How Growing RIAs Should Structure Their Income Statement (Part II)

Compensation Conundrums

Personnel costs are by far the largest expense item on an RIA’s P&L, but we’ve found significant variation in how RIA owners think about compensating their employees (and themselves). This is the second post of a two-part series on compensation best practices for growing investment managers.

Last week, we introduced two common compensation conundrums for RIAs

- How to structure employee compensation when you are not ready to bring on an equity partner.

- How to structure compensation and your P&L before you bring on an equity partner

In our last example, we explained how owners of RIAs can structure employee compensation. This week will focus on how to structure partner compensation.

Striking the Right Balance

Since RIA owners are often senior managers in their firm, their compensation and distributions are often intertwined and are subject to shareholder preferences regarding how they like to be paid. However, this can lead to problems as growing RIAs expand by bringing on new equity partners.

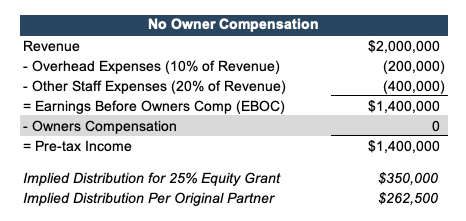

Take the example below of an RIA with four partners with equal ownership considering a 25% equity grant to bring on a new partner who will help the company expand its reach. To minimize their tax burden, the owners historically have not paid themselves a salary and instead were compensated through distributions. However, if they bring on a new employee with a salary and 25% ownership, the new partner would receive higher compensation (including distributions) than the original partners who aren’t taking any salary or bonus.

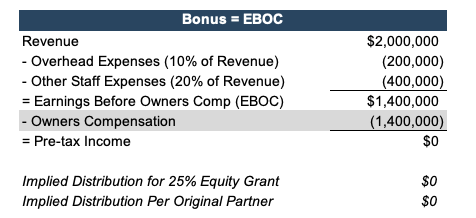

A similar complication arises for partners that pay out their entire EBOC (Earnings Before Owners’ Compensation) in bonuses to minimize reported profitability. We often see this in places with state dividend taxes but no state income tax. Equity incentives in these situations are rarely enticing to prospective hires since dividend prospects are minimal or non-existent as shown below.

Before bringing on an equity partner, it is key to balance returns on labor (compensation) and returns on investment (distributions). To appropriately relate compensation expenses to reasonable returns on labor, owners should consider compensation levels commensurate with job responsibilities and revenue production. Compensation studies can help determine market levels of salaries and bonus expense, but the range of reported salaries in the RIA industry vary significantly. It is helpful to think about what it would cost to replace yourself if you decided to step away from the business; however, this may not be relevant for younger staff additions, whose market rates often depend on their relevant course experience and educational background.

The return on investment is just the residual income after paying your staff (and yourself) an appropriate (market) level of compensation expense. RIA owners often think of their ROI as a ROS (Return on Sales) since the requisite capital to start these businesses is often quite minimal. In other words, they often think an appropriate return on investment is a reasonable pre-tax margin for an RIA of their size. If, for example, industry compensation costs are 70% of revenue and overhead expenses are 10%, then an appropriate pre-tax margin or ROS is 20% (100%-70%-10%). If your current margins are much higher or lower than industry norms, your compensation expenses are probably not in sync with the market.

Does Money Talk Louder Than Words?

Compensation discussions are never easy. If your company is growing and your employees are smart, they will ask for ownership in the business. Even if out-right ownership is not on the table, it is beneficial to align employee incentives with your own. But many owners of growing RIAs make the mistake of waiting too long to share equity ownership and before they realize it, the value of an equity stake in their firm is too expensive for the next generation of leadership to afford.

RIA Valuation Insights

RIA Valuation Insights