The Family Office

Managing Family Wealth Since 27 BC

After appearing on our Family Business Director Blog earlier this month, we decided to share this post as it provides useful guidance on assessing whether a family office is right for your family.

Private investment office… Family business advisor… Single-family office… The name differs and the definition varies greatly depending on whom you ask. But the concept remains the same. Wealthy families often seek assistance to manage their accumulated wealth, organize family affairs, and preserve capital for future generations.

The concept of a family office dates back as far as 27 BC.

The concept of a family office dates back as far as 27 BC when Emperor Augustus Caesar, who at the time controlled approximately 25% of global GDP, employed a group of appointees to manage his estate, businesses, military, and even lifestyle. The concept continued to evolve in the sixth century when it was common for the king’s steward to manage the royal family’s wealth. However, the modern family office, as we know it today, took shape in 1882 when the Rockefeller family (with approximately $1.4 billion, equating to around $255 billion today) founded their family office to organize the family’s business operations and manage their investment needs.

A family office is different than a traditional wealth management firm. A family office typically provides a full suite of services including accounting, budgeting, family education, investment management, insurance, charitable giving, and sometimes even concierge services including travel arrangements, personal security, and miscellaneous other household services. However, it is hard to define the “typical” family office as most develop out of a family’s specific needs. Additionally, many wealthy families likely employ professionals who carry out such duties, without necessarily defining or even realizing their function is similar to a single-family office.

Single-Family Office vs. Multi-Family Office

A single-family office is tailored to meet your family’s specific needs. However, to warrant the cost of a single-family office, a family’s assets likely must exceed $100 million, and to afford a full investment practice, assets likely must exceed $250 million. As such, the multi-family office took shape to provide similar services to ultra-wealthy families (typically those with assets in excess of $25 million), while allowing for cost-sharing between multiple families. A multi-family office can be commercially owned by a group of outside investors or privately owned by a founding family with significant wealth. For example, the Rockefeller family office, which has served the Rockefeller family for almost 140 years, recently expanded its services to over 250 clients.

There are key legal and regulatory differences between a single-family office and a multi-family office. Because single-family offices serve only one family, they are not registered with the SEC (the Investment Advisor Act of 1940 made single-family offices exempt from SEC registration). Multi-family offices, on the other hand, are typically structured as registered investment advisors (RIAs), which are registered with the SEC, or trust companies, which are typically regulated at the state level.

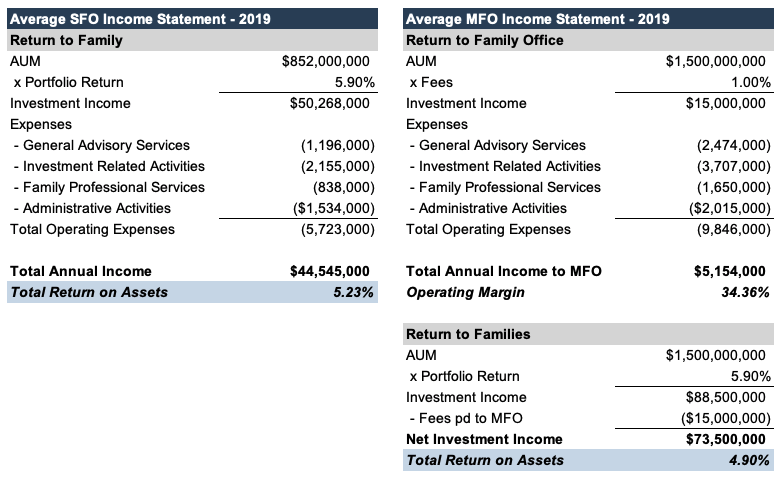

Additionally, a single-family office’s main goal is to preserve and generate wealth for the family. Whereas a multi-family office also seeks to generate a profit for itself. This results in a somewhat lower return on assets for families belonging to a multi-family office as the profits are split between the families and the ownership base. We have compiled what the average income statement for a single-family office and multi-family office looks like to highlight this difference.

