do not enhance profitability.

If the clients of the firm are the designated principals of a given RIA, then the buy-sell agreement might be fashioned to direct equity returns to agents (partners or non-owner employees) based on investment performance or client retention. An example of this would be carried interest payments in hedge funds and private equity.

2. Don’t Value Your Stock Using Formula Prices, Rules-Of-Thumb, or Internally Generated Valuation Metrics

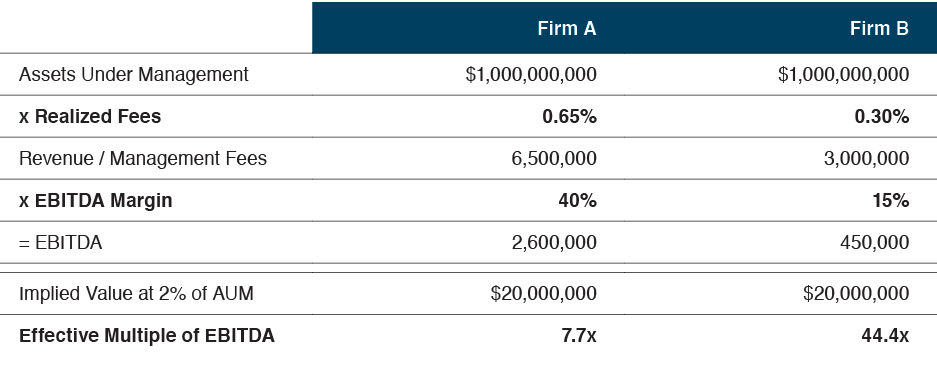

Since valuation is usually the most time consuming and expensive part of administering a buy-sell agreement, there is substantial incentive to try to shortcut that part of the process. Twenty years ago, a client told us “asset management firms are usually worth about 2% of AUM.” We’ve heard that maxim repeated many times, although not so much in recent years, as some firms have sold in noteworthy transactions for over twice that, while others haven’t been able to catch a bid for much less.

We have written extensively about the fallacy of formula pricing. No multiple of AUM or revenue or cash flow can consistently estimate the value of an interest in an investment management firm. A multiple of AUM does not consider relative differences in stated or realized fee schedules, client demographics, trends in operating performance, current market conditions, compensation arrangements, profit margins, growth expectations, regulatory compliance issues, and a host of other issues which have helped keep our valuation practice gainfully employed for decades.

Imagine an RIA with $1.0 billion under management. The old 2% of AUM rule would value it at $20.0 million. Why might that be? In the (good old) days, when RIAs typically garnered fees on the order of 100 basis points to manage equities, that $1.0 billion would generate $20 million in revenue. After staff costs, office space, research charges and other expenses of doing business, such a manager might generate a 25% EBITDA margin (close to distributable cash flow in a manager organized as an S-corporation), or $2.5 million per year. If firms were transacting at a multiple of 8 times EBITDA, the value of the firm would be $20.0 million, or 2% of AUM.

Today, things might fall more into the extremes of firms A and B, depicted in the chart below. Assume firm A is a small cap domestic equity manager earning 65 basis points on average from a mix of high net worth and institutional clients. Because a shop like that can earn a relatively high EBITDA margin of 40% or so, a $20 million valuation is a little less than 8x, which in some circumstances might be reasonable.

Firm B, on the other hand, manages a range of fixed income instruments for large pension funds who are expert at negotiating fees. Their 30 basis point realized fee average doesn’t leave much to cover the firm’s overhead, even though it’s fairly modest because of the nature of the work. The 15% EBITDA margin yields less than a half million dollars in cash flow, which against the rule-of-thumb valuation metric, implies a ridiculous multiple.

The real problem with short cutting the valuation process is credibility. If the parties to a shareholders agreement think the pricing mechanism in the agreement isn’t robust, then the ownership model at the firm is flawed. Flawed ownership models eventually disrupt operations, which works to the disservice of owners, employees, and clients.

