Ken Fisher’s Deal Is Remarkable Because It Isn’t Remarkable

Gets the job done, but that's it. Toyota Corolla.

In the pre-Uber days of business travel, my least favorite part of every trip was the rental car. Driving is fun if you have a fun car and a good road. Driving a generic transportation appliance in an unfamiliar area while juggling a map and a cup of coffee is miserable.

My fortunes changed briefly when Hertz introduced the Neverlost system, a proprietary GPS mapping system that it installed in a portion of its cars. I quickly figured out that Hertz didn’t install Neverlost systems in cheap cars, so if I reserved a small economy car like a Toyota Corolla and ticked the box for Neverlost, I would invariably get a very nice upgrade for free. Might get a Lexus SUV. Maybe a Cadillac. But never a Corolla.

My scheme worked until it didn’t because the Neverlost systems were eventually ubiquitous in the Hertz fleet. I can remember the trip: I landed in Boston in early November, having reserved a Toyota Corolla with Neverlost and expecting something better. To my horror, I walked out to the lot, and there, waiting for me was… a Toyota Corolla with Neverlost. It was a grey color that matched both the overcast sky and my mood. But it got the job done.

I feel kind of the same way about the minority sale of Fisher Investments to Advent and Abu Dhabi’s sovereign wealth fund. It’s not exciting, but it got the job done.

The RIA community wants to be flashy – an east coast / west coast sea of bright blue blazers and toothy grins touting ultra-high-net-worth client bases, family office strategies, alt-access, exclusive products, better living through scale by acquisition, and all backed by multi-billion-dollar sponsors. Fisher Investments is anything but. It’s a middle-America, straightforward, stocks and bonds financial planner for the mass affluent that has grown not by acquisition but by advertising.

At first glance, however, the Fisher deal is eye-popping.

At first glance, however, the Fisher deal is eye-popping. Fisher reportedly sold a bit less than a quarter of the firm for close to $3.0 billion, implying a total firm value of $12.75 billion. FI manages $275 billion in client assets.

Outstanding numbers, but if you move the decimal a couple of places to the left, it looks…normal. Unpack the deal further, and pricing looks strong but reasonable.

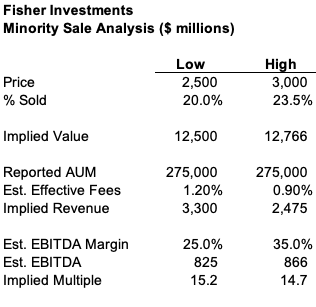

The transaction was reported at $2.5 billion to $3.0 billion for “up to” 23.5% of the company. If the amount ultimately sold is, say, 20% on the low end to the maximum of 23.5% on the high end, the implied value for FI is $12.5 billion to $12.75 billion. Assuming Fisher’s realized fees on its mostly mass-affluent client base (their last ADV reported an average account size of $1.6 million) is in the range of 90 to 120 basis points, we estimate their run-rate annual revenue to be on the order of $2.5 billion to $3.3 billion.

Assuming their massive scale offers them some margin advantage, an EBITDA margin of 25% to 35% would net FI more than $800 million in cash flow. With that, the deal multiple falls somewhere close to 15x.

One other thing to consider when evaluating the deal metrics: Fisher’s growth. In an industry that is supplementing often tepid organic growth with acquisitions, Fisher’s marketing machine made it happen. Fisher Investments reports current AUM of about $275 billion, 17% higher than year-end 2023 and 58% higher than year-end 2022. Astounding! In 2005, FI reported AUM of $27.3 billion, implying compound annual growth over the past eighteen and a half years of 13%. And all that growth was without private equity partners or acquisitions. If you believe the trade press about how to grow an RIA, Ken Fisher did what isn’t possible.

With a proven track record of organic growth like Fisher, 15 times EBITDA seems reasonable, if not cheap. It suggests that Fisher means it when he says he remained in control, and that this wasn’t a minority deal that offered the financial partner many features of control — as we often see happen.

Fisher Investments has for many years been the Toyota Corolla of the RIA space. Not fancy. Not interesting. Not exclusive. Advertising for sales leads. Mass affluent customers. Meat and potatoes wealth management. Nothing remarkable, except for an exceptional growth story that led to a huge transaction.

RIA Valuation Insights

RIA Valuation Insights