Growing Pains

Is the RIA Industry in Growth Mode or Shake-Out?

While the wealth management industry is not new, the amount of change, churn, and growth that has occurred in the industry over the past ten years make it easy to forget how far the RIA industry has come since the heyday of broker-dealers.

Following a financial crisis brought on by scandal and exacerbated by leverage, the fiduciary model has become the solution to restore trust in the industry among both clients and regulators. Since this transition, AUM has grown dramatically, as has the number of RIA firms. After a ten-year bull run, which was only momentarily stalled by the country’s shortest economic recession, strong performance from passively managed funds has enabled fee compression throughout the industry.

Contextualizing the challenges facing the wealth management industry leaves one to wonder if many of these trends are no more than growing pains in the sector’s life cycle. And if so, what might such analysis suggest about the prospects for the fiduciary model?

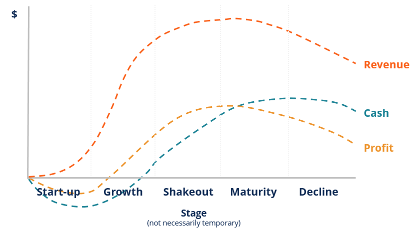

The lifecycle of an industry is often characterized by the following phases: start-up, growth, shakeout, maturity, and decline.

- Start-Up. During an industry’s infancy, customer demand is at first limited due to unfamiliarity with the new product and its performance. From the aftermath of WWII until the advent of ERISA in the 1970s, the broker dealer model flourished. During the 1970s, bad market conditions kept the lid on RIA growth, but by the 1980s registered reps were leaving wire-house firms and young trust officers were leaving banks to set up registered investment advisors, usually offering a very wide variety of services priced under what was then the new fee-based concept, instead of commissions.

- Growth. Just as customer demand is limited at first, so is competition which can lead to impressive growth and profits until more players enter the space. However, the inevitability of competitors chasing profits, is an elementary principal of economics. Over the past couple of decades, the count of RIAs, the number of professionals who work for

RIAs, and the dollar volume of assets managed by RIAs, has exploded. But, competition has led to the need for differentiation, and that need has led to specialization. - Shakeout. Periods of high profits, low market concentration, and pressure for consolidation is often described as the shakeout period because many firms aren’t positioned to survive. As market participants vie for a limited supply of market share, all the while cutting costs to remain competitive, consolidation is inevitable. In theory, ‘economic profit’ in an industry is only temporary.

If the recent history of the wealth management industry can be grafted to a typical industry life cycle framework, the wealth management industry may be in a shakeout period. Consider the following trends that have dominated the independent advisor narrative in recent years:

The wealth management industry may be in a shakeout period.

Product Innovation: Product innovation is the catalyst for every industry lifecycle. That initial great idea, product, or service is adopted by many market players as the industry grows. These adopters often bring their own ideas to the table, or spawn other industries in response. In short, innovation, and the industry life cycle for that matter, is an iterative process bound by serendipity—or disaster as was the case for the fiduciary model after the Financial Crisis.

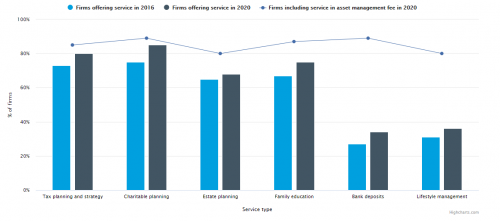

While fiduciary money management has been around for quite some time, its rapid adoption resembles something like a genesis. The growth in the RIA space over the years has been charged by innovation, be it money managers finding new business models that allow their teams more independence or clients demanding new services or increasing levels of specialization. As seen in the 2021 Charles Schwab RIA Benchmarking Study, firms of all sizes are continuing to increase their offerings (across all service types: tax planning, charitable planning, estate planning, family education, bank deposits, and lifestyle management) as firms look to distinguish their value proposition.

