Compensation Structures for RIAs

Part II

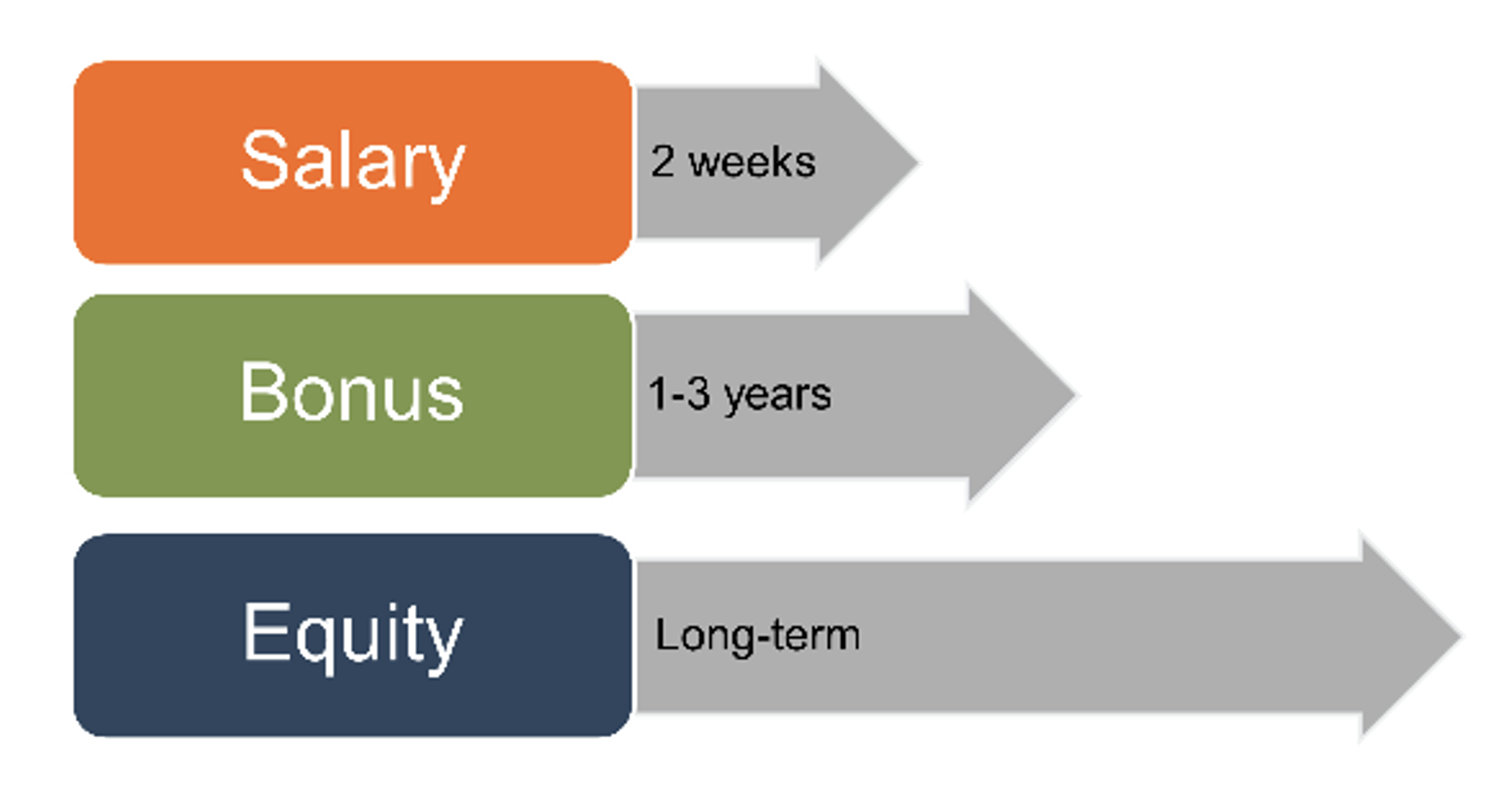

In Part I of this series we discussed the RIA compensation model and how its structure can incentivize employee performance and impact firm profitability under different scenarios. That post outlined the three basic components of compensation at investment management firms:

- Base salary / Benefits. This is what an employee receives every two weeks or so. It’s fixed in nature and is paid regardless of firm or employee performance over the short term. On its own, base salary provides little incentive for employees to grow the value of the business over time.

- Variable Compensation / Bonus. In theory, variable compensation can be tied to any metric the firm chooses. The amount of variable compensation paid to employees varies as a function of the chosen metric(s). Variable compensation is also called at risk compensation because all or part of it can be forfeited if target thresholds are not met. Variable compensation is most often paid out on an annual basis.

- Equity compensation. Equity incentives serve an important function by aligning the interests of employees with that of the company and its shareholders. While base salary and annual variable compensation serve as shorter term incentives, equity incentives serve to motivate employees to grow the value of the business over a longer time period and play an important role in increasing an employee’s ties to the firm and promoting retention.

