Mutual Fund Trends in Q1 2015

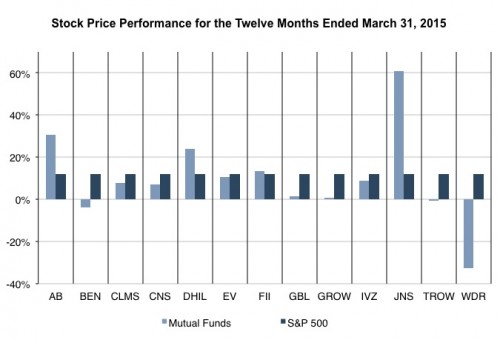

As portrayed in our Q1 2015 newsletter, most publicly traded mutual fund providers underperformed the S&P 500 in an upward trending market. According to Morningstar, active US equity funds endured $138 billion in net outflows over this period while their passive counterparts gained $178 billion in client assets. These dynamics are problematic for many mutual fund companies that rely on active equity products with higher revenue yields and are part of a decade-long trend that has seen active funds lose ground to ETFs and other indexing strategies.

Still, some active managers have been able to buck this trend in recent quarters. Most notably, Janus Capital gained nearly a billion dollars in market capitalization on its gamble to hire famed bond investor Bill Gross and become a more prominent player in the fixed income arena. JNS seemingly hedged this bet by acquiring ETF and exchange-traded note provider Velocity Shares the following month. Whatever the rationale, the dual wagers appeared to have paid off with Janus’s stock up almost 60% over the last year.

Such bold moves may be what it takes for mutual funds moving forward with multiple headwinds across the sector. The rising tide of ETFs and relative underperformance could precipitate asset flows out of mutual funds until alpha returns or fees are cut. Still, the mutual fund providers that have been effective in maintaining client assets, like Hennessy and Diamond Hill, have benefited greatly from the current bull market and resulting margin expansion.

So, as always, the outlook for these businesses hinges on market performance and asset flows. Any continuation of the recent market momentum would certainly be a bonus for mutual fund providers whose net-of-fee performances are competitive with comparable ETF products. Another market downturn, on the other hand, would likely hasten asset flows out of equities and into fixed income or money market funds with lower fees to their sponsors.

Mercer Capital’s RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry

RIA Valuation Insights

RIA Valuation Insights