Purchase Price Allocations for Asset and Wealth Manager Transactions

In recent years, there’s been a great deal of interest in RIA acquisitions from a diverse group of buyers ranging from consolidators, other RIAs, banks, diversified financial services companies, and private equity. Due to the high margins, recurring revenue, low capital needs, and sticky client bases that RIAs often offer, these acquirers have been drawn to RIA acquisitions. Following these transactions, acquirors are generally required under accounting standards to perform what is known as a purchase price allocation, or PPA.

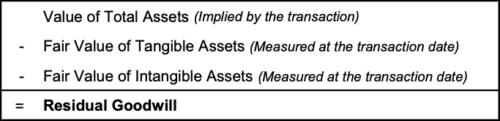

A purchase price allocation is just that—the purchase price paid for the acquired business is allocated to the acquired tangible and separately-identifiable intangible assets. As noted in the following figure, the acquired assets are measured at fair value. The excess of the purchase price over the identified tangible and intangible assets is referred to as goodwill.

Transaction structures involving RIAs can be complicated, often including deal term nuances and clauses that have significant impact on fair value. Purchase agreements may include balance sheet adjustments, client consent thresholds, earnouts, and specific requirements regarding the treatment of other existing documents like buy-sell agreements. Asset and wealth management firms are unique entities with value attributed to a number of different metrics (assets under management, management fee revenue, realized fees, profit margins, etc). It is important to understand how the characteristics of the asset management industry in general and those attributable to a specific firm influence the values of the assets acquired in these transactions.

Because most investment managers are not asset intensive operations, the majority of value is typically allocated to intangible assets. Common intangible assets acquired in the purchase of private asset and wealth management firms include the existing customer relationships, tradename, non-competition agreements with executives, and the assembled workforce.

Customer Relationships

Generally, the value of existing customer relationships is based on the revenue and profitability expected to be generated by the accounts, factoring in an expectation of annual account attrition. Attrition can be estimated using analysis of historical client data or prospective characteristics of the client base.

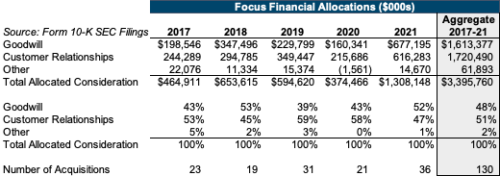

Due to their long-term nature, relatively low attrition rates, and importance as a driver of revenue in the asset and wealth management industries, customer relationships often command a relatively high portion of the allocated value. We can see this in the public filings of RIA aggregator Focus Financial. Between 2017 and 2021, Focus completed 130 acquisitions of RIAs. Of the aggregate allocated consideration for these transactions, a full 51% was allocated to customer relationships. Most of the remainder (48%) was allocated to goodwill.

Tradename

The deal terms we see employ a wide range of possible treatments for the tradename acquired in the transaction. The acquiror will need to decide whether to continue using the asset or wealth manager’s name into perpetuity or only use it during a transition period as the acquired firm’s services are brought under the acquirer’s name. This decision can depend on a number of factors, including the acquired firm’s reputation within a specific market, the acquirer’s desire to bring its services under a single name, and the ease of transitioning the asset/wealth manager’s existing client base. In any event, for most relatively successful small-to-medium sized RIAs, the tradename has some positive recognition among the customer base and in the local market, but typically lacks the “brand name” recognition that would give rise to significant tradename value.

In general, the value of a tradename can be derived with reference to the royalty costs avoided through ownership of the name. A royalty rate is often estimated through comparison with comparable transactions and an analysis of the characteristics of the individual firm name. The present value of cost savings achieved by owning rather than licensing the name over the future period of use is a measure of the tradename value.

Noncompetition Agreements

In many asset and wealth management firms, a few top executives or portfolio managers account for a large portion of new client generation. Deals involving such firms will typically include non-competition and non-solicitation agreements that limit the potential damage to the company’s client and employee bases if such individuals were to leave.

These agreements often prohibit the covered individuals from soliciting business from existing clients or recruiting current employees of the company. In the agreements we’ve observed, a restricted period of two to five years is common. In certain situations, the agreement may also restrict the individuals from starting or working for a competing firm within the same market. The value attributable to a non-competition agreement is derived from the expected impact competition from the covered individuals would have on the firm’s cash flow and the likelihood of those individuals competing absent the agreement. Factors driving the likelihood of competition include the age of the covered individual and whether or not the covered individual has other incentives not to compete aside from the legal agreement (for example, if the individual is a beneficiary of an earn-out agreement or received equity in the acquiror as part of the deal, the probability of competition may be significantly lessened).

Assembled Workforce

In general, the value of the assembled workforce is a function of the saved hiring and assembly costs associated with finding and training new talent. However, in relationship-based industries like asset and wealth management, getting a new portfolio manager or advisor up to speed can include months of networking and building a client base, in addition to learning the operations of the firm. The ability of employees to establish and maintain these client networks can be a key factor in a firm’s ability to find, retain, and grow its business. An existing employee base with market knowledge, strong client relationships, and an existing network may often command a higher value allocation to the assembled workforce. Unlike the intangible assets previously discussed, the value of a assembled workforce is valued as a component of valuing the other assets. Under current accounting standards, the assembled workforce value is not recognized or reported separately, but rather is included as an element of goodwill.

Goodwill

Goodwill arises in transactions as the difference between the price paid for a company and the value of its identifiable assets (tangible and intangible). Expectations of synergies, strategic market location, and access to a certain client group are common examples of goodwill value derived from the acquisition of an asset or wealth manager. The presence of these non-separable assets and characteristics in a transaction can contribute to the allocation of value to goodwill.

Earnouts

In the purchase price allocations we do for RIA acquirors, we frequently see earnouts structured into the deal as a mechanism for bridging the gap between the price the acquirer wants to pay and the price the seller wants to receive. Earnout payments can be based on asset retention, fee revenue growth, or generation of new revenue from additional clients, assets, or product offerings. Structuring a portion of the total purchase consideration as an earnout provides some downside protection for the acquirer, while rewarding the seller for meeting or exceeding growth expectations. Earnout arrangements represent a contingent liability for the acquiror that must be recorded at fair value on the acquisition date.

Conclusion

The proper allocation of value to intangible assets and the calculation of asset fair values require both valuation expertise and knowledge of the subject industry. Mercer Capital brings these together in our extensive experience providing fair value and other valuation and transaction work for the investment management industry. If your company is involved in or is contemplating a transaction, call one of our professionals to discuss your valuation needs in confidence.

RIA Valuation Insights

RIA Valuation Insights