3. Clearly Define The “Standard” of Value Effective for Your Buy-Sell Agreement

The standard of value essentially imagines and abstracts the circumstances giving rise to a particular transaction. It is intended to control for the identity of the buyer and the seller, the motivation and reasoning of the transaction, and the manner in which the transaction is executed.

Portfolio managers have a particular standard of value perspective, even though they don’t always think of it that way. The trading price for a given equity represents market value, and some PMs would make buying or selling decisions based on the relationship between market value and intrinsic value, which is what they think the security is worth based on their own valuation model. Investment analysts inside an RIA think of the value of their firm in terms of intrinsic value, which depending on their unique perspective could be very high or very low. CEOs, in our experience, think of the value of their investment management firm in terms of what they could sell it for in a strategic, change of control transaction with a motivated buyer – probably because those are the kinds of multiples that investment bankers quote when they meet with them.

None of these standards of value are particularly applicable to buy-sell agreements, even though technically they could be. Instead, valuation professionals such as our group look at the value of a given company or interest in a company according to standards of value such as fair market value or fair value. In our world, the most common standard of value is fair market value, which applies to virtually all federal and estate tax valuation matters, including charitable gifts, estate tax issues, ad valorem taxes, and other tax-related issues. It is also commonly applied in bankruptcy matters.

Fair market value has been defined in many court cases and in Internal Revenue Service Ruling 59-60. It is defined in the International Glossary of Business Valuation Terms as:

The price, expressed in terms of cash equivalents, at which property would change hands between a hypothetical willing and able buyer and a hypothetical willing and able seller, acting at arm’s length in an open and unrestricted market, when neither is under compulsion to buy or sell and when both have reasonable knowledge of the relevant facts.

The benefit of a fair market value standard is familiarity in the appraisal community and the court system. It is arguably the most widely adopted standard of value, and for a myriad of buy-sell transaction scenarios, the perspective of disinterested parties engaging in an exchange of cash and securities for rational financial reasons fairly considers the interests of everyone involved.

The standard known as “fair value” can be considerably more opaque, having two different origins and potentially very different applications. In dissenting shareholder matters, fair value is a statutory standard that varies depending on legal jurisdiction. In many states, fair value protects minority shareholders from oppressive actions by providing them with the right to payment at a value equivalent to that which would be received in the sale of the company. A few states are not so generous as to providing aggrieved parties with undiscounted value for their shares, but the trend favors not disadvantaging minority owners in certain transactions just because a majority owner wants to remove them from ownership. The difficulty of statutory fair value, in our experience, is the dispute over the meaning of state statutes and the court’s interpretations of state statutes. Sometimes the standard is as clearly defined as fair market value, but sometimes less so.

If a shareholders agreement names the standard of “Fair Value”, does it mean statutory fair value, GAAP fair value, or does it really mean fair market value? It pays to be clear.

The standard of value is critical to defining the parameters of a valuation, and we would suggest buy-sell agreements should name the standard and cite specifically which definition is applicable. The downsides of not doing so can be reasonably severe. For most buy-sell agreements, we would recommend one of the more common definitions of fair market value. The advantage of naming fair market value as the standard of value is that doing so invokes a lengthy history of court interpretation and professional discussion on the implications of the standard, which makes application to a given buy-sell scenario more clear.

Which Fair Value?

Making matters more complex, fair value is also a standard under Generally Accepted Accounting Principles, as defined in ASC 820. When GAAP fair value was originally established, members of the Financial Accounting Standards Board, which is responsible for issuing accounting guidance, suggested that they wanted to use a standard similar to fair market value but didn’t want their standard to be governed and maintained by non-related institutions such as the U.S. Tax Court.

GAAP fair value is similar to fair market value, but not entirely the same. As GAAP fair value has evolved, it has become more of an “exit value” standard, suggesting the price that someone would pay for an asset (or accept to transfer a liability) instead of a bargain reached through consideration of the interests of both buyers and sellers.

The exit value perspective is useful from an accounting perspective because it obviates financial statement preparers’ tendency to avoid write-downs in distressed markets because they “wouldn’t sell it for that.” In a shareholder dispute, however, the transaction is going to happen, so the bid/ask spread has to be bridged by valuation regardless of the particular desires of the parties.

