RIA M&A Update

RIA M&A activity has remained resilient through the first quarter of 2023, even as macro headwinds have emerged for the industry over the past year. Fidelity’s March 2023 Wealth Management M&A Transaction Report listed 68 deals through March 2023, up 19% from the 57 deals executed during the same period in 2022. These transactions represented $108.3 billion in AUM—a 21% increase from the first quarter of 2022, although much of this increase was attributable to First Citizens Bank’s purchase of Silicon Valley Bank’s $15.9 billion RIA division in March. Excluding the SVB transaction, transacted AUM was up about 4% year-over-year.

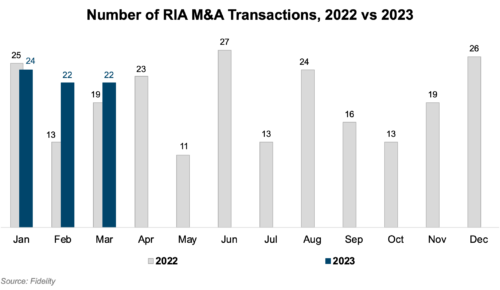

2022 was a year plagued with high inflation, rising interest rates, and tight labor markets. Rising costs and interest rates coupled with a declining fee base have put pressure on highly leveraged consolidator models. At the same time, a potential downturn in performance has left some sellers on the sidelines until fundamentals improve. Despite these pressures, M&A activity set new records in 2022 with 229 deals completed, although the pace of M&A did show signs of cooling in the second half of the year.

While macro conditions have been challenging, structural changes in the RIA landscape have continued to support deal activity. In recent years, the professionalization of the buyer market and the entrance of outside capital have driven demand and increased competition for deals. Serial acquirers and aggregators have increasingly contributed to deal volume, supported by dedicated deal teams and access to capital. Such firms accounted for approximately 65% of transactions through the first quarter of 2023. Mariner, CAPTRUST, Beacon Pointe, Wealth Enhancement Group, and Focus Financial all completed multiple deals in the first quarter of 2023.

On the supply side, the current market environment will likely have a mixed impact on bringing sellers to market. On one hand, some sellers may be reluctant to sell when the markets (and their firm’s financial performance) are down significantly from their peak. On the other hand, a concern that multiples may decline if the current market environment persists may prompt some sellers to seek an exit while multiples remain relatively robust. This dynamic has prompted many sellers to hedge their exit by pursuing a partial sale now with an eye for a more complete exit once market conditions improve.

While market conditions play a role in exit timing, the motives for sellers often encompass more than purely financial considerations. Sellers are often looking to solve succession issues, improve quality of life, and access organic growth strategies. Such deal rationales are not sensitive to the market environment and will likely continue to fuel the M&A pipeline even in a downturn. Whatever net impact the current market conditions have on RIA M&A, it may take additional time before the impact becomes apparent in reported deal volume, given the often multi-month lag between deal negotiation, signing, and closing.

What Does This Mean for Your RIA?

For RIAs planning to grow through strategic acquisitions: Pricing for RIAs has trended upwards in recent years, leaving you more exposed to underperformance. While the impact of current macro conditions on RIA deal volume and multiples remains to be fully seen, structural developments in the industry and the proliferation of capital availability and acquirer models will likely continue to support higher multiples than the industry has in the past. That said, a long-term investment horizon is the greatest hedge against valuation risks. Short-term volatility aside, RIAs continue to be the ultimate growth and yield strategy for strategic buyers looking to grow their practice or investors capable of long-term holding periods. RIAs will likely continue to benefit from higher profitability and growth than broker-dealer counterparts and other diversified financial institutions.

For RIAs considering internal transactions: We’re often engaged to address valuation issues in internal transaction scenarios. As in most transactions, valuation considerations are front of mind in internal transactions. But how the deal is financed is often a crucial secondary consideration in internal transactions where buyers (usually next-gen management) lack the ability or willingness to purchase a substantial portion of the business outright. As the RIA industry has grown, so too has the number of external capital providers who will finance internal transactions. A seller-financed note has traditionally been one of the primary ways to transition ownership to the next generation of owners (and, in some instances, may still be the best option). Still, an increasing amount of bank financing and other external capital options can provide selling partners with more immediate liquidity and potentially offer the next-gen cheaper financing costs.

If you are an RIA considering selling: Whatever the market conditions are when you go to sell, it is essential to have a clear vision of your firm, its value, and what kind of partner you want before you go to market. As the RIA industry has grown, a broad spectrum of buyer profiles has emerged to accommodate different seller motivations and allow for varying levels of autonomy post-transaction. A strategic buyer will likely be interested in acquiring a controlling position in your firm and integrating a significant portion of the business to create scale. At the other end of the spectrum, a sale to a patient capital provider can allow your firm to retain its independence and continue operating with minimal outside interference. Given the wide range of buyer models out there, picking the right buyer type to align with your goals and motivations is a critical decision that can significantly impact personal and career satisfaction after the transaction closes.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, PE firms and alternative managers, and related investment consultancies.

RIA Valuation Insights

RIA Valuation Insights