Debt Financing for RIAs

How to Finance an Ownership Transition

As noted in a recent post, there are many viable options for RIA principals when it comes to succession planning. One way to transition ownership while maintaining independence is to sell internally to key staff members. The most obvious roadblock when planning for internal succession is pricing. But once you establish a price, how does the next generation pay? An internal transition of ownership typically requires debt and/or seller financing as it’s unlikely that the next generation is able or willing to purchase 100% ownership in a matter of months. In this post, we consider the expanding options for RIAs seeking debt financing and the typical terms they can expect.

Is Debt Financing the Right Solution?

Debt financing has become a more practical option for RIA principals working on succession planning as more specialty lenders have entered the market. Some of the benefits of debt financing are outlined below.

- Debt financing, as opposed to seller financing, allows the exiting shareholder to make a clean break with the business. This benefits both the exiting shareholder and the remaining principals. Exiting shareholders, who are likely at retirement age, receive liquidity at close that they can use to diversify their personal holdings, and the remaining principals don’t have ownership lingering in the hands of a former employee.

- Debt financing, as opposed to equity financing, allows the remaining principles to maintain autonomy. Excluding loan covenants, lenders have no control over your business. On the other hand, equity partners usually require more intrusive oversight such as a board seat and/or budget approval, which remaining shareholders may not tolerate.

- Debt financing is cheaper than equity financing. Equity investors, who are subordinated to debtholders, require an additional premium over the average cost of debt.

- Interest payments are tax-deductible. Interest payments can reduce the borrower’s tax burden during the amortization period.

Despite these benefits, debt financing does increase the remaining shareholders’ personal risk. Debt financing is an obligation to repay the money acquired through it, unlike equity financing which typically does not require repayment. Debt financing for RIAs also typically includes a personal guarantee, which many borrowers are opposed to. Borrowers are also more exposed to their own business by levering up to purchase an equity stake.

Increasing Number of Specialty Lenders for RIAs

As Financial Planning explained, “the market for RIA-friendly lending options has exploded” over the last two years. Looking back, Live Oak Bank was one of the first to address the specific needs of RIA principals when they began providing favorable terms to independent advisory firms in 2012. As explained on their website, “where most banks look for tangible collateral when they lend money, Live Oak Bank lends on cash flow to companies (like advisory firms) which have little to no collateral.” Prior to this, most RIAs had to turn to local banks, who generally were not comfortable with the asset-light balance sheets and fee-based structure of RIA firms.

RIAs now can turn to a growing number of specialty lenders who are accustomed to working with RIAs. Some of the firms offering debt financing specifically for RIAs include Oak Street Funding, Merchant Credit Partners, PPC Loan, and SkyView Partners.

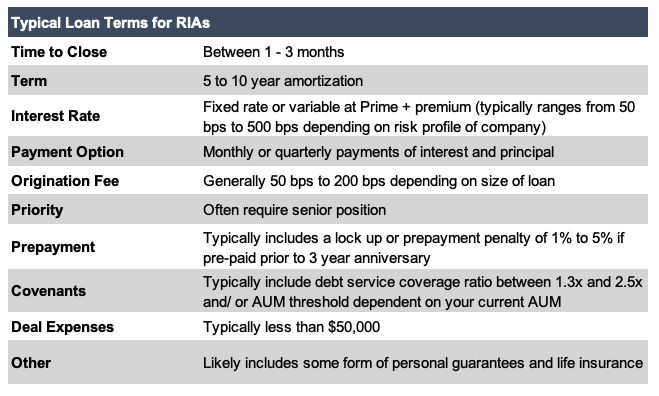

Typical Terms for RIAs

Additionally, one provision may be contingent upon another. For example, a higher origination fee could reduce the need for a pre-payment penalty. At the risk of providing an example of terms that may be unachievable for some RIAs, we have outlined terms RIA principals can generally expect when seeking debt financing.

Most lenders require a personal guarantee, which is a legal promise by the partners to repay the loan made to their business in the event the business defaults. While it is typical that lenders to small businesses require this additional layer of protection, it is important to understand how a personal guarantee works and what it could mean for your personal finances.

Because RIAs do not have fixed assets to use as collateral, a personal guarantee gives your lender the right to pursue your personal assets if your business defaults on the loan. The SBA is of the opinion that a personal guarantee “ensures that the borrower has sufficient personal interest at stake in the business.” Notably, a personal guarantee is not released if you sell the business. While you can ask your lender to replace your personal guarantee with a personal guarantee from a new owner, the lender is typically not required to do so.

Conclusion

Similar to evaluating mortgage options, it is important to talk to multiple lenders to guarantee the most favorable terms for your business transition. Having a knowledgeable advisor to manage this process can allow remaining ownership to stay focused on running the business while ensuring consideration of all appropriate options.

RIA Valuation Insights

RIA Valuation Insights