Portfolio Valuation: How to Value Venture Capital Portfolio Investments

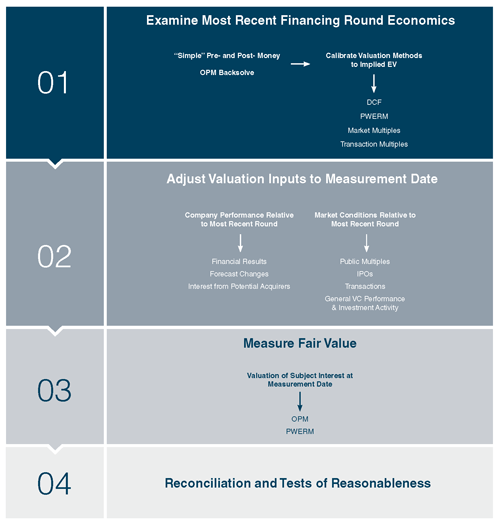

The following outlines our process when providing periodic fair value marks for venture capital fund investments in pre-public companies.

Examine the most recent financing round economics

The transaction underlying the initiation of an investment position can provide three critical pieces of information from a valuation perspective:

- Size of the aggregate investment and per share price.

- Rights and protections accorded to the newest round of securities.

- Usually, but not always, an indication of the underlying enterprise value from the investor’s perspective.

Deal terms commonly reported in the press (example) focus on the size of the aggregate investment and per share price. The term “valuation” is usually a headline-shorthand for implied post-money value that assumes all equity securities in the company’s capital structure have identical rights and protections. While elegant, this approach glosses over the fact that for pre-public companies, securities with differing rights and protections should and do command different prices.

The option pricing method (OPM) is an alternative that explicitly models the rights of each equity class and makes generalized assumptions about the future trajectory of the company to deduce values for the various securities. Valuation specialists can also use the probability-weighted expected return method (PWERM) to evaluate potential proceeds from, and the likelihood of, several exit scenarios for a company. Total proceeds from each scenario would then be allocated to the various classes of equity based on their relative rights. The use of PWERM is particularly viable if there is sufficient visibility into the future exit prospects for the company.

The economics of the most recent financing round helps calibrate inputs used in both the OPM and PWERM.

- Under the OPM, a backsolve procedure provides indications of total equity and enterprise value based on the pricing and terms the most recent financing round. The indicated enterprise value and a set of future cash flow projections, taken together, imply a rate of return (discount rate) that may be reasonable for the company. Multiples implied by the indicated enterprise value, juxtaposed with information from publicly traded companies or related transactions, can yield valuation-useful inferences.

- Under the PWERM, in addition to informing discount rates and providing comparisons with market multiples, the most recent financing round can inform the relative likelihood of the various exit scenarios.

When available, indications of enterprise value from the investor’s perspectives can further inform the inputs used in the various valuation methods.

In addition to the quantitative inputs enumerated above, discussions and documentation around the recent financing round can provide critical qualitative information, as well.

Adjust valuation inputs to measurement date

Between a funding round and subsequent measurement dates, the performance of the company and changes in market conditions can provide context for any adjustments that may be warranted for the valuation inputs. Deterioration in actual financial projections may warrant revisiting the set of projected cash flows, while improvements in market multiples for similar companies may suggest better pricing may be available for the company at exit. Interest from potential acquirers (or withdrawal of prior interest) and general IPO trends can inform inputs related to the relative likelihood of the various exit scenarios.

Measure fair value

Measuring fair value of the subject security entails using the OPM and PWERM, as appropriate and viable, in conjunction with valuation inputs that are relevant at the measurement date. ASC 820 defines fair value as, “The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.”

Reconciliation and tests of reasonableness

A sanity check to scrutinize fair value outputs is an important element of the measurement process. Specifically as it relates to venture capital investments in pre-public companies, such a check would reconcile a fair value indication at the current measurement date with a mark from the prior period in light of both changes in the subject company, and changes in market conditions.

Mercer Capital assists a range of alternative investment funds, including venture capital firms, in periodically measuring the fair value of portfolio assets for financial reporting purposes to the satisfaction of the general partners and fund auditors. Call us – we would like to work with you to define appropriate fund valuation policies and procedures, and provide independent opinions of value.

RIA Valuation Insights

RIA Valuation Insights