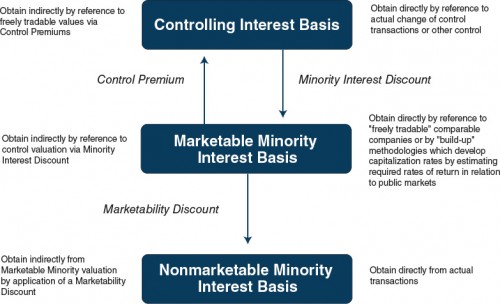

4. Avoid Costly Disagreement as to “Level of Value”

Just as the interests and motivations of particular buyers and sellers can affect transaction values, the interest itself being transacted can carry more or less value, and thus the “level” of value, as it has come to be known, should be specified in a buy-sell agreement.

A minority position in a public company with active trading typically transacts as a pro rata participant in the cash flows of the enterprise because the present value of those cash flows is readily accessible via an organized exchange. Portfolio managers usually think of value in this context, until one of their positions becomes subject to acquisition in a takeover by a strategic buyer. In a change of control transaction, there is often a cash flow enhancement to the buyer and/or seller via combination, such that the buyer can offer more value to the shareholders of the target company than the market grants on a stand-alone basis. The difference between the publicly traded price of the independent company, and value achieved in a strategic acquisition, is commonly referred to as a control premium.

Closely-held securities, like common stock interests in RIAs, don’t have active markets trading their stocks, so a given interest might be worth less than a pro rata portion of the overall enterprise. In the appraisal world, we would express that difference as a discount for lack of marketability.

Sellers will, of course, want to be bought out pursuant to a buy-sell agreement at their pro rata enterprise value. Buyers might want to purchase at a discount (until they consider the level of value at which they will ultimately be bought out). In any event, the buy-sell agreement should consider the economic implications to the RIA and specify what level of value is appropriate for the buy-sell agreement.

Fairness is a consideration here, as is the sustainability of the firm. If a transaction occurs at a premium or a discount to pro rata enterprise value, there will be “winners” and “losers” in the transaction. This may be appropriate in some circumstances, but in most RIAs, the owners joined together at arm’s length to create and operate the enterprise and want to be paid based on their pro rata ownership in that enterprise. That works well for the founders’ generation, but often the transition to a younger and less economically secure group of employees is difficult at a full enterprise level valuation. Further, younger employees may not be able to get comfortable with buying a minority interest in a closely held business at a valuation that approaches change of control pricing. Ultimately, there is often a bid/ask spread between generations of ownership that has to be bridged in the buy-sell agreement, but how best to do it is situation specific.

Whatever the case, the shareholder agreement needs to be very specific as to level of value. We even recommend inserting a level of value chart, like the one you see above, and drawing an arrow as to which is specified in the agreement.

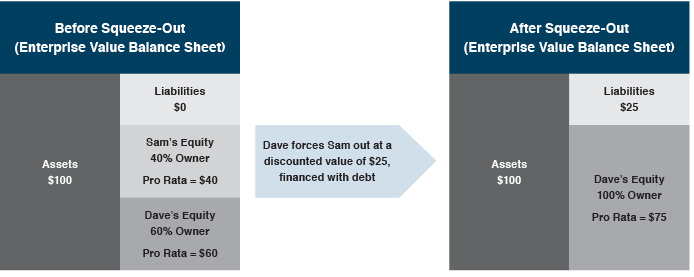

One thing to avoid in buy-sell agreements is embedded pricing mechanisms that unintentionally incentivize the behavior of some partners to try to “win” at the expense of other partners. We were involved in one matter where a disputed buy-sell agreement could be read to enable other partners to force out a minority partner and redeem their interest at a deeply discounted value.

Economically, to the extent that a minority shareholder is involuntarily redeemed at a discounted value, the amount of that discount (or decrement to pro rata enterprise value) is arithmetically redistributed among the remaining shareholders. Generally speaking, courts and applicable corporate statutes do not permit this approach in statutory fair value matters because it would provide an economic incentive for shareholder oppression.

