RIA Stocks Suffer Worst Quarter Since the Financial Crisis

Most Traditional and Alternative Asset Managers in Bear Market Territory After Turbulent Year for Global Equities

Following a decade of (fairly) steady appreciation, RIA stocks finally capitulated with the market downturn and growing concerns over fee compression and asset flows. As a leading indicator, such a decline suggests the outlook for these businesses has likely soured over the last year or so.

What Goes up Must Come Down…

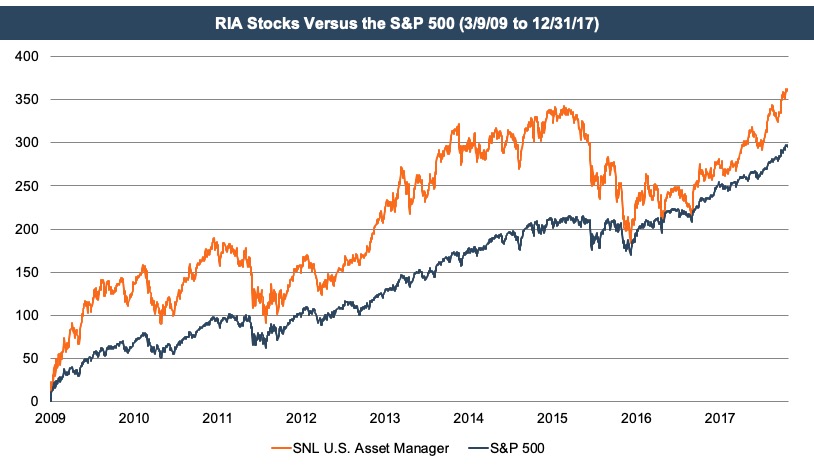

Prior to last year, RIA stocks benefited immensely from the bull run that began in March of 2009, besting the market by over 60% during this favorable period for asset returns.

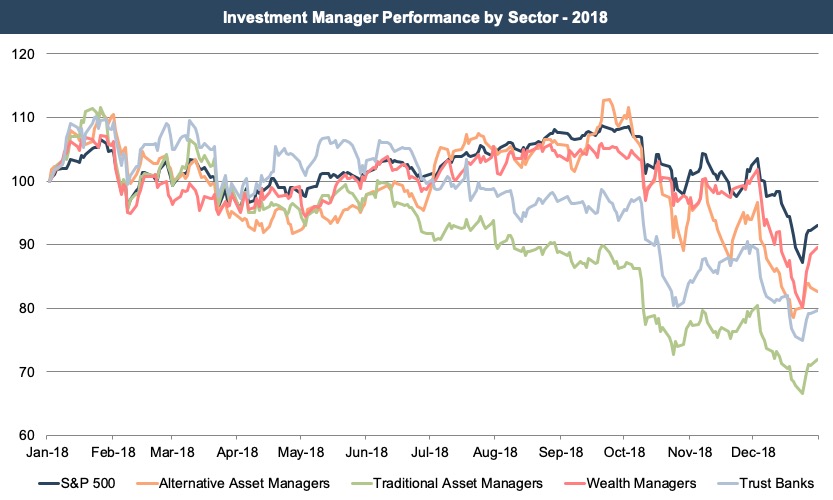

In 2018, this trend reversed course, and the return of market volatility and negative returns precipitated a broad decline across all industry sectors.

Traditional active managers have felt these pressures most acutely as poorly differentiated products struggled to withstand downward fee velocity and at the same time have been a prime target of regulatory developments. To combat fee pressure, traditional asset managers have had to either pursue scale (e.g. BlackRock) or offer products that are truly differentiated (something that is difficult to do with scale). Investors have been more receptive to the value proposition of wealth management firms as these businesses are (so far) better positioned to maintain pricing schedules as a result.

