RIA Deal-Making Was Flat Last Year but Poised to Surge in 2017

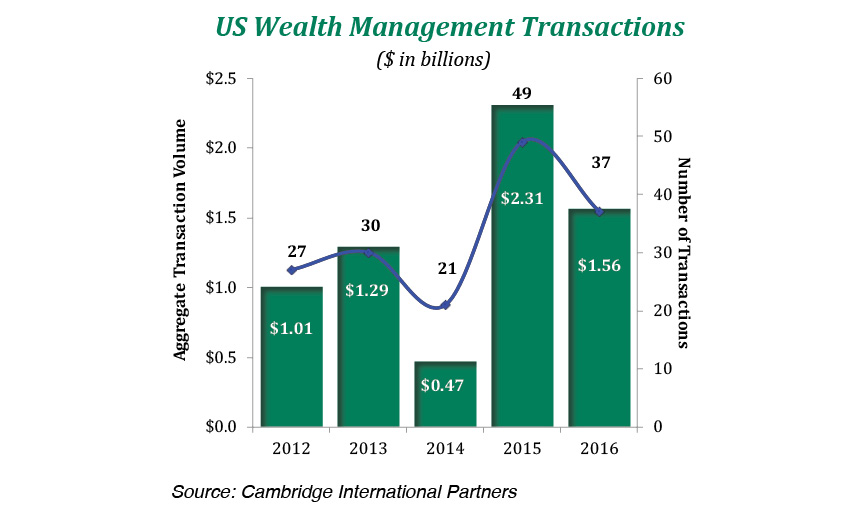

Despite a rocky year for asset manager valuations, sector M&A was still strong. Total transactions were down about 10% from 2015 while aggregate deal value increased close to 20%. Several themes from the prior year also persisted as wealth management acquisitions remained robust and banks continued to play a pivotal role on both the buy-side and the sell-side.

Banks have been on the hunt for RIA acquisitions for quite some time in their quest for returns not tied to interest rate movements. A steepening yield curve could curtail some of this momentum as lending profits improve, but we haven’t seen it yet. Given the favorable economics underlying many RIAs (high margins, low capital requirements, recurring revenue stream, etc.), we suspect they’ll continue to be in demand by financial institutions.

Perhaps a more surprising trend is the continued interest in alternative asset managers, despite the sector’s recent woes. Acquisitions involving alt managers accounted for approximately one-quarter of investment management transactions globally last year, according to data from Cambridge International Partners. This trend seems counterintuitive in the era of passive investing and fee compression, but strategic and financial acquirers appear to be drawn to the segment’s exposure to non-correlated asset classes and high revenue yield on assets under management.

Less surprising is the recent consolidation of discount brokers for self-directed investors. Falling commission rates and transaction fees have spurred capitulation in the sector to create scale and cost efficiencies. 2016 was no exception to this trend as Ally Financial bought Tradeking, E-Trade purchased OptionsHouse, and TD Ameritrade agreed to buy Scottrade. The culmination of all these deals is the creation of two large independent retail brokers, TD Ameritrade and E-Trade as rivals to much larger Schwab and Fidelity. With so few sizeable independent brokerage firms left, industry consolidation may have run its course. Keep an eye on E-Trade though – new senior leadership hasn’t ruled out a potential sale over the next year or two.

On balance, the outlook for asset manager M&A in 2017 is more promising. With over 11,000 RIAs currently operating in the U.S., the industry is still very fragmented and ripe for further consolidation. An aging ownership base is another impetus, and the recent market gains might induce prospective sellers to finally pull the trigger. Fee compression could also lead to more transactions if RIAs look to create synergies and cost efficiencies to maintain their profit margin. Absent another correction or heightened volatility, 2017 could prove to be a record year for asset manager M&A.

Mercer Capital’s RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry. Follow us on Twitter @RIA_Mercer.

RIA Valuation Insights

RIA Valuation Insights