RIA Industry Extends Its Bull Run Another Quarter

Continuation of Market Rebound Drives All Categories of Publicly Traded RIAs Higher in Q4 2020

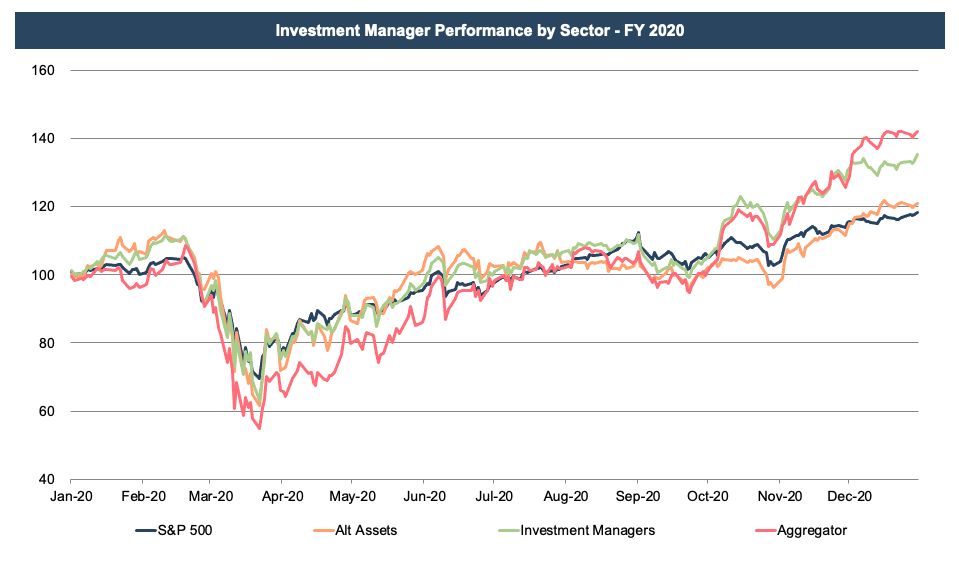

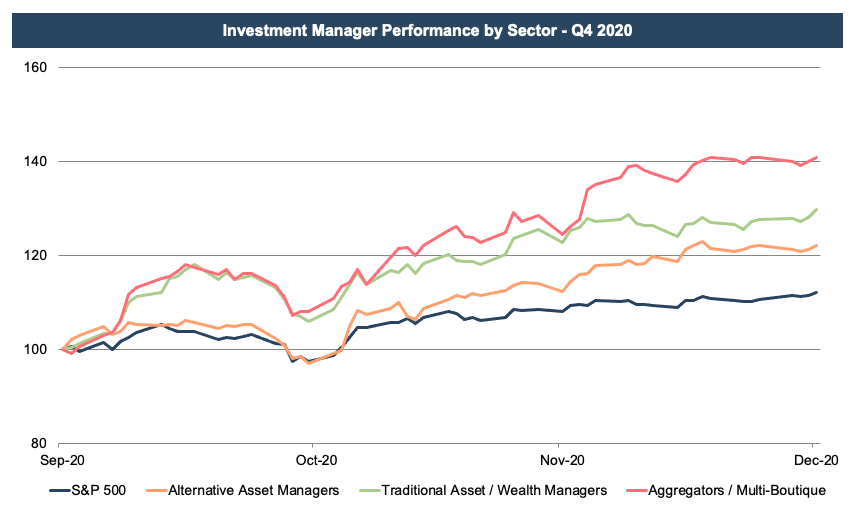

Share prices for publicly traded investment managers have trended upward with the market since March’s collapse. Aggregators fared particularly well over the last nine months on low borrowing costs and steady gains on their RIA acquisitions. Traditional asset and wealth managers have also performed well over this time on rising AUM balances with favorable market conditions.

The upward trend in publicly traded asset and wealth manager share prices since March is promising for the industry, but it should be evaluated in the proper context. Pre-COVID, the industry was already facing numerous headwinds including fee pressure, asset outflows, and the rising popularity of passive investment products. While the 11-year bull market run largely masked these issues, asset outflows and revenue pressure can be exacerbated in times of market pullbacks and volatility.

The fourth quarter was also favorable for publicly traded RIAs of all sizes except the under $10 billion in AUM category. This underperformance is largely attributable to the lack of diversification in this index and one company’s (Hennessy Advisors) earnings misses rather than any indication that smaller RIAs have struggled over the last few months.

