Did Macquarie Pay 11x EBITDA for Waddell & Reed? Yes and No

Catching a Falling (Butter) Knife

Last week, Macquarie Group announced its acquisition of Waddell & Reed (WDR) for $1.7 billion. Waddell & Reed is one of the oldest mutual fund and asset management firms in the U.S. with a range of investment styles and insurance products. Waddell and Reed’s asset management division will expand Macquarie’s investment solutions, boost Macquarie’s annuity earnings, and push Macquarie’s U.S. AUM to $276 billion, making it one of the top 25 active managers in the U.S.

The transaction marks a shift in Macquarie’s past acquisition strategy, which has historically followed the old saying, “The time to buy is when there’s blood in the street.” The firm’s last large acquisition was in 2010 when it acquired Delaware Funds (with $135 billion AUM) for $428 million. Instead, Macquarie is moving when the market is at an all-time high and paying nearly a 50% premium to WDR’s share price.

Not only does this mark a shift in Macquarie’s deal strategy, but it is also the first acquisition by Macquarie’s new CEO. Shemara Wikramanayake, who has been called the most powerful woman in Australian finance, is now dealing with skeptics who ask why she paid such a premium for a business whose AUM has halved over the last six years.

Transaction Overview

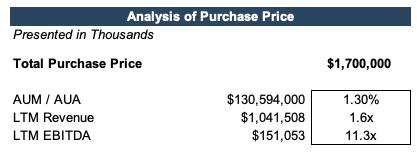

At first glance, the AUM and revenue multiples paid by Macquarie Group appear fairly normal for an asset manager, but maybe not for a firm with a 14% EBITDA margin and years of declining AUM.

While EBITDA multiples over 11.0x are not unheard of in this space, one would likely expect an impressive growth trajectory to accompany it. To understand the deal multiples implied by Macquarie’s acquisition of Waddell and Reed, we must dig into the details of the transaction.

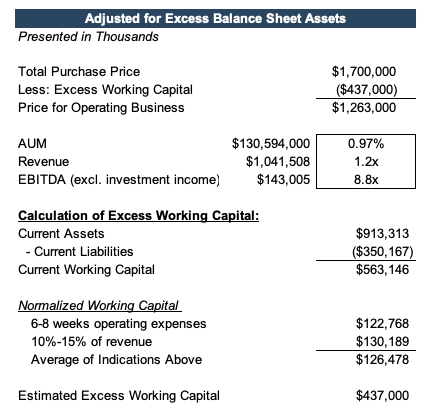

WDR has historically held lots of cash and investments on its balance sheet, for which Macquarie likely paid dollar for dollar. Typically, RIAs hold between 6-8 weeks of operating expenses on its balance sheet as working capital, or approximately 10% to 15% of revenue. With an estimated $437 million of excess working capital on its balance sheet, the price for the operating business is approximately $1.26 billion, which implies multiples more in line with the typical range observed in the legacy asset management space.

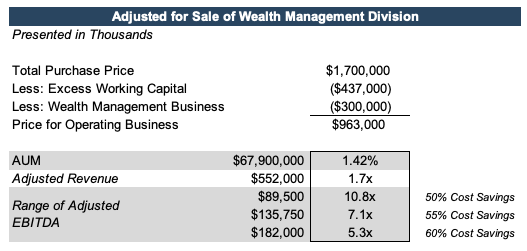

Additionally, upon completion of the deal, Macquarie Group will sell WDR’s wealth management division to LPL Financial (a U.S. retail investment advisory firm, BD, and RIA custodian) for $300 million. The adjusted transaction price as a multiple of WDR’s asset management division’s AUM is 1.42%. However, determining the post transaction revenue and EBITDA requires a good bit of speculation.

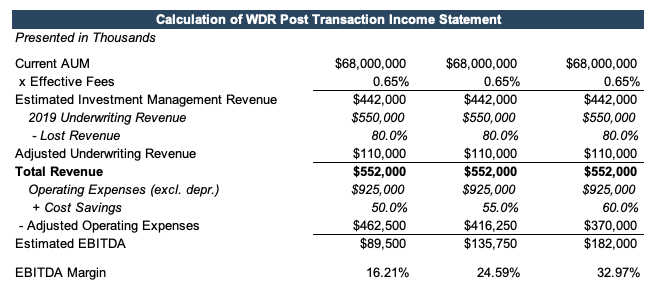

With AUM of approximately $68 billion and pro forma effective fees of around 65 bps, the post-transaction business will likely generate about $450 million of investment income. A little under 90% of WDR’s underwriting revenue was generated through its advisor network. Post-transaction, Macquarie will be one of LPL’s top strategic asset management partners, which suggests that Macquarie will not lose all revenue associated with its advisor network. As such, we have estimated WDR’s underwriting revenue stream could fall by approximately 80%. There will be expense savings generated by selling this business and additional synergies from merging with Macquarie. However, buyers don’t often pay for something they bring to the table, so WDR was likely only compensated for the cost reductions associated with selling its wealth management business. Thus, we have modeled a range of scenarios with between 50% to 60% cost savings.

Even if Waddell and Reed’s AUM has been falling year-over-year, scale is valuable in the asset management space and we doubt that Macquarie was able to pick up WDR’s asset management business for a 5.0x EBITDA multiple. But the 7x-11x range seems reasonable. Macquarie’s acquisition of Waddell and Reed highlights how the success of legacy asset managers is currently dependent upon achieving scale.

While the $25 per share purchase price represents a healthy premium to the latest pricing, the market has been down on investment managers since March’s sell-off. Paying a premium does not necessarily mean that Wikramanayake overpaid. Some may say that Macquarie is catching a falling knife by buying a business whose assets have been on the slide, but maybe it was just a butter knife…

RIA Valuation Insights

RIA Valuation Insights