By way of example, assume a business is worth (has an enterprise value of) $100, and there are two shareholders, Sam and Dave. Dave owns 60% of the business, and Sam owns 40% of the business. As such, Dave’s pro rata interest is worth $60 and Sam’s pro rata interest would be valued at $40. If the 60% shareholder, Dave, is able to force out Sam at a discounted value (of, say, $25 – or a $15 discount to pro rata enterprise value), and finances this action with debt, what remains is an enterprise worth $75 (net of debt). Dave’s 60% interest is now 100%, and his interest in the enterprise is now worth $75 ($100 total enterprise value net of debt of $25). The $15 decrement to value suffered by Sam is a benefit to Dave. This example illustrates why fair value statutes and case law attempt to limit or prohibit shareholders and shareholder groups from enriching themselves at the expense of their fellow investors.

Does the pricing mechanism create winners and losers? Should value be exchanged based on an enterprise valuation that considers buyer-seller specific synergies, or not? Should the pricing mechanism be based on a value that considers valuation discounts for lack of control or impaired marketability? Exiting shareholders want to be paid more and continuing shareholders want to pay less, obviously. What’s not obvious at the time of drafting a buy-sell agreement is who will be exiting and who will be continuing.

There may be a legitimate argument to having a pricing mechanism that discounts shares redeemed from exiting shareholders, as this reduces the burden on the firm or remaining partners and thus promotes the continuity of the firm. If exit pricing is depressed to the point of being punitive, the other shareholders have a perverse incentive to artificially retain their ownership longer and force out other shareholders. As for buying out shareholders at a premium value, the only argument for “paying too much” is to provide a windfall for former shareholders, which is even more difficult to defend operationally. Still, all buyers eventually become sellers, so the pricing mechanism has to be durable for the life of the firm.

5. Don’t Forget to Specify the “As Of” Date for Valuation

This seems obvious, but the particular date appropriate for the valuation matters. We had one client (not an RIA) spend a quarter million dollars on hearings debating this matter alone. The appropriate date might be the triggering event, such as the death of a shareholder, but there are many considerations that go into this.

If the buy-sell agreement specifies that value be established on an annual basis (something we highly recommend to manage expectations and avoid confusion), then the date might be the calendar year end. The benefit of an annual valuation is the opportunity to manage expectations, such that everyone in the ownership group is prepared for how the valuation is performed and what the likely outcome is given various levels of company performance and market pricing. Annual valuations do require some commitment of time and expense, of course, but these annual commitments to test the buy-sell agreement usually pale in comparison to the time and expense required to resolve one major buy-sell disagreement.

If, instead of having annual valuations performed, you opt for an event-based trigger mechanism in your buy-sell, there is a little more to think about. Consider whether you want the event precipitating the transaction to factor into the value. If so, prescribe that the valuation date is some period of time after the event giving rise to the subject transaction. This can be helpful if a key shareholder passes away or leaves the firm and there is concern about losing clients as a result of the departure. After an adequate amount of time, it becomes apparent as to the impact on firm cash flows of the triggering event. If, instead, there is a desire to not consider the impact of a particular event on valuation, make the as-of date the day prior to the event, as is common in statutory fair value matters.

6. Appraiser Qualifications: Who’s Going to Be Doing the Valuation?

Obviously, you don’t want just anybody being brought in to value your company. If you are having an annual appraisal done, then you have plenty of time to vet and think about who you want to do the work. In the appraisal community, we tend to think of “valuation experts” and “industry experts”.

