RIA M&A Q1 2022 Transaction Update

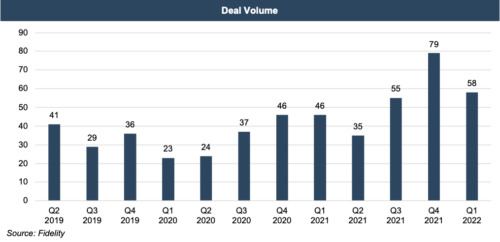

RIA M&A activity continued to trend upward through the first quarter of 2022 even as potential macro headwinds for the industry emerged. Fidelity’s March 2022 Wealth Management M&A Transaction Report listed 58 deals in the first quarter, up 26% from the first quarter of 2021. These transactions represented $89.2 billion in AUM, down 2% from the prior year quarter.

Deal volume continues to be led by serial acquirers and aggregators. Mariner, CAPTRUST, Beacon Pointe, Mercer Advisors, Creative Planning, Wealth Enhancement Group, Focus Financial, and CI Financial all completed multiple deals during the quarter. This group of companies, along with other strategic acquirers and consolidators, have continued to increase their share of industry deal volume and now account for about half of all deals. In addition to driving overall industry deal volume, the proliferation of strategic acquiror and aggregator models has led to increased competition for deals throughout the industry, which has contributed to multiple expansion and shifts to more favorable deal terms for sellers in recent years.

While deal activity remained robust, the first quarter this year was dominated by macro headlines like inflation, rising interest rates, tight labor markets, and multiple contraction in equity markets—all of which are factors that have potential to impact RIA performance and M&A activity. Rising costs and interest rates coupled with a declining fee base could lead to strain on highly-leveraged consolidator models, and a potential downturn in performance could put some sellers on the sidelines until fundamentals improve. While the duration and extent to which these trends will ultimately impact RIA M&A are still uncertain, recent pricing trends for publicly traded consolidators suggest that investors aren’t particularly optimistic about these models in the current environment.

On the other side of the equation, historically tight labor markets and rising costs could amplify certain acquisition rationales like talent acquisition and back-office synergies. Structural trends continue to support M&A activity as well: the RIA industry remains highly fragmented and growing with over 13,000 registered firms and more money managers and advisors who are capable of setting up independent shops. As advisors age, succession needs will likely continue to bring sellers to market.

Whatever net impact the current market conditions have on RIA M&A, it may take several months before the impact becomes apparent in reported deal volume given the often multi-month lag between deal negotiation, signing, and closing. But at least through March, transaction activity has remained steady. The Fidelity report lists 19 deals in March, a record level for the month and in line with the levels reported in January and February.

What Does This Mean for Your RIA?

For RIAs planning to grow through strategic acquisitions: Pricing for RIAs has continued to trend upwards in recent years, leaving you more exposed to underperformance. While the impact of current macro conditions on RIA deal volume and multiples remains to be fully seen, structural developments in the industry and the proliferation of capital availability and acquiror models will likely continue to support higher multiples than the industry has been accustomed to in the past.

That said, a long-term investment horizon is the greatest hedge against valuation risks. Short-term volatility aside, RIAs continue to be the ultimate growth and yield strategy for strategic buyers looking to grow their practice or investors capable of long-term holding periods. RIAs will likely continue to benefit from higher profitability and growth compared to broker-dealer counterparts and other diversified financial institutions.

For RIAs considering internal transactions: We’re often engaged to address valuation issues in internal transaction scenarios. Naturally, valuation considerations are front of mind in internal transactions as they are in most transactions. But how the deal is financed is often an important secondary consideration in internal transactions where buyers (usually next-gen management) lack the ability or willingness to purchase a substantial portion of the business outright.

As the RIA industry has grown, so too has the number of external capital providers who will finance internal transactions. A seller-financed note has traditionally been one of the primary ways to transition ownership to the next generation of owners (and in some instances may still be the best option), but there are also an increasing number of bank financing and other external capital options that can provide the selling partners with more immediate liquidity and potentially offer the next-gen cheaper financing costs.

If you are an RIA considering selling: After years of steadily increasing multiples and fundamental performance, RIA valuations are now at or near all-time highs. But whatever the market conditions when you go to sell, it is important to have a clear vision of your firm, its value, and what kind of partner you want before you go to market. As the RIA industry has grown, a wide spectrum of buyer profiles has emerged to accommodate different seller motivations. A strategic buyer will likely be interested in acquiring a controlling position in your firm and integrating a significant portion of the business to create scale.

At the other end of the spectrum, a sale to a patient capital provider can allow your firm to retain its independence and continue operating with minimal outside interference. Given the wide range of buyer models out there, picking the right buyer type to align with your goals and motivations is a critical decision, and one which can have a significant impact on personal and career satisfaction after the transaction closes.

RIA Valuation Insights

RIA Valuation Insights