Do RIA Investors Prefer Growth Over Value?

What Public Company and Transaction Data Multiples May Tell Us About RIA Investor Preferences

As valuation experts, we watch trading multiples closely in both the public and private markets. We diligently follow handpicked investment manager indexes, and we monitor publicly disclosed transactions as well as our own proprietary data collected through our hundreds of valuation engagements. In a valuation context, market pricing is often viewed as a test of reasonableness as to an appraiser’s conclusion of intrinsic value. As any investment management professional knows, the reason may elude public pricing from time to time, but in the long run, market pricing is the only true proxy for intrinsic worth. Studying how multiples change over time helps us contextualize industry trends and pervading sentiments.

In recent years, market sentiment for publicly traded investment managers has lagged the optimism seen in the robust private markets for RIAs and other investment managers. This should sound counterintuitive. In most cases, publicly traded companies are priced at a premium to their typically smaller, less liquid peers. Theoretically, public companies enjoy the benefits of liquidity and heightened access to capital which in turn spurs growth. Additionally, publicly traded companies are typically larger and have demonstrated the aptitude to amass scale, institutional backing, and brand necessary for an IPO. To some degree, these trends do bolster public market valuations, which makes it all the more striking that public multiples should trail private market competitors.

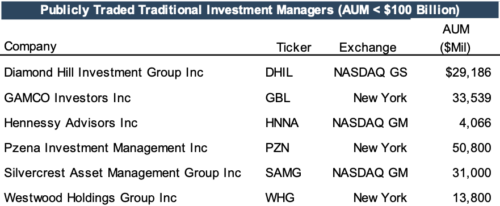

*Table represents Mercer Capital’s index of U.S. publicly traded investment management firms with under $100 billion in AUM, excluding those specializing in alternative investments

While public companies traditionally warrant outsized multiples, transaction data to is often biased upwards. In most cases, and especially in the investment management industry, deals are made for the purpose of unlocking “transaction value.” This may arise from increasing profitability, growth, or reducing risk. For instance, in joining two firms, advisors may be able to increase margins by sharing overhead and management costs or by streamlining cost-effective operational platforms. In other instances, advisors may be able to tack on new service offerings or expand into more strategic geographies. Any value identified in a transaction above fair market value is referred to as a transaction premium and is often shared between the buyer and seller upon negotiated terms.

