Not Every RIA Buyer Is a Control Freak

Despite Conventional Wisdom, Some Investors Prefer Minority Positions

Fiat Cinquecento (500), originally designed in 1957, currently on display in the sculpture garden at the Museum of Modern Art (photo by the author).

Ideally, our work with investment management firms at Mercer Capital distills both conventional valuation principles and real-world industry experience. These two influences typically align; valuation theory develops to represent the thinking of actual transacting parties, and – in turn – transaction behavior validates theory.

Sometimes, though, we witness rational actors engaging in transactions that challenge certain norms of professional thinking. At such times, we ask ourselves whether valuation theory, as we know it, is doctrine or dogma.

The pricing of minority transactions in the RIA space leaves some people scratching their head. Traditional valuation theory holds that investors pay less for minority interests than controlling interests. Reality suggests otherwise. Some established institutional buyers of minority interests in RIAs invest at similar, or even higher, multiples to what other consolidators will pay for controlling interests. Some institutional buyers even prefer taking minority stakes in investment management firms – not a circumstance we see much from the private equity community. Even insider transactions don’t always follow valuation maxims, as valuations for succession are colored by considerations far beyond the sterile realm of hypothetical buyers and sellers. It seems to some that the RIA community has turned valuation theory on its head, but the truth is more nuanced.

Valuation Vacuum Wonkery

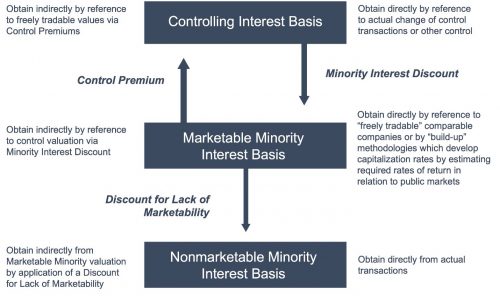

Conventional wisdom holds that minority interests in closely held companies are worth less than their pro rata stake in the enterprise. A 15% interest in a business that would sell for $10 million is widely believed by valuation practitioners to be worth something less than the $1.5 million that its pro rata stake in the enterprise would otherwise command. The difference between value inherent in controlling interests and minority interests can be illustrated by way of a diagram known as a levels of value chart.

The value of an enterprise can be described as the present value of distributable cash flow – and this parameter is useful for thinking about the different perspectives of control and minority investors.

A control level investor effectively has direct access to enterprise level cash flows, with unilateral influence over operations, the ability to buy, sell or merge the enterprise, pay distributions, and set compensation policy. Absent special considerations, a control investor can achieve the greatest benefit, and therefore pay (or expect to be paid) the highest price for an enterprise.

Most reported transactions in the RIA channel are made on this basis, and M&A multiples reported publicly, or whispered privately, reflect change of control valuations.

Minority investors lack two important prerogatives of control: influence and liquidity.

Minority investors lack two important prerogatives of control: influence and liquidity. Discounts for lack of control – also known as minority interest discounts – reflect the inability of minority interest holders to direct the enterprise for their own benefit. The marketable, minority interest level of value is analogous to an interest in a publicly traded company, wherein investors can access the present value of distributable cash flow by way of an open market transaction but have no particular sway over a company’s strategy or operations.

Discounts for lack of marketability (a.k.a. marketability discounts) capture the lack of access to enterprise cash flows via distributions or a ready and organized market to sell the interest. The nonmarketable, minority interest level of value is what most valuation practitioners think of when they think of minority interests in closely held enterprises: a value which is materially distinct from a pro rata controlling interest.

Internal Transactions Challenge Valuation Theory

Real world economics of minority transactions in RIAs can look very different than our professional discipline would suggest, reflecting issues unique both to the industry and to the universe of typical investors in the industry.

Much of the reason that RIA transactions don’t always conform to traditional valuation pedagogy is the nature of the investment management model itself. The theory behind the levels of value is intended to represent the perspective of hypothetical disinterested investors. In a world of financial buyers who can choose freely between alternative instruments, this idea holds.

