A Rising Tide Lifts All Boats

All Classes of Asset Managers Up Over the Last Year

Favorable market conditions over the last twelve months have buoyed RIA market caps to all-time highs. This almost seems counterintuitive against a backdrop of fee compression, fund outflows, and generally negative press (some of it by us), but a rising market means higher AUM balances, leading to greater fees and profitability, regardless of other headwinds facing the industry – not a perfect storm by any means, but good enough to best the broader indices during a relatively strong stock market rally.

RIA Market Performance as of 6/1/17

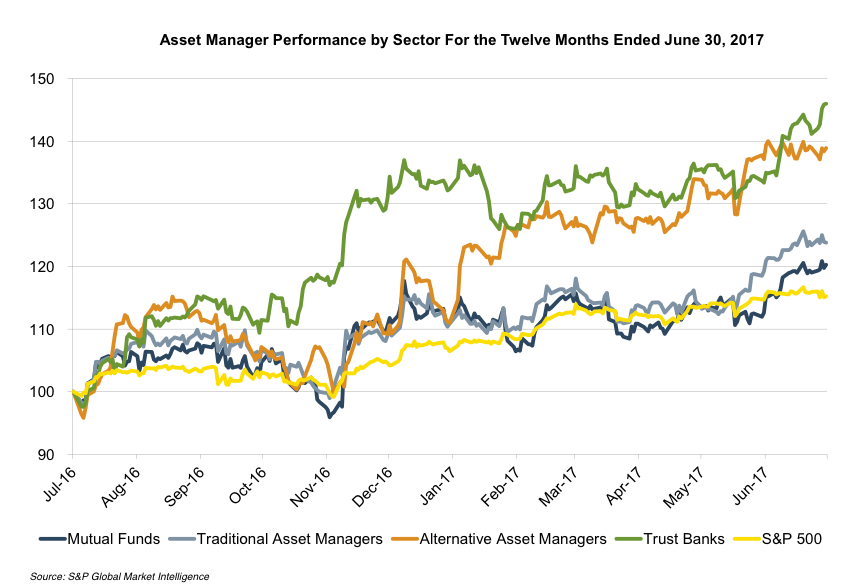

Publicly traded custody banks (BNY Mellon, State Street, and Northern Trust) outperformed other classes of asset managers over the last twelve months, continuing their upward trajectory over the last few years but still lagging the broader indices since the financial crisis of 2008 and 2009. Placing this recent comeback in its historical context reveals the headwinds these businesses have been facing in a low interest rate environment that has significantly compressed money market fees and yields on fixed income investments. Their recent success may, therefore, be indicative of a reversion to mean valuation levels following years of depressed performance, rather than a sudden surge of investor optimism regarding future prospects. Further, pricing improvements for this group appear to be more relative to an improved banking environment than a change in circumstances for trust and custodial services.

Still, in recent quarters, most trust bank stocks outperformed other classes of asset managers, like mutual funds and traditional RIAs, as passive products and indexing strategies continued to gain ground on active management. A rising yield curve portends higher NIM spreads and reinvestment income, and the market has responded accordingly – our custody bank index gained 45% over the last year, surpassing the broader indices and all other classes of asset managers.

Publicly traded alternative asset managers have also performed well in recent months, but, like custody banks, are still reeling from poor investment returns over the last decade. The value-added proposition (alpha net of fees) has been virtually non-existent for many hedge funds and PE firms over this period despite the sector’s recent gains.

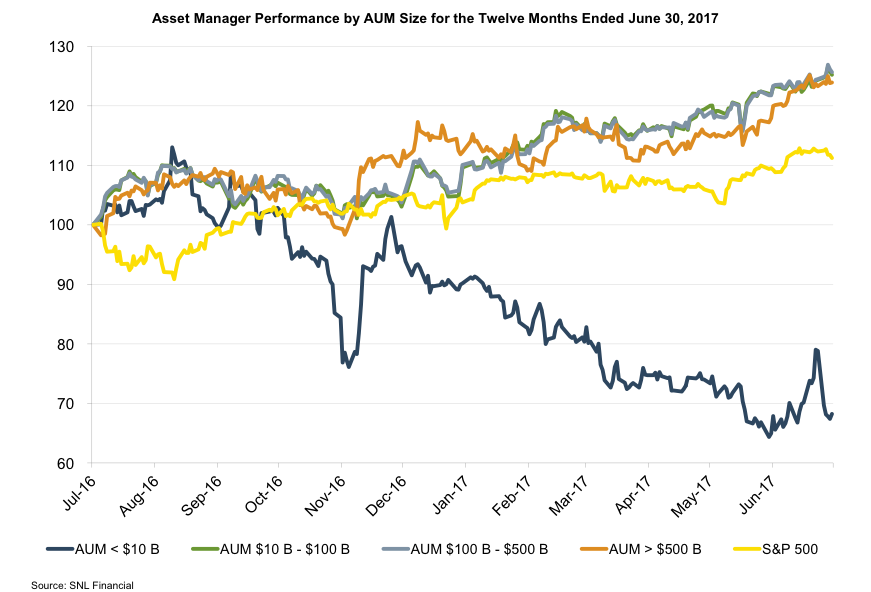

Once again, the RIA size graph seems to imply that smaller RIAs have significantly underperformed their larger peers over the last twelve months. The reality, though, is that this segment is the least diversified (only two components, Hennessy Advisors and US Global Investors, both of which are thinly traded) and certainly not a good representation of how RIAs with under $10 billion in AUM are actually performing. Specifically, Hennessy’s weakness is largely attributable to recent sub-par investment performance from its Cornerstone Growth Fund, and US Global’s focus on natural resource investing has taken a hit from softening commodity prices. Most of our clients fall under this size category, and we can definitively say that these businesses (in aggregate) haven’t lost half their value since August as suggested by this graph. Other sizes of publicly traded asset managers have performed reasonably in line with the market over this period.

Market Outlook

The outlook for these businesses is similarly market driven – though it does vary by sector. Trust banks are more susceptible to changes in interest rates and yield curve positioning. Alternative asset managers tend to be more idiosyncratic but still influenced by investor sentiment regarding their hard-to-value assets. Mutual funds and traditional asset managers are more vulnerable to trends in active and passive investing. All are off to a decent start in 2017 after a strong end to 2016 as the market weighs the impact of fee compression against rising equity prices.

RIA Valuation Insights

RIA Valuation Insights