Valuation experts are known for:

- Appropriate professional training and designations

- Understanding of valuation standards and concepts

- Perspective on the market as consisting of hypothetical buyers and sellers (fair market value mindset)

- Experienced in valuing minority interests in closely held businesses

- Advising on issues for closely held businesses like buy-sell agreements

- Experienced in explaining work in litigated matters

Industry experts, by contrast, are known for:

- Depth of particular industry knowledge

- Understanding of key industry concepts and terminology

- Perspective on the market as typical buyers and sellers of interests in RIAs

- Transactions experience

- Regularly providing specialized advisory services to the industry

In all candor, there are pros and cons to each “type” of expert. We worked as the third appraiser on a disputed RIA valuation many years ago in which one party had a valuation expert and the other had an industry expert. The resulting rancor bordered on the absurd. The company had hired a reasonably well known valuation expert who wasn’t particularly experienced in valuations of investment management firms. That appraiser prepared a valuation standards-compliant report that valued the RIA much like one would value a dental practice, and came up with a very low appraised value (his client was delighted). The departing shareholder hired an also well-known investment banker who arranges transactions in the asset management community. The investment banker looked at a lot of transactions data and valued the RIA as if it were a department at Blackrock. Needless to say, that indicated value was many, many times higher than the company’s appraiser. We were brought in to make sense of it all.

Vetting a valuation expert for appropriate credentials and experience should focus on professional standards and practical experience:

- Professional Requirements. The two primary credentialing bodies for business valuation are the American Society of Appraisers (ASA) and the American Institute of Certified Public Accountants (AICPA). The former awards the Accredited Senior Appraiser designation, or ASA, and the latter the Accredited in Business Valuation, or ABV, designation. Without getting lost in the weeds, both are substantial organizations that require extensive education and testing to be credentialed, and both require continuing education. Also well known in the securities industry is the Chartered Financial Analyst charter issued by the CFA Institute, and while it is not directly focused on valuation, it is a rigorous program in securities analysis. CFA Institute offers, but does not require, continuing education.

- Practical Requirements. Experience also matters, though, in an industry as idiosyncratic as investment management. Your buy-sell agreement should specify an appraiser who regularly values non-depository financial institutions such that they understand the dynamic differences between, say, an independent trust company and a venture capital manager. While there are almost 12,000 RIAs in the U.S., the variety of business models is such that you will want a valuation professional who understands and appreciates the economic nuances of your firm.

In any event, your buy-sell agreement should specify minimum appraisal qualifications for the individual or firm to be preparing the analysis, but also specify that the appraiser should have experience and sufficient industry knowledge to appropriately consider the key investment characteristics of RIAs. Ultimately, you need a reasonable appraisal work product that will withstand potential judicial scrutiny, but you should not have to explain the basics of your business model in the process.

7. Manage Expectations by Testing Your Agreement

No matter how well written your agreement is or how many factors you consider, no one really knows what will happen until you have your firm valued. If you are having a regular valuation prepared by a qualified expert, then you can manage everyone’s expectations such that, when a transaction situation presents itself, parties to the transaction have a reasonably good idea in advance of what to expect. Managing expectations is the first step to avoiding arguments, strategic disputes, failed partnerships, and litigation.

If you don’t plan to have annual valuations prepared, have your company valued anyway. Doing so when nothing is at stake will make a huge difference if you get to a situation where everything is at stake. Most of the shareholder agreement disputes we are involved in start with dramatically different expectations regarding how the valuation will be handled. Going ahead and getting a valuation done will help to center, or reconcile, those expectations and might even lead to some productive revisions to your buy-sell agreement.

Putting It All Together

If you have not yet crafted a buy-sell agreement for your RIA, you can see that there is much to consider. Most investment management firms have some shareholders agreement, but in many cases the agreements do not account for the many circumstances and issues briefly addressed in this whitepaper. That said, our advice is to first pull your buy-sell agreement out of the drawer and read it, carefully, and compare it to the commentary in this paper. If you don’t understand something, talk with your partners about what their expectations are and see if they line up with the agreement. Consider having a valuation firm review the agreement and tell you what they might see as issues or deficiencies in the agreement, and then have the firm appraised. If there is substantial difference of opinion in the partner base as to the value of the firm, or the function of the agreement, you know that you don’t actually have an agreement.

On the positive side of the equation, a well-functioning agreement can serve the long term continuity of ownership of your firm, which provides the best economic opportunity for you and your partners, your employees, and your clients. Strategically, it may well be the lowest hanging fruit available to enhance the value of your company, and your own career satisfaction.

RIA Valuation Insights

RIA Valuation Insights