What Matters Most for RIA Buy-Sell Agreements?

In Our Experience…

Series 1 Jaguar E-type OTS (Open Two Seater) Photo Credit: Rusty Heaps

In 1961, Jaguar stunned the automotive community by adapting its highly successful D-type race car, which had won the 24 hours of Le Mans three consecutive years in the late 1950s, to create the E-type road car. The E-type was instantly acclaimed. It had everything you could ask for in a sports car at the time: an inline six-cylinder motor that powered it to 60 mph in under seven seconds, monocoque construction, disc brakes, rack and pinion steering, independent front and rear suspension, and a top speed of over 150. Most importantly, it was gorgeous. Enzo Ferrari himself said it was “the most beautiful car ever made.”

No one ever said a particular buy-sell agreement was the “most beautiful” ever written (even in our office), but some are better than others. And, like a good sports car, you can break down the key elements of a buy-sell agreement that must be there for the agreement to be successful. The first hurdle to clear is for the buy-sell agreement to specify that the company is to be valued within reasonable parameters appropriate to the situation. We don’t see many shareholders’ agreements in the RIA community relying on “rule-of-thumb” like multiples of revenue or AUM – probably because, while simplicity is appealing, it’s too easy for that kind of high level analysis to create unintended winners and losers in a buy-sell action.

But that begs the question: if an asset manager’s buy-sell is going to specify reasonable expectations for the value of the firm, what are they? We think there are at least four.

1. A Buy-Sell Agreement Should Clearly Define the “Standard” of Value

The standard of value is an important element of the context of a given valuation. We think of the standard of value as defining the perspective in which a valuation is taking place. Investment managers might evaluate a security from what they think it’s worth (intrinsic value) as opposed to its trading price (market value) and make an investment decision based on that differential.

Similarly, valuation professionals such as our squad look at the value of a given company or interest in a company according to standards of value such as fair market value or fair value. In our world, the most common standard of value is fair market value, which applies to virtually all federal and estate tax valuation matters, including charitable gifts, estate tax issues, ad valorem taxes, and other tax-related issues. It is also commonly applied in bankruptcy matters.

Fair market value has been defined in many court cases and in Internal Revenue Service Ruling 59-60. It is defined in the International Glossary of Business Valuation Terms as:

The price, expressed in terms of cash equivalents, at which property would change hands between a hypothetical willing and able buyer and a hypothetical willing and able seller, acting at arm’s length in an open and unrestricted market, when neither is under compulsion to buy or sell and when both have reasonable knowledge of the relevant facts.

The standard of value is so important, it’s worth naming, quoting, and citing specifically which definition is applicable. The downsides of not doing so can be reasonably severe. Take, for example, the standard of “fair value.” In dissenting shareholder matters, fair value is a statutory standard that can be very different depending on the legal jurisdiction. By contrast, fair value is also a standard of value under Generally Accepted Accounting Principles, as defined in ASC 820. GAAP fair value is similar to fair market value, but not entirely the same. In any event, it pays to be clear.

For most buy-sell agreements, we would recommend one of the more common definitions of fair market value. The advantage of naming fair market value as the standard of value is that doing so invokes a lengthy history of court interpretation and professional writing on the implications of the standard, and thus makes application to a given buy-sell scenario more clear.

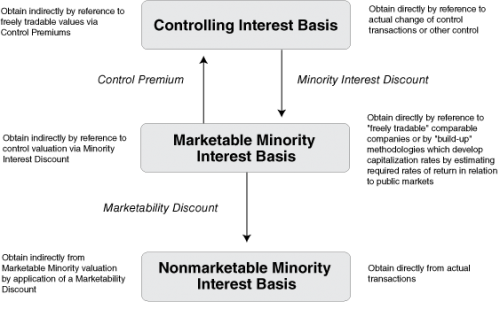

2. Unless it is Clarified, There will be Costly Disagreement as to “Level of Value”

Investment managers in publicly traded securities don’t often have reason to think about the “level” of value for a given security. But closely-held securities, like common stock interests in RIAs, don’t have active markets trading their stocks, so a given interest might be worth less than a pro rata portion of the overall enterprise. In the appraisal world, we would express that difference as a lack of marketability.