Data per The Global Family Office Report 2019

AUM = Global Average AUM for SFOs and MFOs

Portfolio Return = Average Family Office Portfolio Return from Q1/Q2 2018 through Q1/Q2 2019 in N America

Expenses = Average Global Expenses for SFOs and MFOs

As shown above, the total return on assets managed by a single-family office (5.2%) is slightly higher than the return on assets managed by the multi-family office (4.9%). The return generated by the multi-family office, however, is sensitive to our assumption of fees charged for family office services. We have estimated multi-family office fees to be 1.0% of AUM. Family offices have varying fee structures but typically include a combination of fixed fees, hourly fees, and asset-based fees. While these asset-based fees typically range between 50bps to 100bps, for comparability, we have assumed a fee at the higher end of this range to provide an estimate for comprehensive services such as would be provided by a single-family office.

Investment Performance

At first glance, the average return for the portfolio (5.9% for the twelve months ended Q1/Q2 2019) appears rather low, given that wealthier individuals typically have a greater ability to take risk, leading to generally higher returns. However, keep in mind that family offices don’t just manage an individual’s investable assets, as does a typical wealth manager from whom you would likely expect a 7%-ish return. A family office generally manages a family’s entire portfolio, including cash.

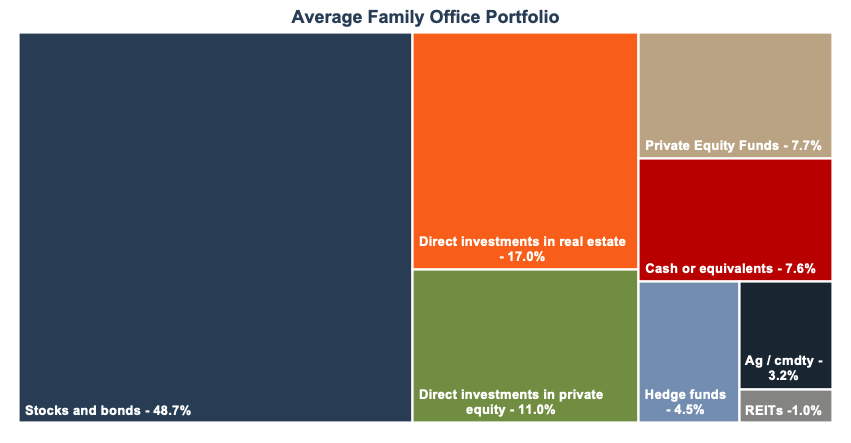

The “average” portfolio for a family office is shown below.

Recently, family offices have started investing in more diverse and riskier products, such as private companies and distressed debt, that have typically been reserved for institutional investors. Family offices have reduced their allocation to hedge-funds over time, unable to justify such high fees for often mediocre performance and have reallocated these funds to direct investments in debt and equity. Over the last few years, family offices have become somewhat of a disruptive force in the private equity and venture capital space as they are able to offer competitive pricing and terms since their holding periods are longer than the typical private equity fund and they have more flexible investment criteria than a private equity firm who may be working to manage the expectations of hundreds of investors, instead of one family.

Growing Presence of Family Offices

Educating your family about how your wealth and/or family business is managed is essential for the preservation of your family legacy.

In the 1980s family offices started to multiply as the number of families who were able to afford such services increased the concept. In 2018, EY estimated that there were approximately 10,000 single family offices worldwide, a ten-fold increase over less than a decade. Looking forward, the number of single and multi-family offices is expected to continue increasing as the number of wealthy families grows and investor preferences continue to shift towards having more control over one’s own wealth. While family offices are more streamlined than traditional investment firms there are some obvious drawbacks of mixing business and family. This is why family education and communication is so important. Educating your family about how your wealth and/or family business is managed is essential for the preservation of your family legacy.

As the family office continues to evolve and wealthy families have more options when it comes to managing their wealth, it will be increasingly important for families to ask who can help them best align the family’s interests, making it easier to operate your business, cooperate with other family members, and allow yourself more time to do what is important to you.

RIA Valuation Insights

RIA Valuation Insights