Don’t Get Distracted by Franklin/Legg and MS/E-Trade

Creative Planning’s Minority Sale is the Most Consequential RIA Deal So Far in 2020

1970 Oldsmobile Cutlass Supreme: What GM sold at the top (wikimedia.org)

Stop and reflect on the significant financial news of the past month – what do you remember? Coronavirus? Warren Buffett’s annual shareholder letter? Morgan Stanley merging with E-Trade? Franklin Templeton buying Legg Mason?

It’s hard to imagine, but the most significant deal in the RIA community so far this year happened less than three weeks ago and is already nearly forgotten: Peter Mallouk sold a minority stake in his firm, Creative Planning, to private equity firm General Atlantic. The transaction is easily one of the largest minority transactions in the history of the RIA industry, and potentially provides a blueprint for others to follow.

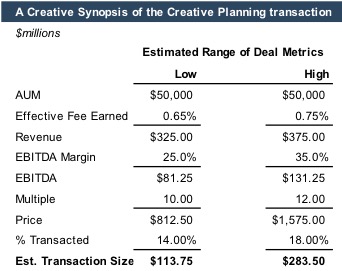

Deal specifics were not given, and we don’t have any inside knowledge of how the transaction was structured. What we do know is that Creative Planning reported just under $50 billion in AUM at year-end 2019, twice the size of United Capital when it was acquired outright last year by Goldman Sachs.

Creative Planning’s fee structure is not atypical for the industry, and no doubt some fees on upper-end clients are negotiated. But while we cannot say with certainty what their effective fee schedule is across their overall business, it wouldn’t be unreasonable to assume that Creative Planning realizes 65 to 75 basis points on that $50 billion, for total revenue in the $300 to $400 million range. Stop and take that in for a moment, as very few investment management franchises have achieved a similar scale.

We strongly suspect that the margin Mallouk realizes is enviable. Creative Planning posts a smaller headcount than United Capital, despite having twice the assets under management. Investment management is a labor-intensive business, but Creative Planning is efficient, and probably boasts an EBITDA margin north of 25%, maybe as much as 35% (and possibly more). This suggests that the firm makes on the order of nine figures per year in distributable cash flow. Of note, prior to this transaction, Mallouk was the sole owner.

We strongly suspect that the margin Mallouk realizes is enviable.

As for the multiple paid, we remember the high-teens multiples bandied about last year for the Goldman/United deal and the sale of Mercer Advisors. Mallouk was interviewed by Barry Ritholtz in December and mentioned he was entertaining an offer to sell part of his firm. In the conversation, Mallouk suggested that an appropriate multiple for a minority stake in a firm was 25% less than if it were a change of control transaction. If we benchmark that discount off of the major transactions for similarly scaled franchises last year, we estimate that Creative Planning fetched a low double-digit multiple of EBITDA. That would value Mallouk’s business, even on a minority interest basis, at ten figures.

The implication of all this is Mallouk sold a “mid-teens” percentage interest in Creative Planning for nine figures, and possibly as much as a quarter-billion dollars. Mallouk says he’s keeping all this cash in the business, as a cushion to protect his firm in the event of a bad market. More likely, in our opinion, is that the cash will serve as a war chest to fund growth in the event of market stress. If Mallouk did draw a strong multiple in a strong market and is now prepared to buy market share and hire talent in a downturn, this transaction will go down as one of the best in the history of investment management.

As this bull market approaches its twelfth year, it’s worth noting how firms are positioning and repositioning for the long term. And it’s worth considering what isn’t happening as well. Mallouk didn’t sell the firm outright, and he didn’t go public. He says he sees upside in independence, and he’s putting his money where his mouth is.

Mallouk didn’t sell the firm outright, and he didn’t go public.

The Creative Planning transaction is very different than the more widely reported deals from February. The Morgan Stanley acquisition of E-Trade is interesting for brand extension into the mass affluent space (a la Goldman/United), and we’re curious to see if the Franklin/Legg Mason deal delivers promised expense savings as a larger franchise (we are skeptical). In both cases, though, the firms are managing their downside from changes (fee compression) in the market – which is not characteristic of the operating environment for Registered Investment Advisors. The Creative Planning transaction is about taking advantage of the remarkable upside available in the RIA space. It’s the kind of deal we hope to see more of.

RIA Valuation Insights

RIA Valuation Insights