Pzena Going Private Could Have Larger Implications for the Investment Management Industry

Last week Pzena Investment Management, Inc. (ticker: PZN) announced that it had entered into an agreement to become a private company again via a transaction in which holders of PZN Class A common stock would receive $9.60 per share in cash, a 49% premium to its closing price before the announcement ($6.44). In this week’s post, we attempt to rationalize this premium and any implications for the investment management industry.

We haven’t interviewed any members of Pzena’s Special Committee or Board of Directors that ultimately approved the deal, but we’ll speculate on their reasoning for taking PZN private. An obvious explanation is that Pzena management wanted to avoid the additional costs and scrutiny that come with public filings. PZN is smaller than most public companies, and the publicly traded portion of its stock represented 20% of its equity capital, so it was likely devoting a significant amount of time and resources to a relatively modest float of $163 million (transaction price of $9.60 a share multiplied by 16.9 million publicly traded shares). It’s very conceivable that Pzena management thought being public was more trouble than it was worth.

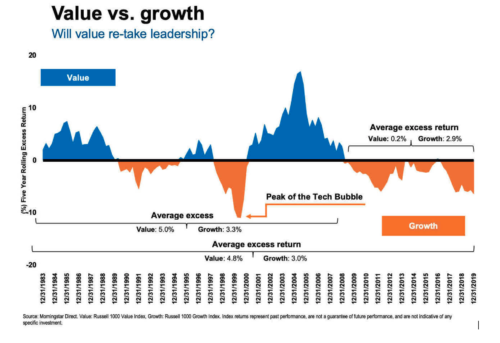

Public markets haven’t been kind to Pzena, as their stock hasn’t performed well. The firm went public in 2007 with an IPO price of $18 per share, and it’s lost nearly half its value during relatively favorable market conditions. PZN pays a modest dividend, but not enough to overcome the decline in share price. Much of this decline is attributable to the challenges the asset management industry has faced over this time relating to fee pressure and the rising popularity of passive investment products. The dominance of growth investing since the Financial Crisis of 2008-09 has compounded these issues for value managers like Pzena.

PZN Founder and CEO Richard Pzena told Citywire in a 2020 interview, “Value investing is more upbringing and personality. Growing up, we learned that the same stuff you pay full price for, you can get at half price sometimes.” If his firm was willing to pay a ~50% premium for PZN stock, maybe he felt it was finally half off.

There’s also been the recent recovery in value stocks and Pzena’s (relatively) strong investment performance with its John Hancock Classic Value fund (ticker: PZFVX) outperforming the S&P 500 by just over 500 basis points year-to-date. Alpha often leads to asset inflows, so PZN management is probably optimistic about the firm’s prospects despite its lackluster share price performance since the IPO.

Does this mean asset managers are worth more as a closely held firm than a publicly traded company? Not necessarily. All else equal, investors will generally pay less for a nonmarketable interest than an otherwise comparable interest that is freely tradable in a public market. This differential in value is commonly referred to as a discount for lack of marketability or DLOM. DLOMs exist in the investment management industry but are generally lower than discounts in most other industries since RIAs and asset managers tend to fully distribute their earnings to shareholders, which enhances their liquidity and lowers their applicable discount.

The implication of this transaction is not that private investment managers are worth more but that the public option may not be a viable solution for asset managers (or RIAs) that are PZN’s size ($45 billion in AUM at June 30, 2022) or smaller.

The investment management industry is not a fixed asset-intensive business that requires substantial investments in property or equipment, so the need to raise capital through an IPO or other form of financing is usually minimal. They’re also typically owned by insiders, so it’s not essential for their shares to be publicly traded such that third-party investors can enter and exit their position at will.

We could see some of the smaller publicly traded investment managers (GBL, HNNA, DHIL, SAMG, and WHG, to name a few) follow Pzena’s lead and pursue the private route, but more likely it will serve as further evidence that it doesn’t make economic sense for most RIAs and asset managers to go public. We hope that’s not the case since we often find public RIA and asset manager pricing instructive in our industry valuations. Nevertheless, it could be a while before we see another IPO in the space. Investment management principals at sizeable firms that are considering a public offering will likely think twice if the Board of one of the larger asset managers ultimately determined that it was in the shareholders’ and company’s best interest to go private. There are plenty of other exit and liquidity options for RIA and asset management principals, which we’re happy to discuss.

RIA Valuation Insights

RIA Valuation Insights