Consolidation in the RIA Industry?

A Look at Record-Pace RIA Acquisition

Consolidation is a theme that has a lot of traction in the RIA industry. The prevailing narrative is that a growing multitude of buyers are scrambling to compete for a limited number of firms. Circumstances such as aging founders or a lack of internal succession planning are bringing firms to market, where these businesses are quickly bought up and rolled into any one of the several acquisition models that have emerged (and continue to emerge) in the industry. Aggregators are bolting RIAs onto their platforms, branded acquirers are assembling RIAs with national scale through a series of acquisitions, and larger RIAs are growing through strategic acquisitions of smaller firms. Competition amongst these buyers for the limited number of firms coming on the market has supported deal activity and multiples even when M&A in other industries has plummeted.

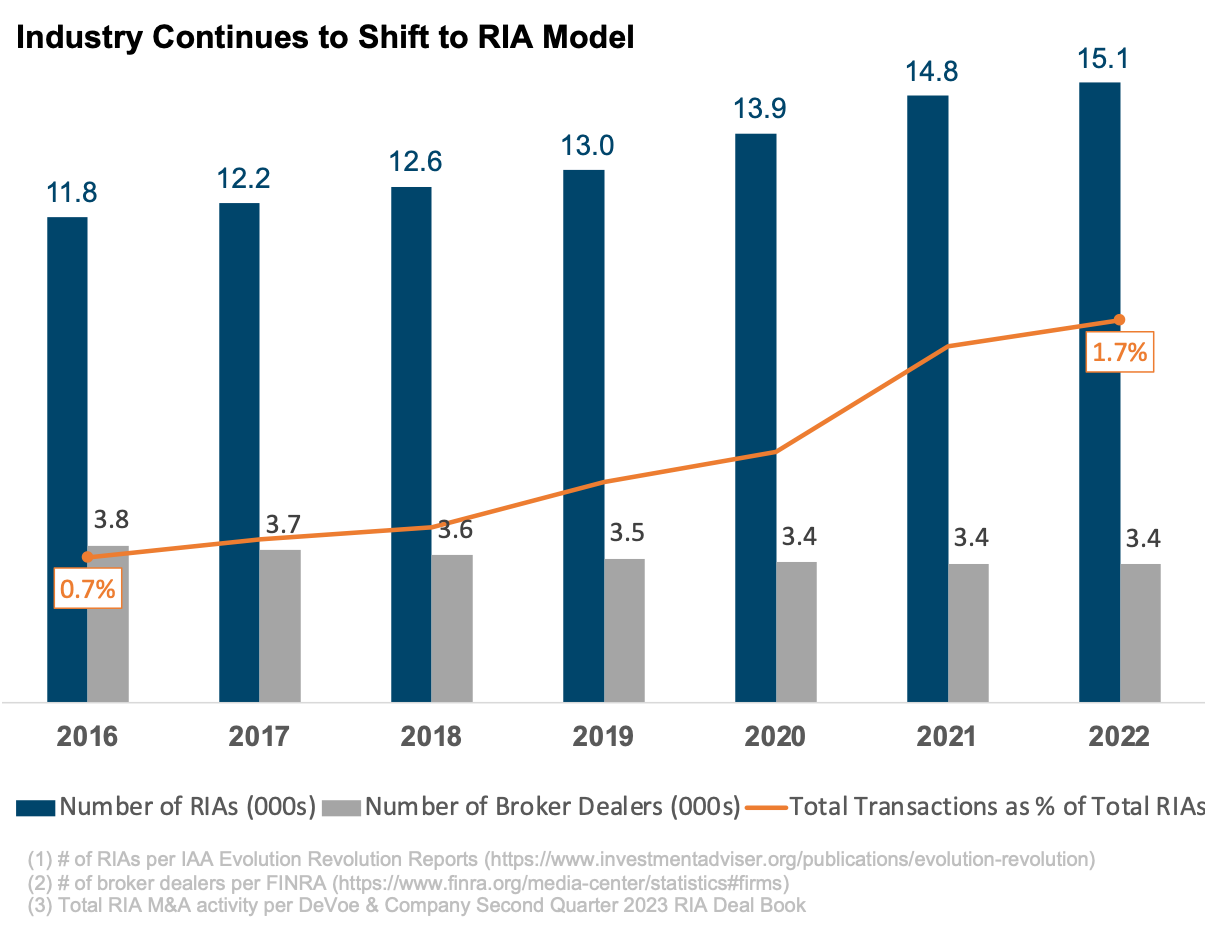

With the rapid pace of deal activity in the RIA industry, you might expect to see the number of firms decline, as that is typically the norm for consolidating industries. The banking industry, for example, has been consolidating for three decades, and as a consequence, the number of banks in the US has steadily declined from about 18,000 in 1990 to about 6,000 today. But that’s not been the case in the RIA industry, at least not yet. Despite consolidation pressures and record levels of acquisition activity, the reality is that the number of RIAs continues to increase, with new formations outpacing consolidation. In 2022, there were approximately 15,100 individual SEC-registered investment advisory firms, up from about 11,800 in 2016. Deal activity (measured as a percentage of total RIAs) rose from about 0.7% to 1.7% over this period—a dramatic increase, yet not enough to offset new RIA formation.