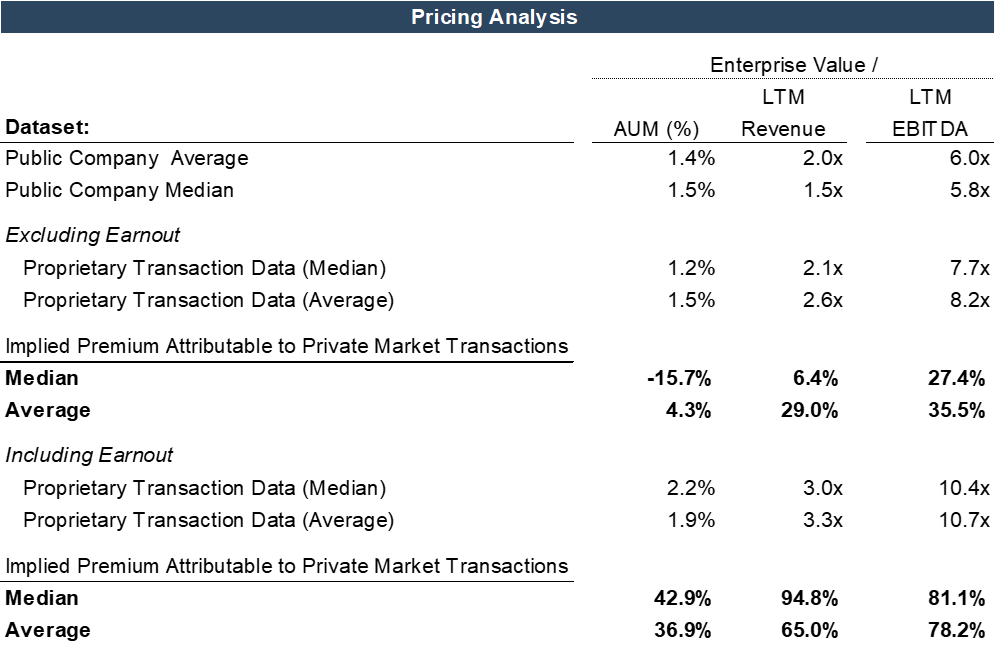

Transaction premiums vary widely and are difficult if not impossible to quantify without already having determined a specific buyer. In the context of “fair market value” – the most common standard of value used in appraisals — we try to decouple any transaction premiums when relying upon transaction data. In many instances, however, transaction premiums cannot be identified in private transactions due to the inability of a third party to ascertain the value a unique buyer sees in their purchase. For this reason, appraisers are often cautious when using guideline transactions data. A common proxy for a transaction premium, albeit a rudimentary one, is an earnout. Earnouts are contingent money paid out to the seller over time based on future performance. The purpose of an earnout is to align the incentives of the buyer and seller after any transaction is closed. If we consider earnouts to be a decent proxy for a transaction premium, transaction multiples observed from private market data still indicate a premium of 6.4% enterprise value to revenue and 27.4% enterprise value to EBITDA (see table below).

We believe there are multiple reasons for this discrepancy in pricing among public and private buyers. First, most publicly traded investment management firms can be categorized as asset managers, specializing in investment products and seeking to generate alpha, while the typical RIA often focuses on wealth management, specializing in a range of services to protect and grow client wealth. Over the past decade or so, asset managers have faced fee compression as passive investment products such as ETFs and index funds have outperformed actively managed funds in both fund flow and return. Wealth managers, on the other hand, have demonstrated exceptional client retention independent of market performance. Consequently, wealth managers are often valued at a premium to asset managers in the current market environment. This may explain to some extent why smaller transactions are trading at multiples above publicly-traded competitors, but probably not entirely.

For instance, consider Silvercrest Asset Management Group, Inc. Despite its name, Silvercrest can be considered, for all intents and purposes, a wealth manager. According to Silvercrest’s most recent 10-k, the RIA boasts 98% client retention and promotes itself as a financial advisor offering family office services to ultra-high net worth individuals (net worth above $10 million) along with investment services to institutional investors. While investment research, portfolio construction, and implementation are performed in-house, Silvercrest benefits from the same higher margin, higher retention model of any wealth management firm. Despite the similarities to smaller wealth managers, Silvercrest was trading more or less in line with the median multiples observed among publicly traded asset management firms with assets under management below $100 billion. Compared to our proprietary transaction data, excluding contingent consideration, Silvercrest is valued well below private market indications.

So, Who Is Correct?

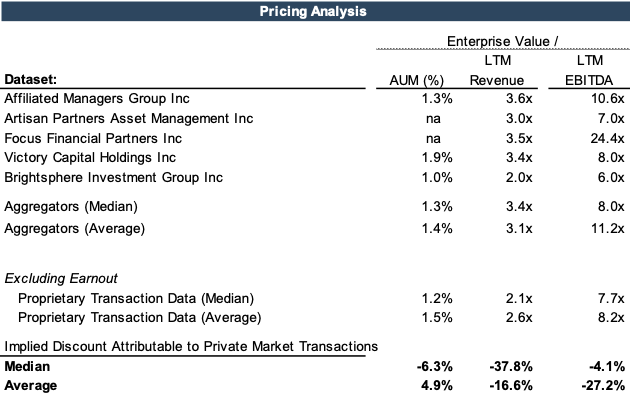

To understand the pricing discrepancy between public and private markets, it is helpful to look to the publicly traded RIA consolidators for perspective.

The aggregator value proposition to investors can more or less be summed up as enhanced growth through RIA (typically wealth management) acquisitions done at multiples below the aggregator’s multiple (multiple arbitrages) and financed with cheap (for now) debt. RIA multiples have expanded significantly in recent years, which leaves growth as the primary driver of shareholder return. While the aggregator model may advertise streamlined platforms or expansive service offerings, the business model is more or less the same as those wealth managers they look to acquire. Multiples, however, tell a different story. As seen in the table above, median revenue and EBITDA multiples are well above those observed in our transactions data, suggesting a significant premium on growth in the RIA market.

The premium investors place on growth in the RIA industry helps explain the discrepancy in multiples between the private and public markets. The private RIA market is dominated by a handful of aggregators, and the need to achieve growth to appease shareholders may be a primary reason for outsized valuations within the smaller, private markets. Additionally, smaller RIAs, like any smaller company, are able to achieve superior growth during the beginning of their life cycle, better attracting buyers and higher valuations. While in most industries the premium placed on outsized growth for smaller companies is typically offset by higher discount rates attributable to company specific risk, the RIA industry may place a higher premium on growth opportunities than other industries.

As independent appraisers, our objective is to render an unbiased conclusion of value that is both aware of while also independent of general market sentiments. This is why it is essential to hire an appraiser with both deep industry knowledge and expertise in business valuation. If you are considering a valuation or a transaction, please contact a Mercer Capital professional.

RIA Valuation Insights

RIA Valuation Insights