But most RIA investors are insiders, practitioners who work at the investment management firms. The lines between returns to labor and returns to capital are often blurred (although we strongly advise structuring your model otherwise). Insiders have different motivations to show loyalty to their employer, and in turn firms often bestow ownership on staff on favorable terms because of the labor-intensive, relationship-based nature of investment management.

Insider ownership is often managed by buy-sell agreements, which at the same time restrict owners from certain actions but also provide them with access to liquidity (under specified circumstances) and a claim on returns. Buy-sell agreements often establish particular parameters for valuation as a way to side-step valuation theory to benefit the ownership and the business model of the particular RIA. Valuation theory operates in a ceteris paribus (all else equal) universe, whereas buy-sell agreements do not operate in this vacuum.

Valuation theory operates in an all else equal universe, whereas buy-sell agreements do not.

Finally, the issue of discounts for lack of marketability – that minority investors suffer from lack of ready access to enterprise level cash flows – is a byproduct of focus on old economy, heavy industry businesses structured as C-corporations in which dividend policy can be parsimonious. Most RIAs are structured as tax pass-through enterprises (LLCs or S-corporations) and don’t rely on heavy amounts of capital reinvestment. High payout ratios (often nearing 100%) mean minority investors do, in fact, typically enjoy regular returns from enterprise cash flows. Consequently, discounts for lack of marketability are usually smaller for investment management firms than for minority investments in many other industries.

Institutional Investors Make Minority Investments With Majority Conditions

One would expect institutional investors, as financially driven actors who are free to invest across a broad spectrum of opportunities, to behave in a manner more consistent with the hypothetical investors described by valuation theory. The institutional community has, however, developed practices to protect itself from many of the vagaries of minority investing. Achieving rights and returns similar to control investors has led to transaction pricing on par with control transactions, a phenomenon which isn’t inconsistent with conventional wisdom.

Institutional investors in the RIA space have corrected for many of the disadvantages associated with being a minority investor by way of contractual minority interest protections.

Institutional investors in the RIA space have corrected for many of the disadvantages associated with being a minority investor by way of contractual minority interest protections. No two firms handle this the same way, but board representation, performance reporting, rights to change senior management, compensation agreements, bonus plans, restrictions on non-cash benefits, assurance of timing and performance for distributions, and even revenue sharing arrangements can go a long way to putting a minority investor on terms comparable to a majority owner. Without the risks that accompany lack of control and lack of marketability, minority participants can focus on the value of the enterprise.

As an added benefit, if management still holds most of a firm’s equity, then outside investors have more assurance that insiders will pay attention to their jobs. This avoids the issue of RIA leadership “calling in rich” following a lucrative recapitalization and mitigates the monitoring costs that accompany most private equity investing. Sitting alongside management on an economic basis, but knowing management is sufficiently motivated, many institutional investors have effectively created the best of both worlds in minority investing: comparable returns without comparable responsibility.

Valuation Theory Is the Real World

Ultimately, valuation models are descriptive, not prescriptive. The economic principles underlying valuation models are the real secret sauce.

The behavior of insiders and professional investors is often seen in conflict with the notion that minority interests carry a lower value than pro rata control. In fact, these minority investors are not typical, coupling their money with conditions of ownership that mitigate or eliminate the distinctions between value on an enterprise basis and value on a fractional basis. In our view, the behavior of professional minority investors substantiates the presence of valuation discounts for investors who lack similar protections and privileges.

About the car: In the late 1950s, while Detroit focused on building huge, heavy, powerful, front engine sedans and wagons, Italian automaker Fiat designed a petite coupe with a canvas roof and a two-cylinder rear-mounted engine. The Fiat 500 was as contradictory to conventional wisdom at the time as it was easy to park and cheap to own. Detroit boomed, but the Cinquecento sold almost four million units over 18 years. Different markets have different needs.

RIA Valuation Insights

RIA Valuation Insights