Several factors have contributed to the increase in the number of RIA firms. For one, the RIA industry has experienced secular tailwinds from the shift from the broker-dealer/commission model to the fee-based, fiduciary model. As the chart below demonstrates, the number of FINRA-registered broker-dealers has gradually declined in recent years—the mirror image of the growth seen in the RIA industry. In many cases, broker-dealers have shifted to fee-based models, and firms with dual registrations have gradually shifted to the RIA side of the business.

This overarching shift from the broker-dealer model to the RIA model is multi-faceted. For one, it’s clear that clients (in general) prefer the advisory relationship offered by RIAs over that offered by their broker-dealer counterparts. And a model that’s in demand by clients is also in demand by advisors. Additionally, we’ve found that building significant enterprise value (value attributable to the business, not the individual) is generally easier for firm owners to achieve under the RIA revenue model than the broker-dealer model. This prospect of building a business with enduring value that can be sold to an external buyer at the end of the founder’s career or transitioned to next generation management is a key motivation behind many advisors’ decisions to start their own RIA. It also doesn’t hurt that, compared to the broker-dealer model, the capital required to start an RIA is relatively minimal.

When looking at the increase in the number of RIA firms, there are a couple of nuances to keep in mind. Some acquisition models in the industry result in the acquired firm maintaining its SEC registration, so consolidation doesn’t necessarily mean a decline in the number of registered firms. Another caveat is that the data captures only SEC-registered investment advisors and not state-registered investment advisors (generally, advisory firms with over $110 million in AUM are required to register with the SEC, whereas firms below that threshold are regulated by the state in which they do business). These wrinkles aside, the data is unambiguous that there are more SEC-registered advisory firms today than ever before—and that’s hardly indicative of an industry in the throes of consolidation.

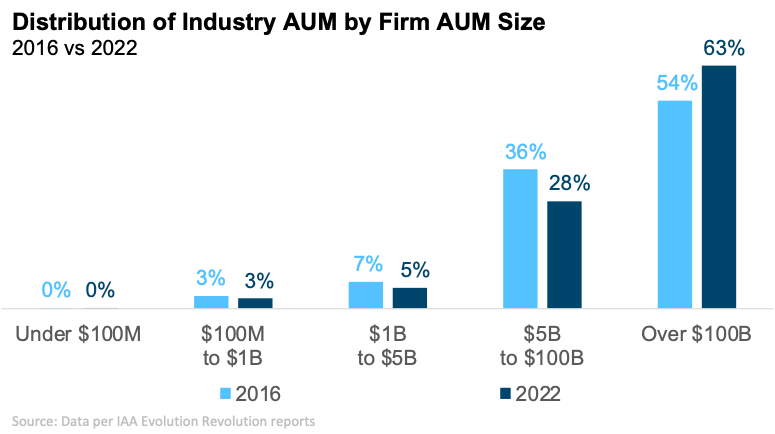

Another way to track consolidation is to look at how assets under management are distributed across firms of different sizes rather than at the number of firms. By this metric, there has been some degree of consolidation: the largest firms (those over $100B) have increased their share of industry assets from 54% in 2016 to 63% in 2022. Most of the market share gained by the largest firms has come from those in the $5B to $100B AUM range, while firms below $5B have seen more stable market share. This makes some sense: most new RIAs formed are below $5B; thus, the rising number of RIAs has been a more significant offset to consolidation in this market segment.

What does all this mean for the industry? As it stands today, the rising supply of RIAs has done little to dampen the pricing for RIAs; instead, it’s seemingly added fuel to the M&A fire. Notwithstanding an increase in the number of firms, attractive firms whose founders are open to selling today remain scarce, and the ratio of buyers to sellers remains high. Consequently, multiples for RIAs have remained at or near all-time highs despite a challenging macro environment. Whatever downward pressure there’s been from the supply side of the equation, strong buyer demand has more than offset it.

While the consolidation pressure in the industry is real, we are still in the early stages. Many successful advisory practices prefer to go it alone and transition internally unless circumstances such as the age of the principals or lack of next-generation management arise to force an external transaction. Consolidation pressures may ultimately lead to an increase in the number of firms on the market and a shift in the supply/demand equilibrium, but as it stands today, sellers are scarce, and building a new firm from scratch is difficult. Time will tell if the RIA industry sees the same level of consolidation as we’ve seen in the banking industry. But at least in the near term, the number of RIA firms appears poised to continue growing as the supply of new firms more than offsets a significant level of M&A activity.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, PE firms and alternative managers, and related investment consultancies.

RIA Valuation Insights

RIA Valuation Insights