Partnering with a Minority Financial Investor

Successful Succession for RIAs

As we explained in a recent post, there are many viable exit options for RIA principals when it comes to succession planning. In this post, we will review some considerations of partnering with a minority financial investor to achieve a successful transition of ownership.

What is a minority financial investor?

There are two features of a minority financial investor to breakdown: minority and financial.

A minority investor does not seek control of your business. Often, a change of control is thought to occur when greater than 50% of the equity changes hands. However, the notion of control can be more complicated with RIAs as an “assignment” of client contracts necessitates client consent. When a “controlling block” of voting shares changes hands, the SEC considers there to have been an assignment of client contracts. While the SEC does not define a “controlling block,” it is typically thought to be the holder of 25% of voting shares or a partner who has the right to receive 25% of the capital upon dissolution.

A financial investor is contrasted to a strategic investor. Financial buyers can generally be classified as investors interested in the return they can achieve by buying a business. They are interested in the cash flow generated by a business and the future exit opportunities from the business. Strategic buyers are interested in a company’s fit into their own long-term business plans. Their interest in acquiring a company may be related to expanding into a new market or consolidating administrative tasks to realize efficiencies.

Bringing the two together, a minority financial investor is typically interested in acquiring less than 25% of your business to participate in the distribution of cash flow or upside from selling your company in a few years to another investor or strategic acquirer.

Is a minority financial investor the best solution for you?

As mentioned above, a minority financial investor does not seek control of your business. Therefore, the majority of your company’s management team must agree to stay on after the capital infusion. While the lack of interference in day to day operations is an attractive feature to some management teams (if, for instance, they’re looking to transition out retiring partners, recycle ownership to future generations, and maintain control of day to day operations), a minority financial investor is not the solution for management teams hoping to achieve a clean break.

How is a minority financial investment structured?

In general, a minority financial investment can be structured as a term investment or a permanent investment. PE firms typically invest for a five to seven-year term with the goal of improving the company’s financial profile in order to sell it at a higher multiple, while permanent capital investors (often single-family offices) are more interested in the business’ long-term cash flow potential.

While every agreement with a minority financial investor will have differences in the details, there are generally two ways to structure these deals.

1. Revenue Share

2. Preferred Equity

Revenue Share

A revenue share is a right to a percentage of revenue instead of a right to distributable cash flow. This structure works exceptionally well for passive minority investments because the minority investor’s distribution is not affected by the operational decisions of management, such as the size of the bonus pool, because their distribution is determined before the removal of expenses. With that, a revenue share generally does not include board representation.

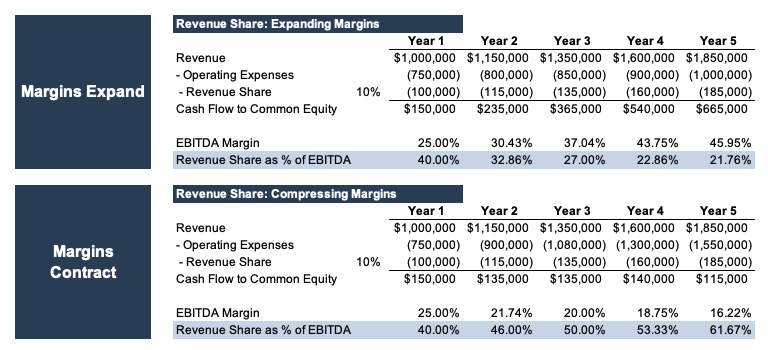

There are benefits to a revenue share for businesses that have stable or expanding margins. As shown in the example below, as margins expand and more flows through to the bottom line, the revenue share as a percentage of EBITDA (as a proxy for free cash flow) decreases, and the common equity holders split a larger share of the distributable cash flow. On the flip side, if margins contract, the size of the revenue share as a percent of EBITDA will increase and the revenue shareholder will gain a larger share of distributable cash flow.

A revenue share usually includes customary minority protections. For example, consent is typically required for certain matters such as:

- Bringing on excess debt or changing the company’s capital structure in a way that would adversely affect the revenue share owner

- Entering into a JV, related party transactions, or new lines of business

- Changing accounting/billing practices or tax election in a way that would adversely affect the revenue share owner

Preferred Equity

Like a revenue share, preferred equity holders participate in the distribution of cash flow before common equity holders; however, preferred equity holders distribution is determined by the bottom line, not the top. Because of this, preferred equity holders are more interested in operational decisions such as executive compensation and budgeting because their distribution could be reduced with additional expenses. Preferred equity holders typically ask for board representation and veto rights on certain key items. Such protective rights include:

- Required distributions of excess cash flow

- Budget approval

- Approval of executive compensation

- Tag along rights

- Preemptive rights to protect preferred equity holders from dilution

Although preferred equity holder’s rank higher than common equity holders, a preferred equity holder faces more risk than a revenue shareholder. In the example of margin compression explored above, the preferred equity holder would likely face a similar decline in distributions as the common equity holder.

Because of the risk profile of each investment, a revenue shareholder may be able to offer more in terms of pricing than a preferred equity investor. A minority financial partner can help you successfully transition ownership from retiring partners but is not the solution for every RIA.

In the next few posts, we will continue to discuss other viable exit options for RIA principals when it comes to succession planning.

RIA Valuation Insights

RIA Valuation Insights