CLICK HERE TO ENLARGE THE IMAGE ABOVE

Number of firms: A shakeout period is often defined by both low market concentration and rapid consolidation as firms use acquisitions to maintain economic profit rather than seek growth organically. As we recently noted, the number of RIA firms continues to grow to record numbers despite intense deal activity that would otherwise be considered a hallmark of consolidation. Meanwhile, wire-houses have consistently lost market share over the past ten years as the myth of corporate brand continues to be undermined by AUM flow. This conflict between the increasing number of firms and the pressure for consolidation is in large part being driven by the same profit dynamics that categorize the beginnings of a shakeout period.

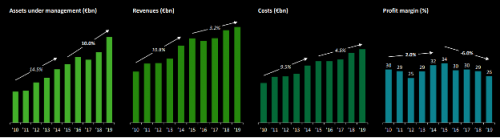

Growth & Profitability: While assets managed by independent advisors nearly tripled during the ten years between 2009 and 2019 profitability has begun to lag as clients have become increasingly fee sensitive. Much of the fee compression in the RIA space is being driven by competition with passively managed funds, which until recently have had the longest bull run in history to go unchallenged. But, as evidenced by the record number of independent advisors, competition among firms is just as easily responsible. Regardless, profitability explains the high deal volume in a wealth management space that benefits from economies of scale. Because revenues are tied to AUM and certain overhead costs are more or less fixed, operating leverage can have a positive impact on margins even with modest fee pressure. But it’s not just fees that are feeling pinched. RIAs are increasingly competing for talented money managers who have become more aware than ever of the value of their book of business.

Economic utility might just be a better metric than economic profitability for understanding the incentives behind consolidation in the wealth management space.

For this reason, economic utility might just be a better metric than economic profitability for understanding the incentives behind consolidation in the wealth management space. In an industry as labor intensive as wealth management, advisors are just as much clients as they are the product, and advisors are leaving wire-houses in favor of independence, often for reasons not always tied to pure economics.

Ultimately, as the industry tries to accommodate both the price preference of clients and the lifestyle preferences of its most valuable assets, market concentration will remain low and deal values high. As such, and despite ballooning valuations, acquisitions remain at all-time highs while so too does the number of RIA firms. A shakeout period explains the conflict between the need for scale and the pressure to retain talent as economic utility is being carved out.

CLICK HERE TO ENLARGE THE IMAGE ABOVE

Or, is the RIA Industry still in Growth Mode?

For now, we see no end in sight for the RIA acquisition frenzy. And, despite the large number of RIA transactions, most firms are not looking to sell. In a yield starved environment, RIAs continually are perceived as the ultimate growth and income investment. AUM growth, and ultimately earnings growth, show no signs of slowing. An upward trending market is a further catalyst. So, while there may be a growing quantity of RIA firms, the appetite for acquisitions appears to be greater with many owners holding on.

What does this mean for your independent wealth management firm? While the industry lifecycle may be a helpful tool for understanding current industry headwinds, the timeline of industry phases is impossible to predict. Innovations can arise that can propel an industry back into a growth phase or just as likely syphon profitability towards rival industries. Additionally, firms can always achieve high growth through product innovation or superior capital budgeting no matter what industry they operate in. At most, the industry lifecycle helps make sense of the challenges facing the industry today and perhaps where to look for solutions, be that through additional services, reduced fees, or acquisitions.

That said, the wealth management industry is competitive and will continue to be so. Fee compression will continue to be a headwind, and as a result staying cost competitive is as important as ever. Higher fees should be justifiable by premium services, value adds or ancillary services. But perhaps equally as important, retaining talent will continue to be crucial as advisors have more market power than perhaps ever before. And while the days of charging 1% of AUM might be waning, the combination of high cash flow and high growth continue to be attractive as evidence by elevated deal volume and multiples.

RIA Valuation Insights

RIA Valuation Insights