Does This Presidential Election Matter to the RIA Industry?

For some reason, we get this question every four years or so, and it’s come up quite a bit in recent weeks. As a matter of practicality, it’s not something we give a lot of thought to in our professional lives because the outcome of this election is uncertain, and its impact on the investment management sector and RIA dealmaking is even less predictable. Regardless, this topic is currently a matter of much debate and natural curiosity among our clients and industry contacts, so it’s probably worth a blog post every 200 weeks or so.

Let’s start by saying that with all of the hot-button issues the candidates are currently squabbling about, the RIA industry does not appear to be top of mind for the former president or current vice president. If you’ve followed the recent debates, then you’ve likely noticed that golf handicap scores, rally attendance metrics (and attendee duration), and supposed immigrant dietary preferences are apparently of greater national interest than what’s going on in the RIA sector.

We, therefore, have to step back and think about what either candidate’s election would mean for the broader financial services industry, taxes, and stock market returns. For Trump, we could see continued deregulatory efforts for banks and financial institutions and a greater likelihood that the Tax Cuts & Jobs Act gets extended beyond 2025. On the negative side, many market analysts expect heightened volatility and investor anxiety under a second Trump presidency. For Harris, a proposed tax on unrealized capital gains would be a detriment to high-net-worth investors, but the impracticality (or unpopularity) of such a measure makes it an unlikely scenario. The perception of a more stabilized stock market (or perhaps more predictable policy moves) under her presidency likely offsets any chances this proposal makes into a law. Unlike the last two debates, we’ll call this a tie – no clear winner (or loser).

There is also a very real possibility (and even likelihood) that either candidate will enter office without full control of Congress. Since Democrats need a net gain of just four seats to reclaim the House majority and Republicans need just one more flip to win back the Senate, gridlock seems like a highly possible outcome for the next president. A split Congress would likely mean a legislative dead-end for major policy initiatives as bipartisan dealmaking has become increasingly scarce in recent years.

Still, the potential for gridlock and lack of candidates’ interest in the RIA space doesn’t mean this election has no implications for investment management firms. Eighty percent of RIAs have recently reported client concerns about the political environment over the next twelve months, according to new research by insurance company Security Benefit.

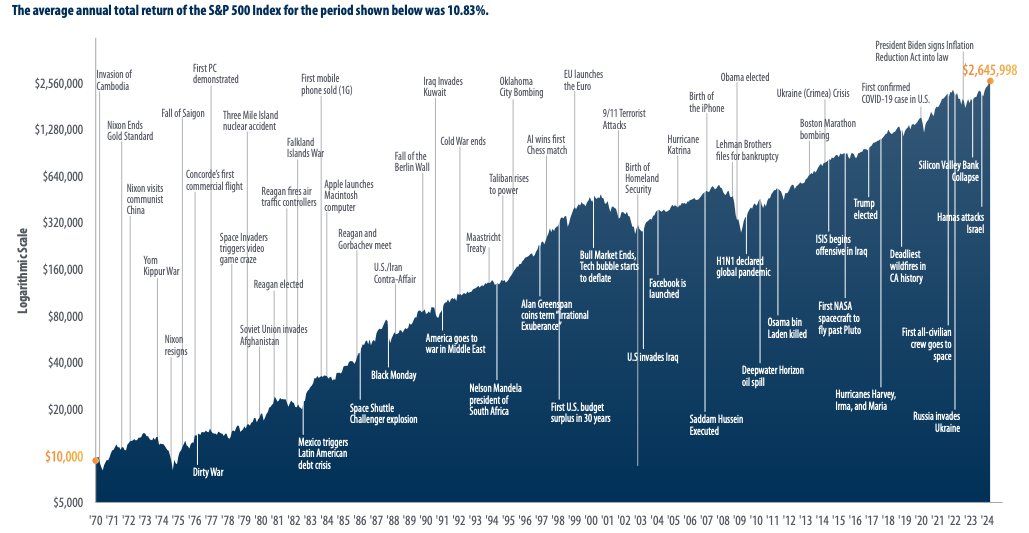

In this context, an advisor’s role is critical in persuading their clients to stay the course, emphasizing that time in the market is almost always a better strategy than timing the market. Conservative clients may be inclined to sell their stock holdings with a Harris victory and vice versa for liberals if Trump wins, but history has shown that to be a poor strategy for long-term investors:

Click here to expand the image above

Even if the market does tank after the election, that could be a buying opportunity for investors with cash on hand. The market initially tanked in the first few months under Obama before performing very well thereafter, and the stock market opened sharply lower after Trump’s election and also performed well during his presidency. The graph above shows an annualized return of nearly 11% for the S&P 500 since 1970 despite numerous recessions, financial crises, international conflicts, and highly contested presidential elections. It’s reasonable to assume that it will continue its ascent over the next four years regardless of this election’s outcome.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, RIAs, trust companies, broker-dealers, PE firms, and alternative managers.

RIA Valuation Insights

RIA Valuation Insights