Challenging Year Ahead for Asset Managers

Asset Management Firms Struggle as Market Downturn and Fund Outflows Persist

2022 proved to be a challenging year for the RIA industry and the stock market as a whole. Persistent inflation, rising interest rates, a tight labor market, and heightened geopolitical tensions affected most sectors of the economy but had a particularly acute impact on the RIA industry.

As asset management firms are generally leveraged to the market, variations in equity prices tend to have an amplified effect on their valuations. Our index of publicly traded asset/wealth management firms reflected this, with stock prices for these firms down 14.8% over the year ended March 31, 2023, underperforming the broader market (the S&P 500 was down 9.6%) and aggregator models, like Focus Financial and CI Financial (down 1.3%).

Click here to expand the image above

Fund Flows

While market movement is often the dominant contributor to AUM changes over a particular period, it’s a variable that’s largely outside a manager’s control. On the other hand, organic growth can be influenced by the quality of a firm’s marketing and distribution efforts and can be a real differentiator between asset management firms over longer periods.

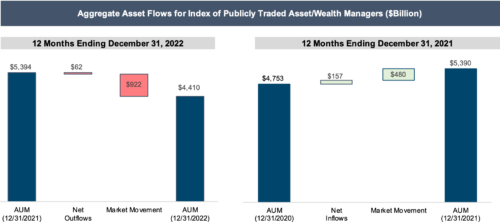

Many asset managers have struggled with organic growth in recent years, partly due to rising fee sensitivity and the influence of passively managed investment products. This year proved no different, with our index of publicly traded asset/wealth management companies seeing $62 billion in net outflows, compared to aggregate net inflows of $157 billion in 2021.

As expected, considering the performance of the stock and bond markets over the past year, market movement was the primary driver of the $922 billion decline in AUM during 2022, compared to a $480 billion increase in 2021.

Click here to expand the image above

Outflows from Active Funds Accelerate

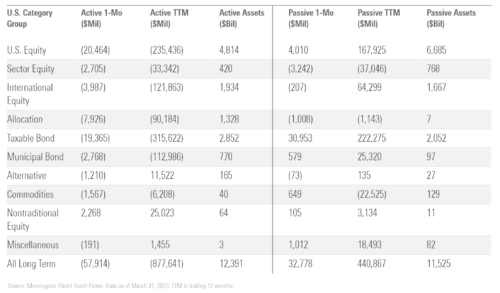

While asset managers saw net outflows over the past twelve months, there were significant variances between active and passively managed funds. Fund flow data from Morningstar (table below) shows that total outflows across active funds for the year ended March 31, 2023, were approximately $878 billion. The aggregate outflows over the past year were most severe for U.S. equity, international equity, and fixed income, with these asset classes shedding a combined $819 billion in assets. For perspective, all categories of actively managed funds except alternative investments and nontraditional equities saw net outflows over the past year.

On the other hand, passively managed funds continued to outpace active funds in terms of net new assets over the past twelve months. Fund flow data from Morningstar (table below) shows that total inflows across passively managed funds for the year ended March 31, 2023, were approximately $441 billion.

Click here to expand the image above

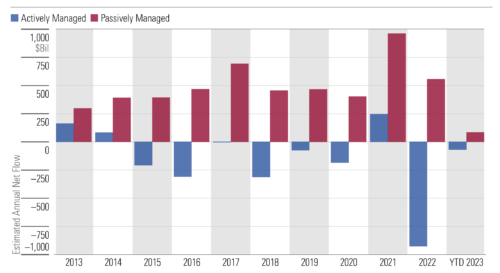

As you can see from the following chart, there has been a trend over the past ten years of investors moving from active to passive funds, and this trend accelerated with the market downturn in 2022. The relative underperformance of active managers, when compared to their benchmarks over the past ten years, has driven investors to low-fee passive funds. This trend will likely continue to pose a challenge for many types of active asset managers in attracting new assets.

Click here to expand the image above

Outlook

The outlook for asset managers depends on several factors. Investor demand for a particular manager’s asset class, recent relative performance, fee pressure, rising costs, and regulatory overhang can all impact RIA valuations to varying extents. Alternative asset managers tend to be more idiosyncratic but are still influenced by investor sentiment regarding their hard-to-value assets. Aggregators and multi-boutiques are in the business of buying RIAs, and their success depends on their ability to complete deals at attractive valuations, to successfully integrate firms and accelerate growth, and their access to (and cost of) financing.

Rising interest rates and inflation caused painful losses in the stock and bond markets in 2022, and market conditions have remained choppy so far in 2023. Moody’s lowered their December outlook for the global asset management industry from stable to negative in response to the current business and economic environment. Following the decline in AUM in 2022, lower starting AUM levels will likely weigh down industry-wide revenues and earnings in 2023.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, PE firms and alternative managers, and related investment consultancies.

RIA Valuation Insights

RIA Valuation Insights