Why Banks Are Interested in RIAs

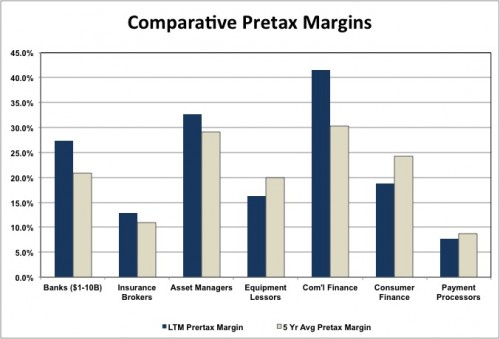

As noted in Mercer Capital’s presentation to the 2014 Acquire or Be Acquired conference sponsored by Bank Director entitled Acquisitions of Non-Depositories by Banks, the relatively high margins associated with asset management is one of the many reasons that banks and other finance companies have been so interested in RIAs over the last few years.

Other often-cited rationales for bank acquisitions of asset managers include:

- Exposure to fee income that is uncorrelated to interest rates

- Minimal capital requirements to grow AUM

- Higher margins and ROEs relative to traditional banking activities

- Greater degree of operating leverage – gains in profitability with management fees

- Largely recurring revenue with monthly or quarterly billing cycles

- Potential for cross-selling opportunities with bank’s existing trust customers

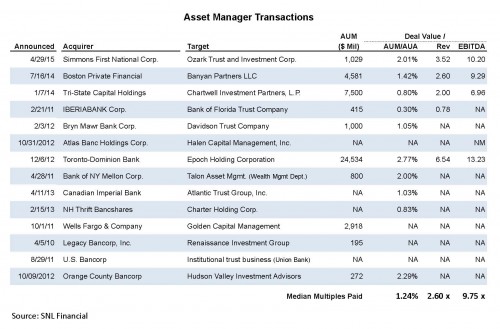

Although deal terms are rarely disclosed, the table below depicts some recent examples of this trend with pricing metrics where available.

While multiples for activity metrics (AUM and revenue) can be erratic and tend to vary with profitability, EBITDA multiples are often observed in the 10x-15x range for public RIAs with their private counterparts typically priced at a modest discount depending on risk considerations, such as customer concentrations and personnel dependencies. Powered by a fairly steady market tailwind over the last few years, many asset managers and trust companies have more than doubled in value since the financial crisis and may finally be posturing towards some kind of exit opportunity to take advantage of this growth.

Mercer Capital’s RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry

RIA Valuation Insights

RIA Valuation Insights