RIA Stocks off to a Rough Start in 2018

A rocky first quarter was particularly volatile for publicly traded RIAs. After reaching record highs in late January, most categories of publicly traded RIAs ended the quarter with negative returns.

First Quarter Performance

The weak performance of publicly traded RIAs during the first quarter comes on the heels of significant outperformance during 2017. Market gains apparently trumped fee compression, fund outflows, regulatory overhang, rising costs, and a host of other industry headwinds that have dominated the headlines in recent years. There is a simple explanation for the industry’s performance in recent years: the combination of market appreciation and operating leverage have precipitated significant improvements in profitability since the Financial Crisis, eliciting a favorable response from investors, despite everything we’ve been reading about the industry. However, the return of market volatility and the reintroduction of the idea that markets can, in fact, go down, have brought back into focus the industry headwinds, and investors have reacted accordingly.

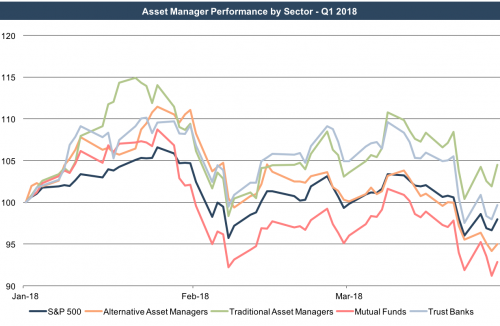

As illustrated in the chart above, upward or downward trends in the broader market tend to have a magnified effect on the stock prices of asset managers. Market swings will have a magnified impact on earnings (and stock prices) for asset managers because top-line volatility is tied to AUM movements and some costs are fixed. While 2017 was a great year for the S&P and an even better year for most categories of RIAs, 2018 has been the complete opposite thus far. This reversal is no surprise, as historically corrections and bear markets have led to more precipitous declines in profitability, due to the presence of fixed expenses in most RIA’s capital structure, a fact illustrated by the significant underperformance of RIAs during 2008 and early 2009.

Taking a closer look at recent pricing reveals that traditional asset managers and trust banks have outperformed the S&P and other classes of asset managers throughout the first quarter. Traditional asset managers ended the quarter up 4.5% and were the only category of asset managers to post positive returns. Trust banks were down just 0.3% during the quarter, buoyed by a steadily rising yield curve, which portends higher NIM spreads and reinvestment income. Alternative asset managers were down 5.0% during the quarter as these businesses continue to find delivery on their value proposition (alpha net of fees) elusive. Mutual funds, which have been battered by active outflows and fee compression, were down 7.1% on the quarter.

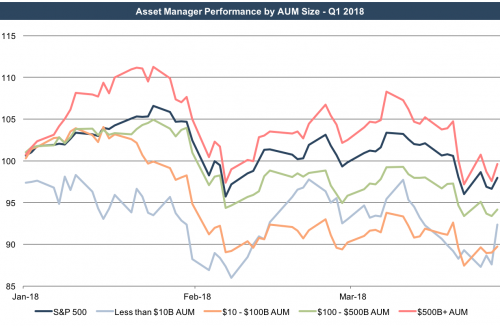

The RIA size graph below shows that larger RIAs generally performed better than smaller RIAs during the first quarter. Asset managers with more than $500 billion in AUM were the only category to outperform the S&P, and asset managers with less than $100 billion in AUM had the worst performance. This is to be expected during periods in which the market declines, as smaller RIAs generally have narrower margins and profitability can shift wildly with small changes in AUM.

Market Outlook

The outlook for these businesses is similarly market driven – though it does vary by sector. Trust banks are more susceptible to changes in interest rates and yield curve positioning. Alternative asset managers tend to be more idiosyncratic but still influenced by investor sentiment regarding their hard-to-value assets. Mutual funds and traditional asset managers are more vulnerable to trends in active and passive investing. The outlook for the industry during the rest of 2018 ultimately depends on how the industry headwinds continue to evolve and (as always) what the market does over the next few months.

Mercer Capital’s RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry. Follow us on Twitter @RIA_Mercer.

RIA Valuation Insights

RIA Valuation Insights