Why Are Small Cap RIAs Down 40% Over the Last Year?

Most Investment Managers Remain in Bear Market Territory Even as the Broader Market Recovers

Believe it or not, the S&P 500 is exactly where it was a year ago. It’s been a wild ride, but most diversified investors probably haven’t done as bad as they think during this time. Unfortunately, that’s not the case for the RIA industry, which is still reeling from the Coronavirus pandemic and numerous other industry-specific headwinds. Such a divergence is unusual for an industry tied to market conditions, so this week we analyze the driving forces behind this disparity.

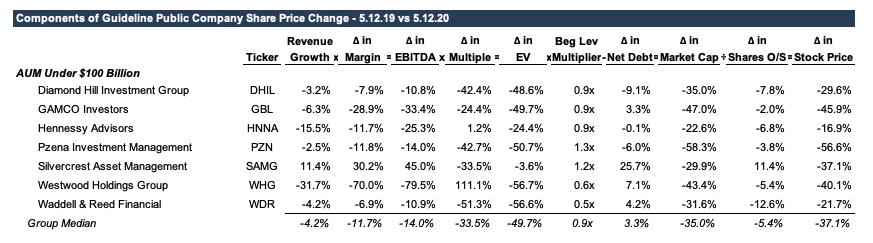

From a quantitative perspective, most of this deterioration is attributable to rising cap rates. Earnings multiples (the inverse of cap rates) tend to follow trends in AUM, which are leading indicators for future revenue and profitability. The market fall-out in the first quarter precipitated a sharp decline in AUM and lowered expectations for future management fees and cash flow. Trailing twelve month multiples shrank to all-time lows in anticipation of much weaker earnings reports over the next few quarters. Smaller RIAs have generally fared worse as lower margins and AUM provide less of a cushion against adverse market events.

The earnings decline is a bit more intuitive. The bear market triggered declines in AUM and management fees, which combined with a bit of operating leverage has created margin pressure for most of these businesses. The cumulative effect of a 10%-15% earnings decline and a 30%-35% multiple contraction is a sharp contraction in equity prices.

The recent pullback is certainly a catalyst but not the only culprit here. Pre-COVID, the industry was already facing numerous headwinds including fee pressure, asset outflows, and the rising popularity of passive investment products. The 11-year bull market run masked these issues (at least ostensibly) as AUM balances largely rose with equities over this time. Finally faced with a market headwind, the bull market for the RIA industry came to a grinding halt last quarter.

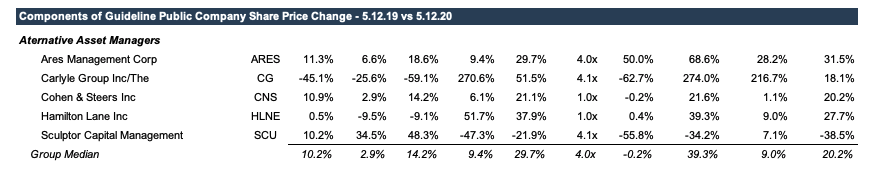

A notable exception in the RIA space is the alt asset sector. Many of these businesses have actually thrived in the current environment as their AUM is typically not directly tied to equity market conditions. As a result, they generally did not fare as well over the last decade relative to more traditional asset managers, but recent events have made most of their asset classes more attractive than public equities.

Outlook

It’s difficult to assess how long these divergent trends in pricing will hold up. We’d expect some mean reversion over time, though alt managers should continue to outperform other classes of RIAs in a bear market with elevated levels of volatility. If, on the other hand, we get more months like April, we should see a bounce in traditional asset manager multiples. Unfortunately, May hasn’t been so kind.

The trends in earnings multiples are a bit more revealing. Falling cap rates suggests a more promising outlook for alt manager cash flows, though it varies by asset class. A hedge fund that thrives on volatility, for example, should fare much better than, say, an MLP or commodity investor. The sharp decline in small cap RIA multiples so far this year tells us that the market is anticipating drastically lower levels of profitability for many of these businesses. The recent bear market compounded the prevailing headwinds pertaining to asset outflows and fee pressure, and several publicly traded RIAs have lost over half their value over the last year.

Implications for Your RIA

Year-to-date, the value of your RIA is most likely down; the question is how much. Some of our clients are asking us to update our year-end appraisals to reflect the current market conditions. There are several factors we look at in determining an appropriate level of impairment.

One is the overall market for RIA stocks, which is down 20% in the first quarter. The P/E multiple is another reference point, which has endured a similar decline. We apply this multiple to a subject RIA’s earnings, so we also have to assess how much that company’s annual AUM, revenue, and cash flow have diminished over the quarter while being careful not to count bad news twice.

We also evaluate how our subject company is performing relative to the industry as a whole. Fixed income managers, for instance, have held up reasonably well compared to their equity counterparts. We also look at how much a subject company’s change in AUM is due to market conditions versus new business development net of lost accounts. Investment performance and the pipeline for new customers are also key differentiators that we keep a close eye on. On balance, it’s a lot to keep up with, and we’re happy to walk you through it if you’re considering a valuation.

RIA Valuation Insights

RIA Valuation Insights