RIA M&A Q2 Market Update

Whispered Numbers Shout

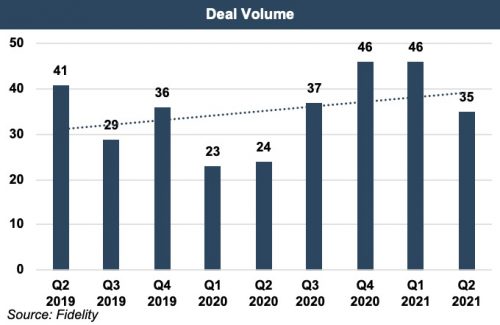

RIA MIA activity slowed somewhat in the second quarter of Q2, but RIA markets are still on track to record the highest annual deal volume on record.

In the latest RIA M&A Deal Report, Echelon Partners attributes the pace of RIA M&A to (1) secular trends, (2) supportive capital markets, and (3) potential changes in tax code in the future.

As we discussed last quarter, fee pressure in the asset management space and a lack of succession planning by many wealth managers are still driving consolidation. But the increased availability of funding in the space, in tandem with more lenient financing terms, has also caused some of this uptick. Further, the Biden administration’s proposal to increase the capital gains tax rate has accelerated some M&A activity in the short-term as sellers seek to realize gains at current tax rates.

But could some of this activity be attributable to the RIA rumor mill and the hype of double-digit multiples in the space?

He Says, She Says … “They sold their firm for 12x”

Although there are over 13,000 RIAs in the U.S., during times like these, the investment management world feels pretty small. Word travels far and fast, and often with minimal detail.

Clients have been asking us about double-digit deal multiples

Over the last few months, more of our clients are asking us about double-digit deal multiples and many owners of small firms are understandably confused when they see our comparably lower indications of value.

So how does all this transaction activity affect valuations?

Guideline Transaction Method

As independent valuation analysts, we are tasked with finding market transactions of privately held companies in the same or similar business that may provide a reasonable basis for valuation of the company we are valuing. Market transactions are used to develop valuation indications under the presumption that a similar market exists for the subject company and the comparable companies. Activity and earnings multiples developed using the market transactions method are used to capitalize appropriate estimates of AUM, revenue, and earning power for the subject company.

In most of our valuations of investment management firms, we seek perspective on the M&A market’s pricing of closely held investment management firms by evaluating transactions involving acquired U.S.-based investment management firms with between $1 billion and $25 billion of AUM. However, given the lack of publicly available information for transactions in the industry, the data from guideline transactions has limited significance for making inferences.

Even when deal multiples are “known,” they can be misleading

Every transaction has different motivators that affect the buyer’s willingness to accept a certain price and the seller’s willingness to pay up. Most RIA transactions include some form of earnout, which can skew the implied deal multiples. And more frequently, deals include some form of an earn-more consideration that may or may not be reasonable to include when calculating implied deal multiples.

Even when deal multiples are “known,” they can be misleading. A transaction priced at, say, nine times pro forma earnings – with normalized compensation, back-office synergies, anticipated changes in fee schedules, and other adjustments – might also be viewed as fifteen times earnings, as reported. So, is the deal multiple nine or fifteen?

RIA buyers are, for the most part, very sophisticated, and not disconnected from reality

Unfortunately, there is a perverse incentive to talk about the higher multiple. Sellers want to brag about how much they got. Buyers want to be seen as the most generous to attract other sellers into the process (reality can wait until after the LOI is signed). And in a market with surplus of buyers, intermediaries (the investment bankers), naturally, want to encourage sellers however they can.

Don’t get us wrong, the RIA market is very strong, and multiples are very high. But RIA buyers are, for the most part, very sophisticated, and not disconnected from reality.

Much of the confusion we see in expectations is being fueled by dozens and dozens of deal announcements with undisclosed terms. In the absence of real information, imagination fills the void. Although we have knowledge of the pricing of many undisclosed deals, we can’t directly rely on this information in a business Appraisal (with a capital “A”) – as it doesn’t constitute known or knowable information to hypothetical buyers and sellers. But all this transaction activity and the increase in observed deal multiples has, nonetheless, impacts investment management valuations. This conflict between publicly available pricing information and rumored deal multiples makes it even more important to hire a valuation firm experienced in this space.

There is no argument that multiples across the investment management space have increased

Because reliable guideline transaction information is scarce, it is essential to build the factors driving the volume of transaction activity and heightened pricing into projections and the cost of capital. Improved equity markets have been driving AUM growth. The inherent operating leverage in the business along with the realization over the last year that RIAs can operate just as efficiently with less or cheaper office space, is driving margin expansion. While it is harder to model increased demand for these businesses into a discounted cash flow model, it can serve to minimize risk and reduce discount rates. Overall, these changes to valuations are generally more subjective.

But there is no argument that multiples across the investment management space have increased. As our president, Matt Crow, has said before about RIA transaction multiples, “an option has value, even if you don’t exercise it.”

RIA Valuation Insights

RIA Valuation Insights