Is 16x Pro Forma EBITDA a Realistic Valuation for Mercer Advisors?

Pre-season Soccer and the Mercer Price Tag are Likely More About Form Than Substance

A familiar look for the Real Madrid goalkeeper in their 7-3 rout against cross-town rival Atletico Madrid last Saturday | Photo credit JOHANNES EISELE/AFP/Getty Images

I was initially intrigued by this match-up. Two of Europe’s greatest soccer clubs and intra-city competitors squaring off in front of a packed crowd on American soil for the first time in their storied history. Fittingly, the game was played in a football stadium because it was that kind of score. The New York Giants and Jets fans that typically frequent the grounds probably appreciated all the action, but Real Madrid supporters and other soccer enthusiasts had a different impression. Despite all the hype leading up to the game, only one team had any interest in being there, and the match itself has been widely panned by most (non-Atleti) observers.

Certain Real Madrid players didn’t seem to mind getting blown out in their first Madrid derby outside of Europe.

The Real/Atleti debacle is perhaps a microcosm for the broader International Champions Cup (“ICC”) in which it is played. The pre-season tournament has been criticized for the lack of quality competition and blatant apathy of the players despite broad participation by most of Europe’s top clubs. Blame the heat, injury aversion, or American nightlife, but it hasn’t been pretty. Like most pre-season affairs, there’s even talk of cancelling it all together, but that probably doesn’t make sense from an economic perspective. The real culprit is the lack of meaning to the games since they have no implications for the teams’ league status and no (direct) impact on the players’ compensation levels. There have been discussions of playing regular season European matches in America (much like the NFL and MLB are doing in London) to remedy this issue, but no definitive decisions have been made yet.

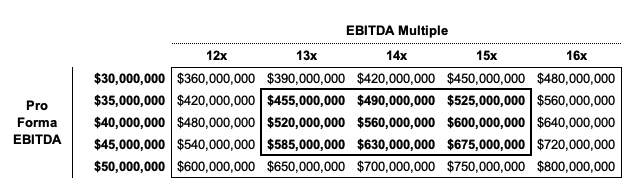

I was similarly intrigued (and skeptical) of the recent reports that RIA aggregator Mercer Advisors was looking to fetch a $700 million-plus price tag in a prospective sale by its PE backers at Genstar Capital. A 15-16x multiple on an estimated pro-forma, run-rate EBITDA of approximately $50 million results in a $750 million to $800 million enterprise value for the business, which certainly got my attention. Still, this figure could be as meaningless as the ICC if it’s an unlikely appraisal of Mercer Advisor’s current market value. We’ll address our opinion from a fair market value and strategic value perspective in this week’s blog.

The Fair Market Value of Mercer Advisors

Despite the similar name, we have no relation to Mercer Advisors. On the one hand, this means that our opinion is not conflicted, but it also means that we are not privy to its financial situation, so we’ll have to opine in general terms. The 15-16x multiple feels a bit rich (we’ll address this later) but may not be nearly as big of a stretch as the “pro forma, run-rate EBITDA estimate” to which it is applied. We don’t know what adjustments were made to get from reported EBITDA to pro forma, run-rate EBITDA, but in our experience, they can be substantial and unsubstantiated.

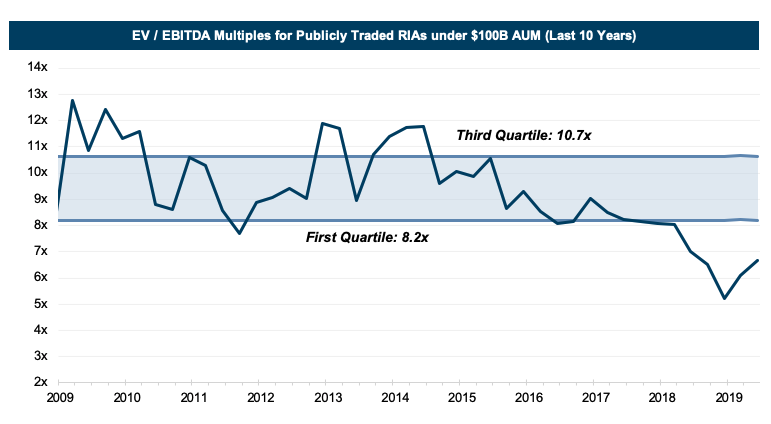

Historically, most publicly traded RIAs with under $100 billion in AUM have traded in the 8-11x range.

The context of fair market value, according to most definitions, is a transaction between a hypothetical willing buyer and a hypothetical willing seller, both having reasonable knowledge of the facts and circumstances. The word hypothetical precludes any consideration for what an actual, specific buyer would pay for the business. This means that certain synergies that could be realized by a strategic buyer are typically not considered in a fair market value appraisal. Since the pro forma adjustments likely include such synergies, they are probably not relevant from a fair market value perspective.

The 15-16x EBITDA multiple is probably also a stretch. Historically, most publicly traded RIAs with under $100 billion in AUM have traded in the 8-11x range, and this has actually ticked lower over the last few years. Even though Mercer Advisors isn’t really an RIA, it is in a similar line of business, so we can’t totally ignore the market’s current pricing of these companies.

On balance, an inflated multiple on a stretched earnings estimate is likely outside a reasonable fair market value range for this business as a stand-alone entity. Especially since RIA aggregators market prices have declined over 30% over the last twelve months leading multiples to fall.

The Strategic Value of Mercer Advisors

Since many believe Mercer’s ultimate acquirer will have synergistic intentions, strategic value may be more applicable in determining the likely purchase price.

Unlike fair market value, strategic value considers the particular motivations of a specific buyer and the synergies that could arise in a contemplated transaction. Since many believe Mercer’s ultimate acquirer will have synergistic intentions, strategic value may be more applicable in determining the likely purchase price. In this context, pro forma EBITDA estimates become more relevant, and we can look to recent transaction evidence for perspective on what strategic buyers are paying for these businesses. The most recent transaction in the space involved Goldman Sachs’ purchase of RIA aggregator United Capital for $750 million or an estimated 18x EBITDA. This price tag may be a bit rich for Mercer Advisors, which, at $16 billion in AUM, is quite a bit smaller than United’s $25 billion in client assets. Mercer’s pro forma EBITDA estimate may also be more heavily adjusted, so $750 million and/or 18x is probably a bit optimistic.

The Focus Financial IPO last Summer offers additional guidance. The IPO price implied a total enterprise value of $2.8 billion or 16x (heavily) adjusted EBITDA. While Focus is much larger than Mercer and United, the 16x multiple may be more applicable here since it is on top of an adjusted EBITDA figure and is reasonably in line with current pricing. Overall, there does appear to be some support for a 16x multiple from a strategic buyer perspective, but we’d like to know more about the pro forma adjustments before validating the $800 million offering price.

Where Do We Think this Deal Will Land?

Providing a reasonable range of value for this business is nearly impossible without knowing the acquirer or anything about Mercer’s financial situation, but we’ll take a stab at it. If we back off the multiple a bit and revise our pro forma earnings estimate, we get something closer to a $450 million to $650 million transaction value.

This estimate is purely speculative, and if $50 million in incremental EBITDA is truly achievable from a buyer’s perspective, then the $700 million-plus price tag looks very achievable especially since Mercer is one of the few independent RIA aggregators of this size left. Overall, we think the $700 million-plus headline value is a bit rich but certainly more meaningful than an ICC trophy.

RIA Valuation Insights

RIA Valuation Insights