Sellers will, of course, want to be bought out pursuant to a buy-sell agreement at their pro rata enterprise value. Buyers might want to purchase at a discount (until they consider the level of value at which they will ultimately be bought out). In any event, the buy-sell agreement should consider the economic implications to the RIA and specify what level of value is appropriate for the buy-sell agreement.

Fairness is a consideration here. If a transaction occurs at a premium or a discount to pro rata enterprise value, there will be “winners” and “losers” in the transaction. This may be appropriate in some circumstances, but in most RIAs, the owners joined together at arm’s length to create and operate the enterprise and want to be paid based on their pro rata ownership in that enterprise. Whatever the case, the shareholder agreement needs to be very specific as to level of value. We even recommend inserting a level of value chart, like the one you see above, and drawing an arrow as to which is specified in the agreement.

3. Don’t Forget to Specify the “As Of” Date for Valuation

This seems obvious, but the particular date appropriate for the valuation matters. We had one client (not an RIA) spend a quarter million dollars on hearings debating this matter alone. The appropriate date might be the triggering event, such as the death of a shareholder, but there are many considerations that go into this.

If the buy-sell agreement specifies that value be established on an annual basis (something we highly recommend to avoid confusion), then the date might be the calendar year end. Consider whether you want the event precipitating the transaction to factor into the value? If not, maybe the as-of date should be the day before the event. Or maybe it matters that, say, a given shareholder died or otherwise left the organization, and it’s worth considering the impact of the departure. If that’s the case, then maybe the appropriate valuation date is the end of the fiscal year following the event giving rise to the transaction.

This blogpost doesn’t begin to name all of the reasons that specifying an “as-of” date matters to the appraisal, but you get the idea.

4. Appraiser Qualifications: Who’s Going to be Doing the Valuation?

Obviously, you don’t want just anybody being brought in to value your company. If you are having an annual appraisal done, then you have plenty of time to vet and think about who you want to do the work. In the appraisal community, we tend to think of “valuation experts” and “industry experts.”

Valuation experts are known for:

- Appropriate professional training and designations

- Understanding of valuation standards and concepts

- Perspective on the market as consisting of hypothetical buyers and sellers (fair market value mindset)

- Experienced in valuing minority interests in closely held businesses

- Advising on issues for closely held businesses like buy-sell agreements

- Experienced in explaining work in litigated matters

Industry experts, by contrast, are known for:

- Depth of particular industry knowledge

- Understanding of key industry concepts and terminology

- Perspective on the market as typical buyers and sellers of interests in RIAs

- Transactions experience

- Regularly providing specialized advisory services to the industry

In all candor, there are pros and cons to each “type” of expert. We worked as the third appraiser on a disputed RIA valuation many years ago in which one party had a valuation expert and the other had an industry expert. The resulting rancor was absurd. The company had hired a reasonably well known valuation expert who wasn’t particularly experienced in valuations in the RIA community. That appraiser prepared a valuation standards-compliant report that valued the RIA much like one would value a dental practice, and came up with a very low appraised value – much to the delight of his client. The departing shareholder, by contrast, hired an also well-known investment banker who arranges transactions in the asset management community. The investment banker looked at a lot of transactions data and valued the RIA as if it were a department at Blackrock. Needless to say, that indicated value was many, many times higher than the company’s appraiser. We were brought in to make sense of it all.

The buy-sell agreement should specify minimum appraisal qualifications for the individual or firm to be preparing the analysis, but also specify that the appraiser should have experience and sufficient industry knowledge to consider the ins and outs of RIAs. Ultimately, you need a reasonable appraisal work product that will withstand potential judicial scrutiny, but you shouldn’t have to explain your business model in the process.

Final Thoughts

I’ll cover in a later blogpost how the appraisal process itself works, and the considerations above are by no means meant to be exhaustive. But when you consider just these four elements, you can see how ambiguity in a buy-sell agreement can be highly disruptive at an investment management firm. While we do occasionally advise clients on setting up shareholder agreements, more often we are called in when an “agreement” is in dispute. We’ll cover one such story in next week’s blogpost.

RIA Valuation Insights

RIA Valuation Insights