What Market Volatility Means for your RIA

Is Volatility the New Normal?

By the middle of March, most RIA owners were hunkering down for what looked to be the next recession. By the end of March, the S&P 500 had fallen approximately 24% from its all-time high of 3,386 on February 19, 2020 to 2,585 on March 31, 2020. By the middle of June, however, the stock market and most RIAs’ assets under management have recovered to where they were about a year ago. While we gave up the gains of the final year of an 11-year market run up, the market and income statements of most RIAs look much the same as they did 18 months ago. Despite this, most RIA principals feel they are in a very different position than they were a year ago.

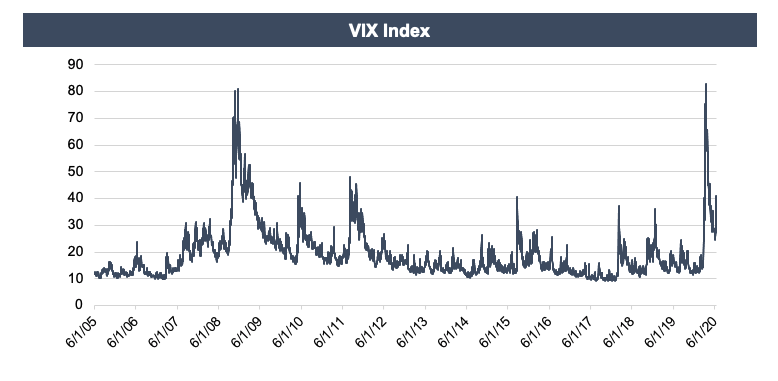

Due to the COVID-19 global pandemic, the future of the economy has become more uncertain. The VIX, which calculates the expected volatility of the U.S. Stock market, hit a new all-time high on March 16th of 82.69, which was higher than the peak during the financial crisis in 2008. The recent VIX measure is especially noteworthy given the comparatively sleepy decade which preceded it.

If one thing has become more clear, it’s that market volatility is here to stay – at least for a while. In this post, we explore what this volatility means for you and for your RIA.

AUM, aka Revenue Base, is More Volatile

For RIAs that charge fees on a quarterly basis, the fees charged on March 31, 2020 will be significantly lower than the fees charged as of June 30 (barring any significant decline in the market over the next 7 days – which is not out of the question). Many RIAs have quickly adjusted to this new normal. Rather than charging fees quarterly, which makes them more susceptible to the large swings in the market, they have switched to charging fees on a monthly basis.

Active Managers May be Able to Exploit Mispricing in the Market

During times of increased volatility, active managers are generally able to take advantage of the swings in stock valuations away from fair value, allowing them to realize increased returns for their clients. This may be more difficult in the current market as the volatility today is not just driven by increased “fear” in the market, but a lack of liquidity in our financial system.

Over the last few months, bid-ask spreads have widened, and trading volumes have generally declined. A lack of liquidity in market structure is associated with increased risk. In a less liquid market, it is more likely that you could get stuck in a losing position. Additionally, in less liquid markets, prices tend to overreact, making market moves less informative. While there are more winning opportunities presented to active managers, there are also more losing ones.

Sector-Specific Managers are Missing Out

Most of the recovery in the market since the March decline is attributable to the resilience of tech stocks. Investors are willing to bet that tech companies, such as Microsoft and Apple, will emerge from the COVID-19 pandemic stronger than before. Just five stocks – Microsoft, Apple, Amazon, Google parent Alphabet, and Facebook – account for more than 20% of the market cap of the entire S&P 500 index, according to BofA Global Research. This means that asset managers without exposure to the tech industry are likely lagging the broader market, as measured by the S&P 500.

Internal Transactions Have Been Canceled

Most sellers of RIAs are currently unwilling to sell at the pricing implied by valuations as of March 31, 2020, which likely did not forecast the quick recovery in equity markets in April. Additionally, the next generation of leadership is likely not currently in the financial position to take on additional risk. Rather, many households are decreasing risk as they prepare for the possibility of another global recession.

External Transactions are on Pause

Unlike the slowdown in M&A in many other industries, the stall in deal activity in the RIA space is not due to a lack of financing. Rather many deals have been put on hold as the due diligence process is impeded by travel restrictions meant to limit the spread of COVID-19. While most business and due diligence can be conducted over Zoom calls, it’s hard to actually sign an eight-figure check without having ever stepped foot in the main office of the company you are buying. And most sellers don’t want to hand their businesses over to someone they haven’t actually met.

Planning is More Important Than Ever

During this time when the outlook for global markets, the economy, and one’s own health and financial well-being is uncertain, many RIA principals are working to nail down the unknowns associated with business ownership. RIA principals are devoting more time to working on their buy-sell agreements in an effort to protect the working relationships with their partners and ensure they and their families are protected financially in the event of a divorce, partner dispute, disablement, or death.

The current environment is ripe with uncertainty. This presents both challenges and opportunities for principals of investment management firms. As we all know, this will eventually pass, so most of our clients are focused on positioning rather than acting.

RIA Valuation Insights

RIA Valuation Insights