The Investment Management Sector Is Being Bombarded … With Money

What Do You Do When Liquidity Matters More Than Fundamentals?

Juan Peron’s 1952 Ferrari 212 Inter, a 2.6 liter V-12 powering some tidy bodywork and enormous white-wall tires, was auctioned by RM Sotheby’s two years ago for about $1.2 million (image from journal.classiccars.com). While some may have felt uneasy about bidding on a car formerly owned by a fascist president who was ousted by a military coup… it is a beauty.

I have little patience for musical theater. About 20 minutes into most productions, I strain my eyesight in the darkened performance hall, staring at my wrist to see how much more entertainment I have to endure.

Sure, Hamilton is excellent, and I enjoy Les Miserable. But most Andrew Lloyd Webber-esque productions leave me pining for a conference call, a 200-slide PowerPoint deck, or some other more satisfying experience. One exception to this is Evita, the fictionalized retelling of Maria Eva Duarte’s rise to prominence, clash with the Argentine establishment, and death from cancer at the age of 33.

I will happily watch an entire three-hour performance of Evita to hear one lyric about the human blind spot to risk when times are good:

When the money keeps rolling in you don’t ask how

Think of all the people guaranteed a good time now

The Money Keeps Rolling In

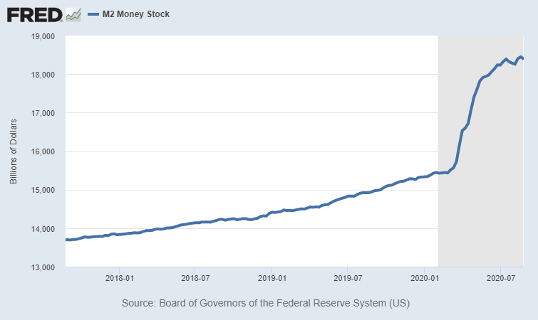

Say what you want about 2020 – it’s been very good to the RIA community. At the heart of all this good news is the Fed’s willingness to expand the money supply at an unprecedented rate, inflating asset prices and giving the investment management community more money to manage.

The BLS Read the Script

After the initial punditry on whether or not the 2020 market crash/recession and recovery would be “L” shaped, “U” shaped, “V” shaped, or “W” shaped, it has become clear that the recovery is “K” shaped, with higher-skilled and higher paying jobs recovering rapidly, and many lower-skill, lower-paying jobs declining. What does this mean for RIAs? Most RIA clients are higher-income professionals who are paying more attention to their investment portfolios in this environment – not less. Bullish for clients = bullish for the industry.

The Trading Community Read the Script

I’m leery of a market driven by liquidity instead of fundamentals, one in which junk bonds are priced to perfection and bank stocks (theoretically higher on the global capital stack than non-investment grade debt) are priced for hard times. But maybe it’s just another example of the K shaped recovery, picking winners and losers, and ultimately ceding more power within the finance landscape to investment managers and away from more traditional suppliers of capital.

The SEC Read the Script

After not amending the qualifications of an accredited investor for the industrialized nature of private equity, the depth of the retail investor community, or even inflation for nearly four decades, the Securities and Exchange Commission gifted the private side of the investment management community even more potential customers last month.

When I sat for the Series 7 back in the day, an accredited investor was supposed to be someone who, by the nature of their background and their balance sheet, not only understood the risk inherent in illiquid securities but could afford the loss should they invest in them. Apparently, the latter isn’t so important these days. Whether or not the wealth management community is prepared to put mass-affluent clients in private equity funds (and whether or not those private equity funds want them) remains to be seen.

And don’t worry about that pesky fiduciary rule…

The SBA Read the Script

Despite all the positive news for the RIA industry, about 2,400 firms applied for and received forgivable loans from the Small Business Administration’s Paycheck Protection Program. Although the forgiveness process has yet to begin, our anecdotal observation suggests that substantially all of these borrowers will have complied with the rules of the program and are eligible for forgiveness. We are on record as supporting the industry’s pursuit of low-cost working capital to provide stability in uncertain times, but many do not agree with us. Either way, it’s more money rolling in.

The PE Community Read the Script

Capital to fuel consolidation has never been more available. Although investment bankers to the RIA space will privately admit that the COVID era makes it difficult to push new deals through due diligence, the “pause” in the action is barely noticeable. We detect, among our clients, a growing backlog of consolidation activity and increasing desire to pick up the pace. Once we feel safe to travel, I expect the pace of M&A is going to be, in a word, brisk. Now is the time to be laying the groundwork for your next transaction – relationships drive deals as much as economics.

Stock Pickers Read the Script

Wherever fund flows land for 2020, it has been a watershed year for active management. After failing to prove value for the better part of a decade, this is a stock-picker’s market – and not just at Robin Hood. H1 was very kind to sustainable investing strategies, and now consolidators are paying more attention to everything from straight-up ESG funds to impact investing. It’s the (not so) new alternative investment strategy. The impact space, in particular, is hard enough to build capacity in that fee compression isn’t likely in the foreseeable future.

Even for more mainstream strategies, index funds only caught part of the disproportionate run-up in tech stocks, and now they’re massively over-weighted in a few names. If returns either broaden to the Russell 2000 or if the broader market outlasts a pullback in tech, it’ll show a market with obvious winners and losers – a market where thinking counts. Selling thinking is good for RIA margins.

Did the Audience Read the Script?

Is this bull market sustainable? There is no metaphysical reason that markets can’t continue to grind higher. Zero Hedge’s article last week about Softbank’s options strategy creating a vacuum that pulled equities higher into its gravitational vortex certainly presents a unique market phenomenon. The market swooned about two days after the strategy was revealed, and we don’t know if this is a pause before we’re headed higher, or if a more ominous storm is forming over equities.

Despite this being a good year for stock picking, it hasn’t been because of valuation expertise. Most of us would have done better forgetting what we learned about the cost of capital and buying Tesla instead. But assuming gravity still counts for something, pricey equities may be in for a rude awakening. I’m not a disciple of the CAPE-crusader, Robert Shiller, because he typically accurately predicts a bear market ten out of every two times. But he has a Nobel prize, and I don’t. If equities collapse, where will you (or your clients) hide? Risk-without-return treasuries? Overabundant commodities? Over-hyped art funds? Low-occupancy office properties?

Don’t Cry For Me…

The lyric I quoted above from Evita references the Peron Foundation, in which people donated to a general fund, managed entirely by Eva Peron, to make grants to needy people for everything from a new pair of shoes to a college education. The Peron Foundation drew lots of attention, and was ultimately a giant disaster, because it was supposed to be the answer to all of society’s problems. When it wasn’t, charges of mismanagement and money laundering came from everywhere.

When the money keeps rolling out you don’t keep books

You can tell you’ve done well by the happy, grateful looks

Sound familiar? My chief concern about the RIA community these days is that because it has done so well for so many customers for so long, it is now like the Peron fund, attracting capital from every direction, all because of data which suggests a bombproof business model. Just as nothing creates success like failure, mean reversion suggests all this goodwill for the investment management industry could lead, ultimately, to a very different outcome.

In the past, it seemed like every time Congress suggested privatizing Social Security so people could invest more in equities, a bear market ensued. Where are we in that cycle now?

RIA Valuation Insights

RIA Valuation Insights