Gin, Business Valuation, and Ryan Reynolds

Earn-Outs in RIA M&A

Image source: www.spiritedzine.com

Typically, my love of business valuation and gin and tonics do not go hand-in-hand, and, unfortunately, Ryan Reynolds has never been thrown into this mix. But last week, three of my favorite things collided in Reynolds’ viral out of office reply.

On Monday, Diageo, a European beverage company, announced it would be acquiring Aviation American Gin, owned by Ryan Reynolds (among others), for total consideration of $610 million, and, on Tuesday, Reynolds had a stark realization…

Thanks for your email. I am currently out of the office but will still be very hard at work selling Aviation Gin. For quite a long time, it seems.

In related news, I just learned what an ‘earn out’ is… And I’d like to take this opportunity to apologize to everyone I told to go f**k themselves in the last 24 hours. My lawyers just explained how long it takes to achieve an ‘earn out’… so… turns out I’m not as George Clooney as I thought. The point is, to those listed below, I’m sorry… and I’ll indeed be needing your help in the coming months and years. Thanks in advance!

Mom, Blake, Peter, Diageo CEO, The Rock, George Clooney, Southern Glazer’s, Betty White, TGI Friday’s, Baxter, Calisthenics, AMC Theaters, Total Wine, The Number 8, Don Saladino, Darden, The Head of Alfredo Garcia, Soothing Lavender Eye Pillows.

Ryan Reynolds

Owner ?

Aviation American Gin

Apparently, the $610 million advertised transaction price is made up of an initial payment of $335 million and contingent payments of $275 million, based on the performance of Aviation American Gin over a 10-year period.

Gin, Business Valuation, Ryan Reynolds, and your RIA

Earn-outs are commonly used in RIA deals, and we expect contingent payments to make up an even larger percent of deal consideration for the next few months, quarters, or years depending on how long the current economic uncertainty lasts. And while we hope most of our clients would be thrilled by the prospect of $335 million in upfront cash payments, we don’t want you to end up feeling as Ryan Reynolds did last week. In this post, we explain what an earn-out is, why they are commonly used in RIA transactions, and how earn-outs may be used as a saving grace for deal activity in the current economic environment.

What Is an Earn-Out?

An earn-out is an agreement between a buyer and a seller to defer a portion of the purchase price. The amount of consideration ultimately paid is determined based on either some measure of post-closing financial performance such as AUM or EBITDA, or a specific milestone that occurs post-closing such as the renewal of a large contract.

Contingent consideration allows for risk-sharing between the buyer and the seller. Deferral of the purchase price functions as a hedge for the buyer against poor future performance, while sometimes simultaneously providing the prospect of additional upside for the seller if they outperform buyer expectations. Importantly, contingent consideration influences post-transaction behavior. When it is necessary for the seller to continue operating the business following the sale (for RIAs, this is almost always the case), the presence of contingent consideration can incentivize the freshly-endowed sellers not to “call in rich” (like Reynolds thought George Clooney did in his sale of Casamigos tequila for $1 billion – actually 30% of the total consideration was subject to a 10 year earn-out like in Reynolds’ case), but continue to promote the success of the business.

Why are Earn-Outs Commonly Used in RIA Transactions?

Earn-outs are commonly used in RIA transactions, as the purchase price is not based on the value of hard assets acquired but expected future cash flows. Future cash flows of an RIA can vary dramatically as they depend on a large number of variables, including:

- The performance of financial markets;

- The skill of the investment management staff;

- The sustainability of the acquired firm’s fee schedule;

- The retention of key staff at the acquired firm;

- The motivation of key staff; and

- The retention of client assets.

As an example, we consider just one of these variables – market performance – and how an earn-out can be used as insurance to the buyer in case of a market downturn. While the market has almost recovered back to February highs, thanks mostly to the FANG stocks, some still think that this V-shaped recovery could turn into a W.

Assume that RIA Capital buys ABC Investment Management, with $4.2 billion in assets, for a total price of $100 million. The transaction is structured such that two-thirds of the proceeds are paid up front and the remainder of the purchase price is paid over three years if ABC’s AUM grows by at least 5% per year.

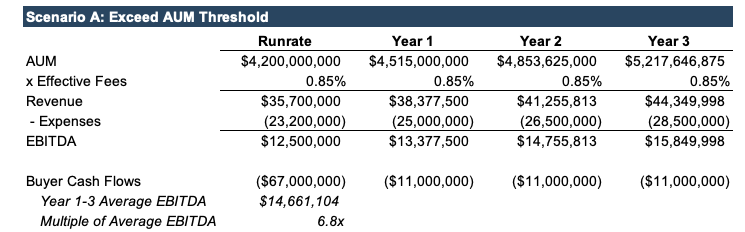

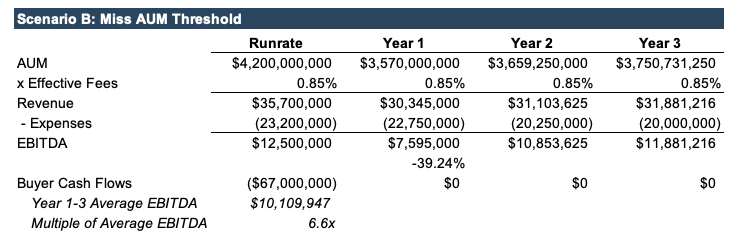

In Scenario A, ABC Investment Management’s AUM grows by 7.5% per year, and given the operating leverage inherent in most RIAs, EBITDA increases from $12.5 million to $15.8 million over the earn-out period. In this scenario, the entire earn-out is paid. The total consideration paid by the buyer is $100 million, which represents 6.8x average EBITDA in years 1-3.

In Scenario B, ABC’s AUM falls by 15% in year one and slowly begins to recover, but, due to the operating leverage, EBITDA falls by almost 40% in the first year (a decline in revenue with little or no decline in expenses results in a larger drop in profitability). In Scenario B, the seller does not receive any contingent payments. The total consideration paid by the buyer is $67 million (the amount of the closing payment), which represents 6.6x average EBITDA in years 1-3.

While the financial results in Scenario A and Scenario B differ quite drastically, the deal economics (from the buyer’s perspective) are similar. In both scenarios outlined above, the buyer paid roughly the same multiple of forward average EBITDA despite the difference in ABC’s EBITDA trajectory.

Expect a Larger Portion of RIA Deal Proceeds to be Paid as Contingent Consideration

RIA transaction activity has slowed during COVID-19. Most deals that were already in motion when COVID-19 hit, were finalized. However, new deal activity has been minimal. While a lot of due diligence can be performed virtually, buying an RIA in the middle of so much uncertainty is hard to swallow. However, the need for succession planning in the RIA space has not halted because of the pandemic. Rather, during COVID-19, many RIA principles have realized that succession planning is something that can no longer be delayed.

So, how do you get buyers and sellers to execute a transaction during COVID-19 when the economic environment is so uncertain and when buyers likely have never set foot in the office they are buying or met management face-to-face? Part of the answer may be to bridge the gap between seller and buyer expectations by structuring the deal in a way that defers payment of a substantial portion of the purchase price in the form of contingent consideration.

If you’re contemplating an offer for your firm that includes an earn-out, talk with an independent expert so you can better understand the value of the payments. And, Ryan Reynolds, if you are reading this, we would be happy to advise you on your next business deal.

RIA Valuation Insights

RIA Valuation Insights