Financial Advisors, Tell Your Clients to Gift Now!

Lower Asset Values Provide an Opportunity for Tax-Efficient Wealth Transfers Before November’s Election

Proposed Tax Changes Hasten Need for Estate Planning Services

Last week we covered Joe Biden’s proposed estate tax changes and their impact on family wealth transfers if he gets elected in November. Biden’s current proposals include the elimination of basis step-up, significant reductions to the unified credit (the amount of wealth that passes tax-free from estate to beneficiary) and gift tax exemption, and increasing current capital gains tax rates to ordinary income levels for high earning households. The cumulative effect of these changes is a substantial increase in high net worth clients’ estate tax liabilities if Biden’s current proposals become law.

Fortunately, there are several things you can advise your high net worth clients to do now to minimize their exposure to these potential tax law changes. Taking advantage of the current high-level of gift tax exemptions ($11.58 million per individual or $23.16 million per married couple) could save millions in taxes if Biden’s proposed lower exemption of $3.5 million per individual becomes law. Other options include the formation of trusts or asset holding entities to transfer wealth to the next generation in a tax-efficient manner (more on this later). Proper estate planning can mitigate the adverse effects of higher taxes on wealth transfers, but the window to do so may be closing if we have a regime change later this year. Further, the demand (and associated cost) for estate planning services may go up significantly in November, so you need to apprise your clients of these potential changes before it’s too late.

Low Valuations Compound Tax Efficiencies for Current Transfers

COVID-19’s impact on the economy and financial markets may have depressed the value of your clients’ marketable securities and closely-held business interests. As my Mercer Capital colleague Travis Harms recently noted in his Family Business Director Blog, it does not matter if your client is looking to sell these assets in the near future, the IRS considers the relevant economic and market conditions at the date of transfer according to its Revenue Ruling 59-60:

The fair market value of specific shares of stock will vary as general economic conditions change from ‘normal’ to ‘boom’ to ‘depression,’ that is, according to the degree of optimism or pessimism with which the investing public regards the future at the required date of appraisal. Uncertainty as to the stability or continuity of the future income from a property decreases its value by increasing the risk of loss of earnings and value in the future.

One of the few positive side effects of the recent downturn is that it provides an opportunity for more tax-efficient transfers of family wealth for estate planning purposes. Travis illustrates the significance of the current opportunity with an example regarding the transfer of interests in a closely-held company.

Consider a family business having a pre-pandemic value on an as-if-freely-traded basis of $25 million. Although the long-term prospects of the business remain unchanged, the dislocations caused by coronavirus have triggered a temporary reduction in fair market value of 25%. The founder has yet to do any estate planning and continues to own 100% of the shares.

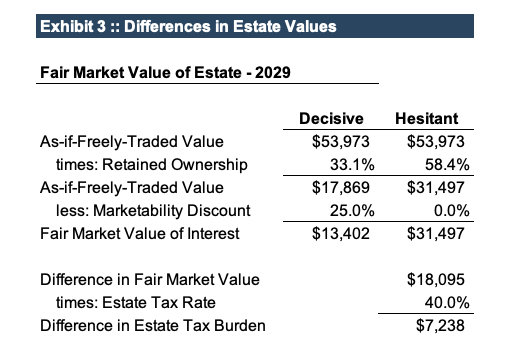

Exhibit 1 depicts the expected value trajectory for the family business both before and after the pandemic.

Because of the resilience of the family business, the value trajectory resumes its pre-pandemic path after three years. The founder’s tax advisers suggest that – since the long-term prospects of the business are unimpaired – the current depressed fair market value provides an excellent opportunity to begin a program of regular gifts. The current lifetime gift tax exclusion is approximately $12 million, and the founder and his advisers devise a strategy of making an initial gift of $6 million, followed by annual gifts of $1 million in each of the following six years.

