Compensation Structures for RIAs: Part I

Compensation models are the subject of a significant amount of hand-wringing for RIA principals, and for good reason. Out of all the decisions RIA principals need to make, compensation programs often have the single biggest impact on an RIA’s P&L and the financial lives of its employees and shareholders.

The effects of an RIA’s compensation model are far-reaching, determining not only how compensation is allocated amongst employees, but also how a firm’s earnings are split between shareholders and employees, what financial incentives employees have to grow the business, and what financial incentives are available to attract new employees and retain existing employees.

Compensation models at RIAs tend to be idiosyncratic, reflecting each firm’s business model, ownership, and culture. In an ideal world, these compensation programs evolve purposefully over time in response to changes in the firm’s size, profitability, labor market conditions, and various other factors. However, inertia is a powerful force: we often encounter compensation programs that made sense in the past but haven’t adapted to serve the firm’s changing needs as the business has grown in scale and complexity.

Effective compensation programs need to change with the times, and the times have certainly changed. The RIA industry has seen tremendous growth over the last decade. As a result, firms today face increasingly complex compensation decisions that affect a growing list of stakeholders: outside shareholders, multiple generations of management, retiring partners, new partners, possible minority investors, and so on. On top of that, a persistent bull market and the accompanying earnings growth over the preceding decade have made it relatively easy to appease both shareholders and employees. Now, financial market conditions and the state of the labor market have led many RIAs to scrutinize their compensation models more than ever before.

Introduction to RIA Compensation Models

At the outset, it’s important to note what compensation models do and don’t do. Compensation models determine how the firm’s earnings are allocated; they don’t (directly) determine the amount of earnings to be allocated. When it comes to determining who gets what, it’s a fixed sum game. The objective of an effective compensation policy is to allocate returns in such a way as to increase this sum over time.

Compensation for RIAs are broken down into three basic components, each of which serves different functions with respect to incentivizing, attracting, and retaining employees:

- Base salary / Benefits. This is what an employee receives every two weeks or so. It’s fixed in nature and is paid regardless of firm or employee performance over the short term. On its own, base salary provides little incentive for employees to grow the value of the business over time.

- Variable Compensation / Bonus. In theory, variable compensation can be tied to any metric the firm chooses. The amount of variable compensation paid to employees varies as a function of the chosen metric(s). Variable compensation is also called at-risk compensation because all or part of it can be forfeited if target thresholds are not met. Variable compensation is most often paid out on an annual basis.

- Equity compensation. Equity incentives serve an important function by aligning the interests of employees with that of the company and its shareholders. While base salary and annual variable compensation serve as shorter-term incentives, equity incentives serve to motivate employees to grow the value of the business over a longer time period and play an important role in increasing an employee’s ties to the firm and promoting retention.

Variable Compensation

In this blog post, we focus our attention on the variable compensation component (we’ll address the others in subsequent posts).

Variable compensation plays an important role in incentivizing employees over the relatively short term (1-3 years). The evidence suggests that such incentives work, too: According to Schwab’s 2021 RIA Compensation Report, firms using performance-based incentive pay saw 25% greater AUM growth, 134% greater client growth, 54% greater revenue growth, and 52% greater net asset flows over a five year period than firms without performance-based incentives.

What Do You Want to Incentivize?

As the name suggests, variable compensation changes as a function of some selected metric, typically revenue, profitability, or some other firm-level metric or individual-level metric, depending on the specific aspects that management intends to incentivize.

In our experience, variable compensation pools tied to firm profitability and allocated amongst employees based on a combination of individual responsibilities and performance provide the most effective incentives for most firms to grow the value of the business over time. Such structures tend to work well because linking variable comp to profitability creates a durable compensation mechanism that scales with the business and aligns shareholders’ and management’s financial and risk management objectives. Variable comp linked to profitability also promotes a cohesive team, rather than the individual silos that can arise out of revenue-based variable comp, which further helps to build the value of the enterprise.

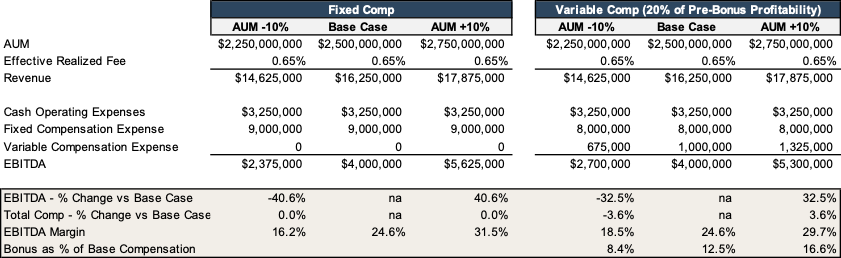

In markets like today’s, where RIA margins face the dual threat of rising costs and declining AUM, compensation mechanisms that directly link employee pay to firm profitability have the additional benefit of helping to blunt the impact of market conditions on firm profitability. Consider the example below, which shows the impact of a 10% AUM increase and a 10% AUM decrease for a hypothetical firm under two comp programs, one in which all compensation is fixed and the other in which there is a variable bonus pool equal to 20% of pre-bonus profitability.

Click here to expand the image above.

In this example, both compensation programs result in $4 million in EBITDA and an EBITDA margin of 24.6% in the base case scenario. In the downside scenario, however, the fixed comp structure leads to a high degree of operating leverage. As a result, a 10% drop in AUM leads to a decline in EBITDA of over 40% and a decline in the EBITDA margin to 16.2%. Under the variable comp structure, the variable bonus pool helps to mute the impact of declining AUM. In this example, a 10% decline in AUM results in a 32.5% decrease in EBITDA and a decline in the EBITDA margin to 18.5% under the variable comp program. In the upside scenario, the increase in EBITDA is greater under the fixed comp structure than under the variable comp structure (an increase of 40.6% vs. 32.5%).

From a shareholder perspective, a variable compensation program such as the one described above effectively transfers some of the risk borne by equity holders to the firm’s employees. In downside scenarios, some of the declines in profitability that would otherwise accrue to shareholders is absorbed by employees. Similarly, some of the increase in profitability is allocated to employees in upside scenarios. The logic of such a compensation program is that employees are incentivized to grow and protect the same metric that shareholders care about—the firm’s profitability.

Conclusion

Investment management is a talent business, and structuring an effective compensation program that allows the firm to attract, retain, and incentivize talent is critical to an RIA’s success. In the coming posts, we’ll address additional compensation considerations such as equity compensation options and allocation processes.

RIA Valuation Insights

RIA Valuation Insights