Recent Bribery Scandal, Another Blow to Alternative Asset Managers

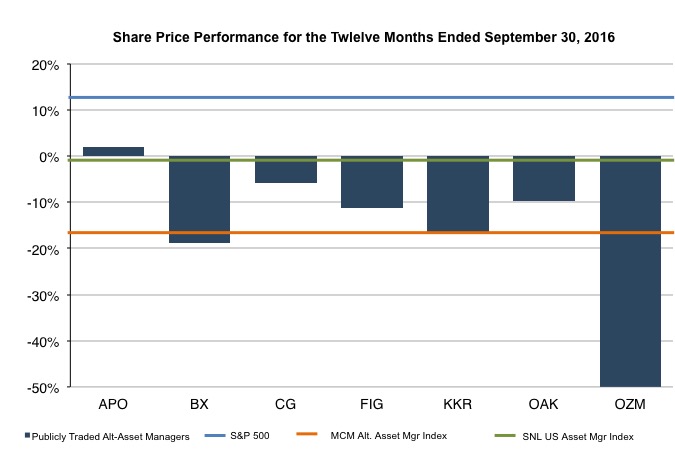

Just a few days ago, the largest publicly traded hedge fund, Och-Ziff Capital Management Group, agreed to pay $413 million to settle federal charges that it disbursed more than $100 million in bribes to African government officials. Even before this announcement, the hedge fund industry was in quite the slump. Since June of last year, publicly traded hedgees and PE firms have lost 40% of their market cap. We’ve discussed the many headwinds facing this industry in prior posts but generally speaking, investors are simply fed up with the low return, high fee combination that has recently characterized the industry, particularly over the last year and a half. The Fed’s anti-volatility campaign hasn’t helped matters, and isn’t likely to abate any time soon.

The Och-Ziff scandal reveals another potential headwind that isn’t necessarily company-specific. While difficult to measure, reputational risk is very real for these businesses that rely heavily on investor trust, transparency, and overall status within the financial community to raise capital. FIFA-like scandals are unacceptable to institutional investors already wary of high fees and sub-par performance.

With this as a backdrop, it is hard to envision much of a silver lining. Still, as we’ve noted in a prior post, asset bubbles are relative. With a third of the developed world selling bonds at negative yields, and the U.S. stock market trending up after six straight quarters of earnings declines, bidding for any return at all in the private company space looks, at least on a relative basis, attractive. Fund raising is still alive and well in alt assets, and should be for some time to come.

The old 2 and 20 management fee / carry model, however, is on life support and probably not going to make it – at least not as the industry standard. The few PE firms and hedge funds still capable of charging such high rates are consistently in the top 5% of investment performance, and sustaining that level of alpha over the long term is nearly impossible. One and ten over a predetermined hurdle is the new normal, and even that could come under pressure if performance continues to suffer while fees tighten for other classes of asset managers.

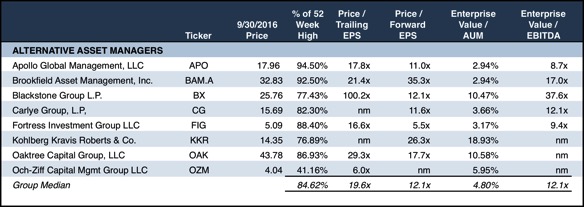

A glance at current multiples doesn’t reveal much except that Blackstone’s earnings are likely depressed, and analysts are expecting some recovery next year as LTM multiples exceed forward P/E ratios for most of these businesses. In an era of fee compression and passive investing, this seems optimistic, though some mean reversion is entirely possible. AUM multiples, on the other hand, have always been high for this sector and are likely to remain that way due to performance fees and non-asset-based sources of income for PE firms. Still, with most of the group trading close to their 52 week high, any significant upside seems unlikely, and OZM shares may never recover.

Mercer Capital’s RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry. Follow us on Twitter @RIA_Mercer.

RIA Valuation Insights

RIA Valuation Insights