Navigating the Shifting Tides

Trends Shaping the RIA Industry in 2023 and Beyond

As the financial landscape continues to evolve, the RIA industry experienced a notable shift in 2023, diverging from the challenges faced in the preceding year. Despite predictions going into 2023 that persistent inflation and elevated interest rates would lead to an economic downturn, no recession came to pass, and all sectors of the RIA industry experienced growth as markets rebounded from the 2022 slump.

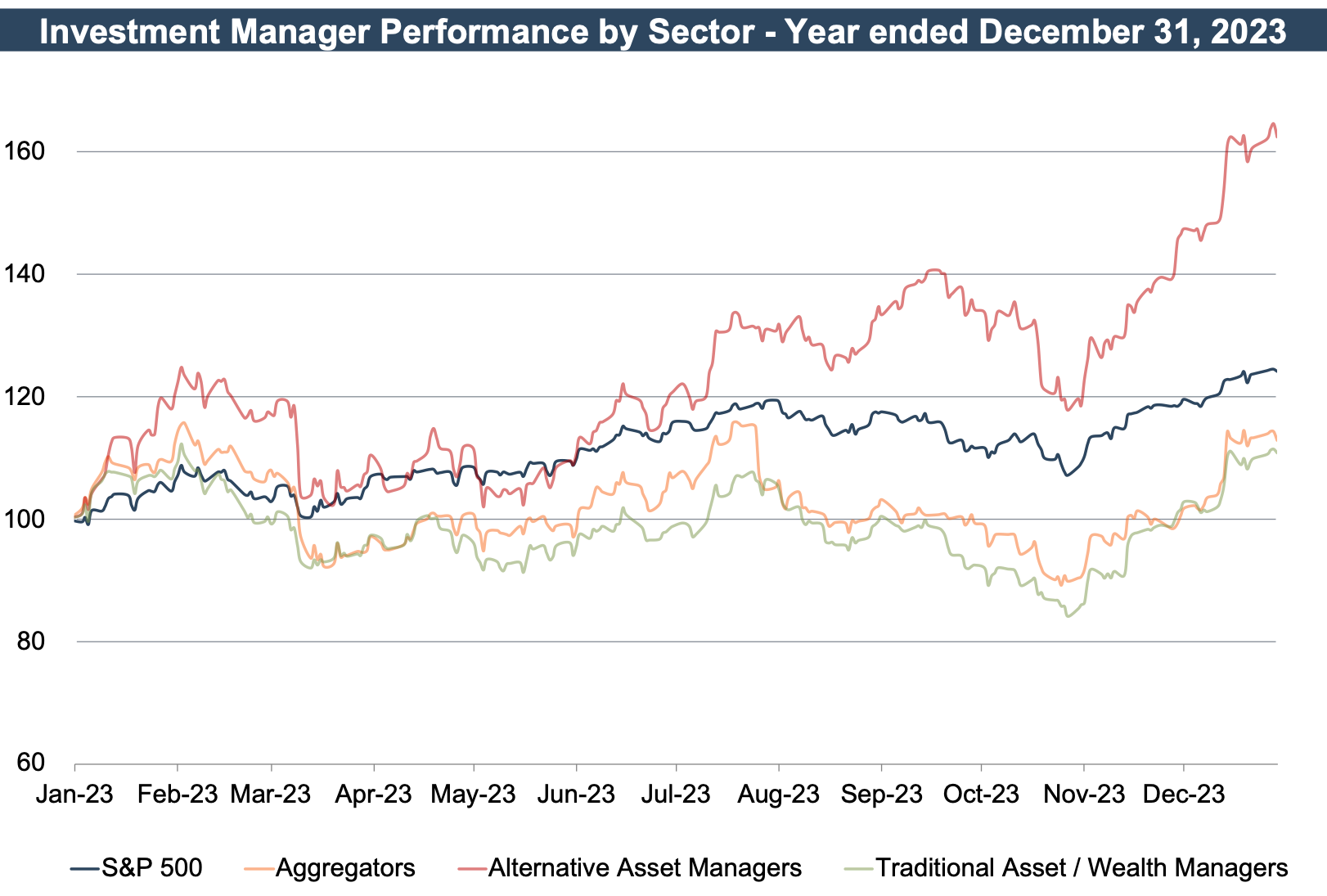

Given the direct impact of the stock market on Assets Under Management (AUM) balances and the inherent operating leverage in the RIA model, investment manager performance tends to closely follow market trends. Public firms with substantial operations in the wealth management space were up 11% year-over-year, underperforming the broader market (the S&P 500 was up 24%) and alternative asset managers (up 62%). This is in stark contrast to the downtrend seen for much of 2022, where traditional asset managers and the broader market were down 27% and 19%, respectively.