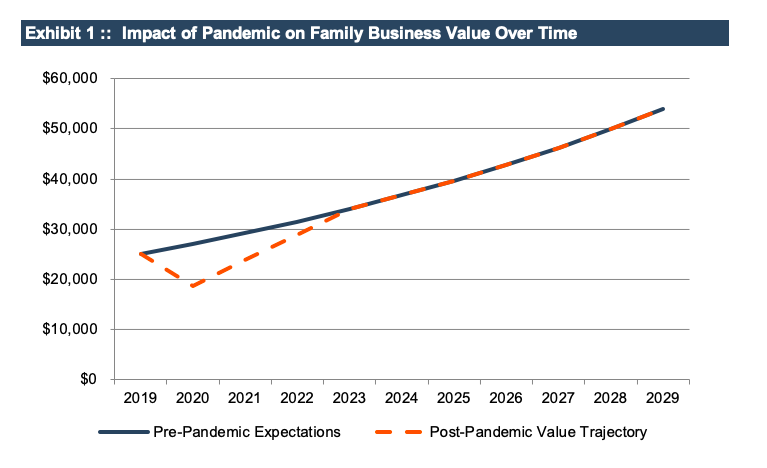

We’ll examine two scenarios. In the first, the founder begins the gifting program immediately (the “Decisive” scenario). In the second, the founder defers the gifting program until the uncertainty associated with the pandemic has passed (the “Hesitant” scenario). In both cases, the shares gifted represent illiquid minority interests, so a 25% marketability discount is applied to derive fair market value.

Since the annual gifts are for fixed dollar amounts, lower per-share values result in more shares being transferred, which reduces the ownership interest in the future taxable estate, all else equal. Exhibit 2 summarizes the shares that are transferred under the gifting program for the Decisive and Hesitant scenarios.

Because the gifts under the Decisive scenario were made while share prices were depressed because of the coronavirus, a larger portion of the shares were transferred than in the Hesitant scenario. As a result, the founder retained just 33% of the total shares after using the $12 million lifetime exclusion, compared with 58% under the Hesitant scenario. As shown in Exhibit 3, the effect on the resulting taxable estate is compounded because, under the Hesitant scenario, the 58% retained interest represents a controlling position in the shares and the value is not reduced for the marketability discount. In fact, although not shown in Exhibit 3, a control premium to the as-if-freely traded could be applicable, which would exacerbate the disparity.

In our example, failing to take advantage of the estate planning opportunity presented by the depressed asset prices added $7.2 million to the eventual estate tax bill. Procrastination can be costly.

Historic Lows in Applicable IRS Interest Rates Provide Further Opportunity for Tax-efficient Transfers

The current AFR (the IRS-approved Applicable Federal Rate for interest on intra-family loans) is hovering at all-time lows – 0.25% to 1.15% per year, depending on loan duration. The new §7520 rate (named for that section of the Internal Revenue Code) applicable to Grantor Retained Annuity Trust (GRAT) transfers is also at a historic low of 0.80%. These low rates allow wealthy families to transfer assets and lock in their low values with minimal financing costs on intra-family loans and trust vehicles.

Forbes provides an example of how GRATs and the new §7520 rate can be used to transfer assets to the next generation in a tax-efficient manner:

Let’s suppose there is a family with assets worth $25 million; the value is down from $30 million before the crisis. They have real estate, investment assets, and a family business. The family wants to keep the business in the family. The older generation transfers $10 million worth of the business into a GRAT when the §7520 rate is 0.8% (May 2020), with the right to receive an annuity of $1 million a year for 10 years. At the end of 10 years, the remainder will be distributed to the grantor’s children. Using the IRS Table B factor of 9.5737, the annuity stream is valued at $9,573,700, and the remainder interest is valued at its present value of $426,300. If the assets grow by 5% and have distributed income of 5%, the grantor will receive a stream of 10 payments of $1,000,000, and the beneficiaries will receive $10,200,416 at the end of the 10-year term (the future value of $10 million, minus ten annual payments of $1,000,000, and growing at 5% per year after income distributions of 5%). If the assets in the GRAT did not appreciate, the GRAT would invade principal, but would be paying the assets to the grantor.

If the parents make a gift of $426,300 (the value of the remainder interest at this low rate), this would use up some of their estate exemptions, but the kids get more than $10.2 million. That is significant leverage on the use of the estate exemption that might be expiring in the near future.

Putting it All Together…

The perfect storm of record-low IRS rates, reduced asset values, and the prospect of significant tax law changes early next year make this the ideal time to advise clients to start thinking about estate planning and tax-efficient ways to transfer assets to the next generation. With asset values trending upwards, vaccine candidates progressing rapidly, and political polling suggesting a high probability of a regime change in November, this perfect storm may not last long. Take advantage by taking action. In the current environment, there is little to gain by procrastinating, but potentially a lot to lose. We’re here to help with any valuation needs your clients (or you) might have to get this done.

RIA Valuation Insights

RIA Valuation Insights