How Growing RIAs Should Structure Their Income Statement (Part I)

Compensation Conundrums

Personnel costs are by far the largest expense item on an RIA’s P&L, but we’ve found significant variation in how RIA owners think about compensating their employees (and themselves). We’ll devote the next two posts to discussing best practices from an outsider’s perspective.

The Scope of Compensation Costs for RIA Firms

According to Schwab’s 2020 Compensation Report, median compensation costs are 70% of revenue for firms with over $100 million in assets under management. We were a bit surprised by these findings since most publicly traded RIAs are in the 40% to 50% range, and our clients are typically in the 50% to 60% category, but these firms are usually larger than the median RIA in the Schwab study. There is also significant variation in these measures depending on the location, type of RIA, and how the owners choose to compensate themselves.

The study reported that 76% of RIAs are planning to hire in the next twelve months, and 42% of firms recruited from other RIAs in the last year. The report also noted that 73% of these acquiring firms share equity with non-founders, suggesting that stock incentives are also part of the overall compensation package for the senior management group.

The Compensation Conundrum for Newly Formed RIAs

This data illustrates the importance of a compelling compensation strategy for growing RIAs looking to recruit from other firms and retain talent. Newly formed RIAs don’t typically have the resources to offer higher base salaries and will often consider filling the void with stronger equity or equity-like incentives. While equity participation is especially lucrative for high growth firms with greater upside potential, partners of newly formed RIAs are generally hesitant to dilute their ownership.

Equity offerings can be problematic for growing or newly formed RIAs whose principals do not take a salary or bonus from the business. While this structure makes sense in states with high income taxes, it overstates profitability and, if not remedied, would overstate income distributions to current (and prospective) owners.

Over the next two posts we will delve into these two common compensation conundrums for RIAs:

- How to structure employee compensation when you are not ready to bring on an equity partner.

- How to structure compensation and your P&L before you bring on an equity partner.

In this post, we address the first problem.

Income (Not Equity) Partners

Compensation is always a tricky issue, but the situation is especially complicated for RIAs as employees are typically able to estimate the profits of the company and compare their compensation to overall firm profits.

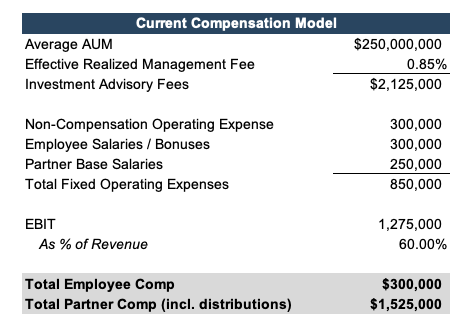

Consider an RIA with two owners and two employees. The two employees know that the firm manages $250 million and estimate that the firm’s effective fees are 85 basis points, so they calculate that the firm likely generates $2,125,000 in annual revenue. By estimating overhead expenses and subtracting their own salaries, they surmise that the two owners/employees take home around $1.5 million, in aggregate.

The two employees know they are paid well but also feel they should be rewarded for their part in the success of the company. The two owners, on the other hand, took a lot of risk starting their own business and feel they deserve to be compensated for their investment. They also want their employees to feel that they are being treated fairly.

What do the owners do?

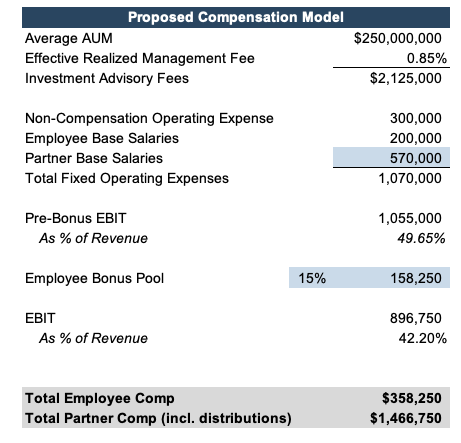

When principals at RIAs are not ready to dilute their ownership in the business, they can structure compensation such that their employees are income-partners (but not actual equity partners). If you structure employee compensation to include a base salary and a bonus that is determined as a percent of company profits then your employees have the opportunity to participate directly in the upside of your business, without diluting your ownership positions.

As shown in the adjusted model below, the owner’s take home pay did not change significantly; however, the employees are now directly compensated based on the profitability of the firm.

Tying a new hires’ compensation to firm profitability is usually good practice but may be too costly if the shareholders aren’t paying themselves a salary and bonus. In the proposed model above, the partners increase their base salary to better align company profits with industry norms.

We will dig deeper into this idea next week.

RIA Valuation Insights

RIA Valuation Insights