Despite favorable market performance in 2023, the year ahead presents several challenges for the RIA industry. Although inflation has begun to subside, interest rates remain at a 15-year high, and the Federal Reserve has been cautious about announcing planned rate cuts in 2024. In a recent interview, Federal Reserve Governor Christopher Waller said that lowering interest rates will need to be “carefully calibrated and not rushed.”

Valuations may face additional pressure as elevated interest rates result in higher yields for other income-producing assets (making them a more attractive alternative to investing in RIAs), and the cost of capital increases on both the equity and debt sides of the equation for leveraged consolidators of wealth management firms. While facing uncertainty heading into 2024, it will be important for wealth management firms to have a strategy in place to navigate these challenges and capitalize on opportunities that may arise.

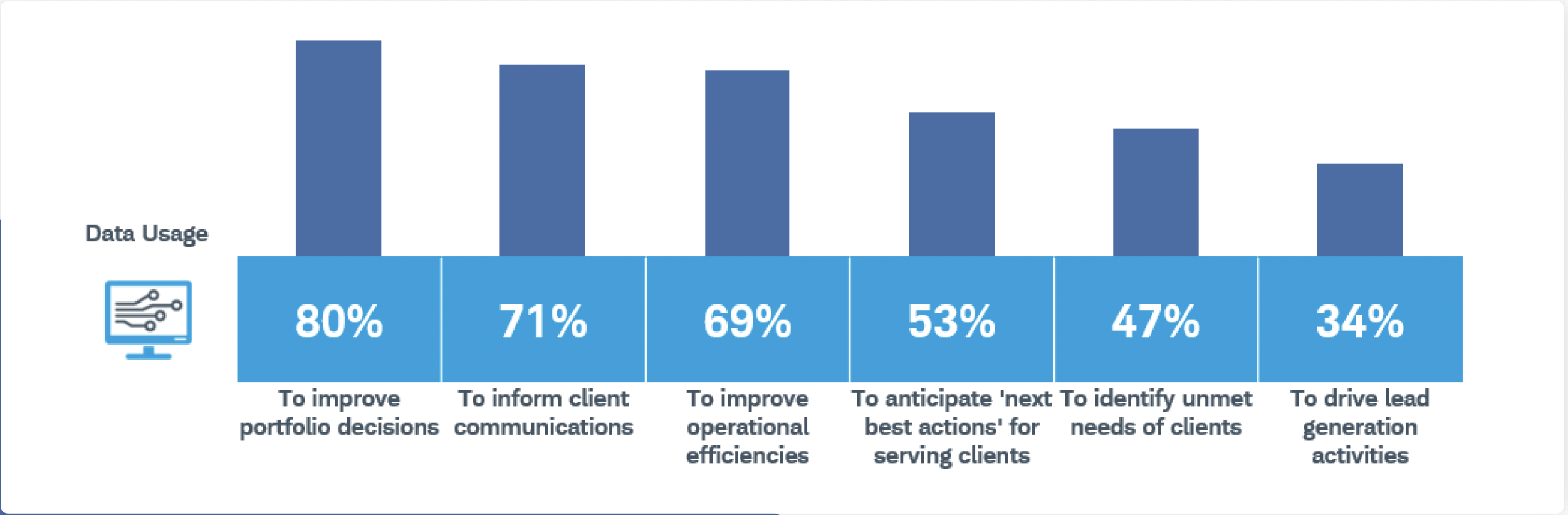

Against this backdrop, the role of data has become increasingly prominent, offering new avenues for growth, scale, and service. Industries across various sectors are unlocking opportunities through advanced data utilization, and RIAs are no exception. The annual Schwab survey of wealth management firms confirmed this sentiment, with over 76% of respondents saying data use provides the opportunity to serve their clients better. In practice, a significant number of advisors are already harnessing data insights: 80% leverage data for improved portfolio decisions, and 69% utilize it to enhance operational efficiencies.

Beyond operational enhancements, the study reveals the transformative impact of data on the client-advisor relationship. Experts interviewed emphasize how data can inform the customization of offerings, anticipate client needs, and foster greater client engagement in the wealth planning process. A substantial portion of RIAs (47%) currently use data to identify unmet client needs, with another 39% planning to do so in the next three years. Furthermore, 53% are currently tapping into data to anticipate the ‘next best actions’ for client service, with 35% planning to do so in the near future. Successfully leveraging these resources to improve client service and lead generation can translate into improved client retention and organic growth.

Click here to expand the image above

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, PE firms and alternative managers, and related investment consultancies.

RIA Valuation Insights

RIA Valuation Insights