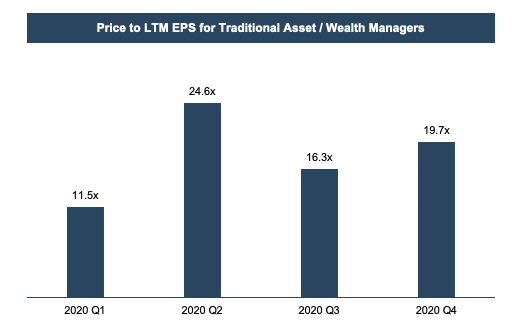

As valuation analysts, we’re often interested in how earnings multiples have evolved over time, since these multiples reflect market sentiment for the asset class. LTM earnings multiples for publicly traded asset and wealth management firms declined significantly during the first quarter—reflecting the market’s anticipation of lower earnings due to large decreases in client assets attributable to COVID-19’s impact on the market. Multiples were inflated in Q2, as prices recovered and earnings lagged—but have metrics have since normalized as prospects for earnings growth have improved with AUM balances.

Implications for Your RIA

During such volatile market conditions, the value of your RIA is sensitive to the valuation date or date of measurement. In all likelihood, the value declined with the market in the first quarter and has now recovered most or all of that loss. We’ve been doing a lot of valuation updates amidst this volatility, and there are several factors we observe in determining an appropriate amount of appreciation or impairment.

One is the overall market for RIA stocks, which was down significantly in the first quarter but has since recovered to above where it was a year ago (see chart above). The P/E multiple is another reference point, which has followed a similar path. We apply this multiple to a subject RIA’s earnings, so we also have to assess how much that company’s annual AUM, revenue, and cash flow have increased or diminished since the last valuation, while being careful not to count good or bad news twice.

While the market for publicly traded companies is one data point that informs private RIA valuations, that’s not to say that privately held RIAs have followed the same trajectory as their larger public counterparts. Many of the smaller publics are focused on active asset management, which has been particularly vulnerable to the headwinds discussed above. Many smaller, privately-held RIAs, particularly those focused on wealth management for HNW and UHNW individuals, have been more insulated from industry headwinds, and the fee structures, asset flows, and deal activity for these companies have reflected this.

We also evaluate how our subject company is performing relative to the industry as a whole. Fixed income managers, for instance, held up reasonably well compared to their equity counterparts in the first quarter of 2020. We also look at how much of a subject company’s change in AUM is due to market conditions versus new business development net of lost accounts. Investment performance and the pipeline for new customers are also key differentiators that we keep a close eye on.

You also need to consider the implications of the recent election and Georgia run-off on your clients’ estate planning needs in the face of higher taxes and lower exemptions (What RIAs Need to Know About Current Estate Planning Opportunities) that could go into effect next year. And you should always be thinking about practice management issues (RIA Practice Management Insights) and how your firm can thrive in a chaotic market environment.

Improving Outlook

The outlook for RIAs depends on a number of factors. Investor demand for a particular manager’s asset class, fee pressure, rising costs, and regulatory overhang can all impact RIA valuations to varying extents. The one commonality, though, is that RIAs are all impacted by the market.

The impact of market movements varies by sector, however. Alternative asset managers tend to be more idiosyncratic but are still influenced by investor sentiment regarding their hard-to-value assets. Wealth manager valuations are tied to the demand from consolidators while traditional asset managers are more vulnerable to trends in asset flows and fee pressure. Aggregators and multi-boutiques are in the business of buying RIAs, and their success depends on their ability to string together deals at attractive valuations with cheap financing.

On balance, the outlook for RIAs has generally improved with market conditions over the last several months. AUM has risen with the market over this time, and it’s likely that industry-wide revenue and earnings have as well. The fourth quarter was generally a good one for RIAs, but who knows where 2021 will take us following a wild year for RIA valuations and market conditions.

A Plug for Mercer Capital’s Upcoming RIA Practice Management Insights Conference

Mercer Capital has organized a virtual conference for RIAs that is focused entirely on operational issues – from staffing to branding to technology to culture – issues that are as easy to ignore as they are vital to success. The RIA Practice Management Insights conference will be a two half-day, virtual conference held on March 3 and 4.

Join us and speakers like Jim Grant, Peter Nesvold, Matt Sonnen, and Meg Carpenter, among others, at the RIA Practice Management Insights, a conference unlike any other in the industry.

Have you registered yet?

RIA Valuation Insights

RIA Valuation Insights