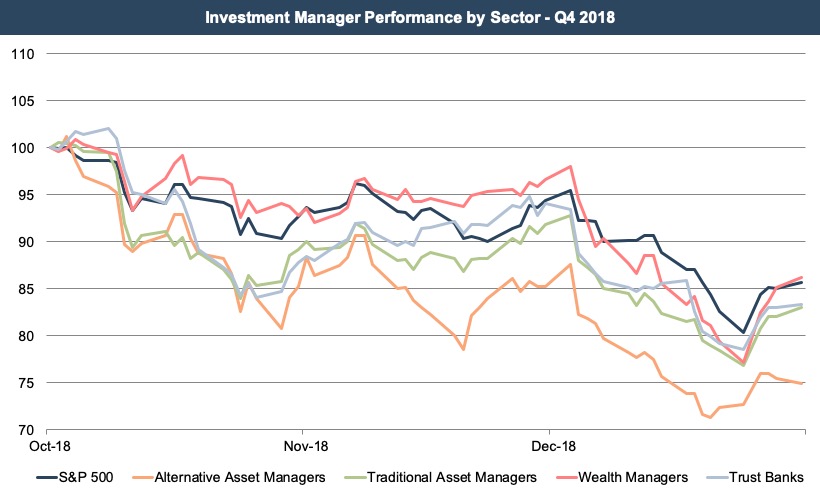

Reflective of the headwinds that the industry faces, asset managers generally underperformed broad market indices during the fourth quarter. As the broader indices stumbled, many RIA stocks plummeted with falling AUM balances and management fees. The operating leverage inherent in the business model of most asset managers suggests that market movements tend to have an amplified effect on the profitability (and stock prices) of these businesses as displayed by their performance in the last quarter.

Does Size Matter for RIAs?

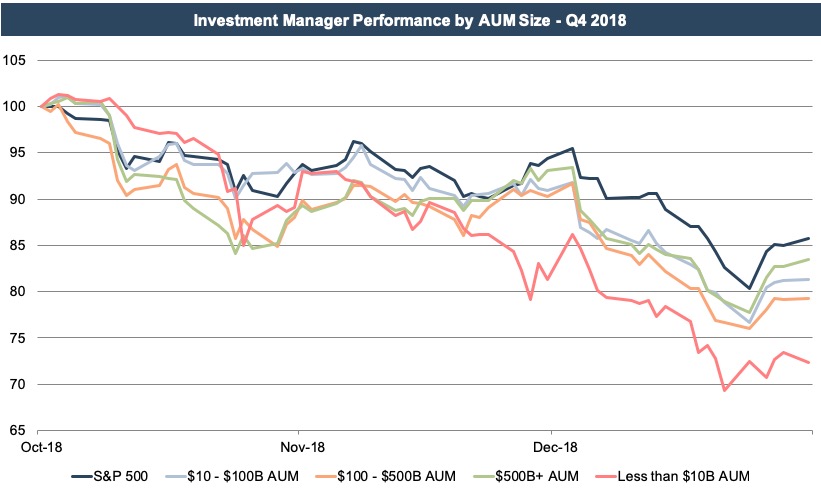

The corresponding RIA size graph seems to affirm this. The larger firms generally outperformed smaller RIAs, though all categories were down in the quarter. Still, this trend is, admittedly, a bit misleading since the smallest category of publicly traded RIAs (those with less than $10 billion AUM) was down nearly 30% during the quarter, although this is the least diversified category of RIAs with only two components. As such, this category is subject to a high degree of volatility due to company-specific developments. Most of our clients are in this size category, and we believe it is highly unlikely that these businesses lost almost a third of their value (in aggregate) over the quarter as suggested by the graph below.

Generally speaking, larger RIAs typically attract higher valuations due to the benefits of scale and a more diverse AUM base. Still, capacity constraints can be an issue, particularly for niche and small cap investment products. So, unless you’re BlackRock, there’s probably a sweet spot for optimal asset size.

A (More) Bearish Outlook

The outlook for these businesses is market driven, though it does vary by sector. Trust banks are more susceptible to changes in interest rates and yield curve positioning. Alternative asset managers tend to be more idiosyncratic, but are still influenced by investor sentiment regarding their hard-to-value assets. Wealth managers and traditional asset managers are more vulnerable to trends in active and passive investing.

On balance, the outlook for 2019 doesn’t look great given what happened to RIA stocks last quarter. The market is clearly anticipating lower AUM, revenue, and earnings with the recent correction, which could be exacerbated by asset outflows if clients start withdrawing their investments. Friday’s steep advance could be a silver lining, though volatility remains high. More attractive valuations could also entice more M&A, which is still relatively subdued despite the recent uptick in dealmaking. We’ll keep an eye on all of it in what will likely be a very interesting year for RIA valuations.

RIA Valuation Insights

RIA Valuation Insights