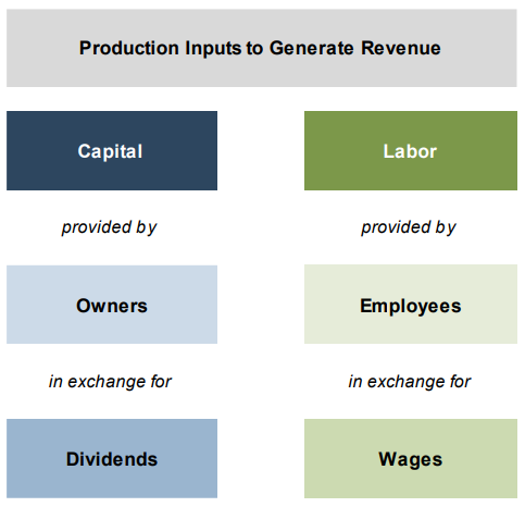

Part I focused on variable or bonus compensation, this week we cover the equity component. If the other forms of compensation are meant to attract (salary) and retain (bonus) qualified talent, RIA equity is intended to align shareholder and employee interests while rewarding long-term contributions to firm growth and value. This structure inherently blends returns to labor (employee comp) with returns on investment (shareholder distributions) by its very design. It is typically the most complicated and misunderstood component of RIA compensation but can be highly effective when implemented correctly. We often use the following depiction to simplify the distinction between these sources of return:

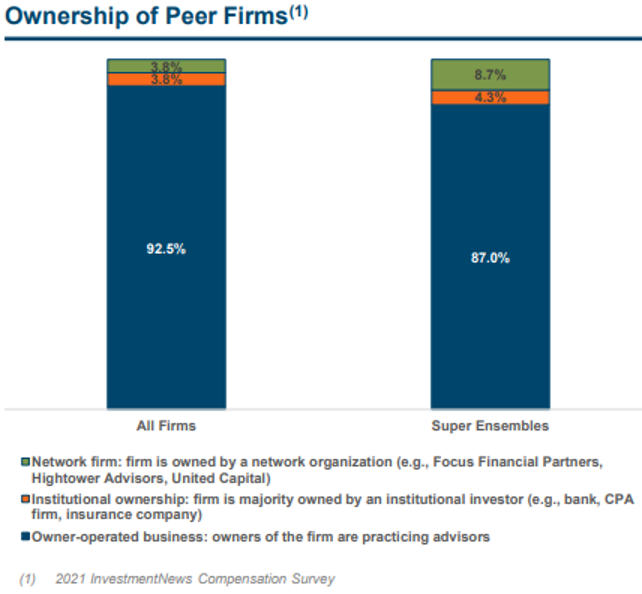

Unfortunately, this distinction between returns to capital and labor become blurred when the business is owner-operated like most investment advisory firms:

As a result, most investment management firms offer their key employees some form of equity compensation to align their interests with shareholders and incentivize them to continue growing the business. Equity comp can also be a differentiator that allows some RIAs to recruit top talent from other investment management firms that don’t offer any sort of stock consideration to their employees. Equity comp has become more common during the Great Resignation and is part of the reason we saw so much turnover following the pandemic.

While implementing an equity incentive plan will typically have a dilutive impact on existing shareholders, a properly structured plan will facilitate attracting and retaining the right talent and motivating participating employees to grow the value of the business over time. In that sense, a well-structured equity incentive plan is accretive to existing shareholders, not dilutive.

Some of the more common equity-incentive plans are discussed below:

- Direct Equity Ownership: For most investment management firms, equity is held by senior management. As these executives retire or leave the business, equity is transferred to the firm’s next-generation management. In these cases, the internal market for the company’s shares serves the function of an equity incentive plan by placing equity ownership in the hands of the individuals with the greatest influence on the performance of the company. Direct equity incentive plans are typically the most straightforward way of transferring equity to the next generation but may not be the most practical if the current principals are unable or unwilling to relinquish ownership or control of the business, or if next-generation management is unable or unwilling to purchase equity.

- Stock Option Grants: Stock option grants give employees the right, but not the obligation, to purchase equity in the company for a specified period of time at a specified exercise price. Typically, the exercise price is equal to the fair market value of the company’s shares as of the grant date, which allows employees receiving the option grants to participate in any appreciation in value over the value at the grant date. Stock option grants may be subject to vesting periods in order to promote employee retention.

- Synthetic Equity Plans: Under synthetic equity plans, employees receive something that mimics equity ownership from an economic perspective, but typically without the non-economic rights (such as management and voting rights) that accompany direct ownership. Examples of such plans include phantom equity and stock appreciation rights (SARs). Under these plans, a select group of employees (usually senior management) receive payments tied to the company’s stock value at a certain date or dates. In the case of phantom equity plans, the payments can be based on the value of the stock at a certain date (a full value plan) or only the appreciation in value relative to the grant date value (an appreciation only plan). These plans can be highly customizable with respect to dividend participation, vesting schedule, and triggering events for redemption / forfeiture.

- Profits Interests: RIAs structured as LLCs can issue profits interests, which represent an interest in the future profits or appreciation in value of the firm. Profits interests offer potential tax advantages in that they should not result in taxable income for the recipient when they are granted, and the appreciation in value may be taxed as capital gains rather than ordinary income.

There are advantages and disadvantages to each type of plan, and the most appropriate one for your firm will depend on what you and your aspiring owners are trying to accomplish. We’re happy to walk you through this if you need some guidance.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, RIAs, and independent trust companies.

RIA Valuation Insights

RIA Valuation Insights