RIA Market Update: Q1 2024

With Valuations Up, Investor Interest Moves to Alts and Big-Name Managers

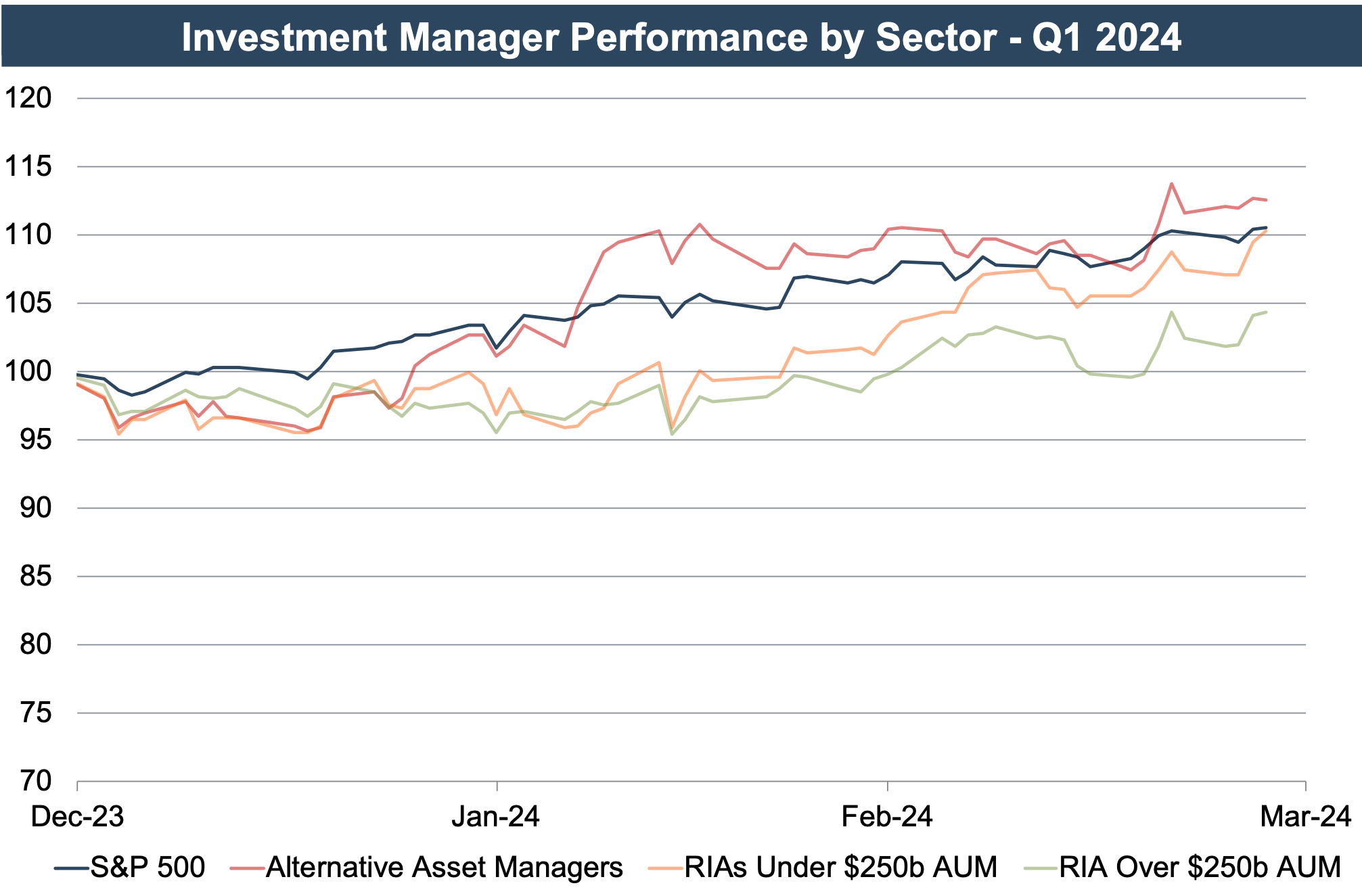

Share prices for most publicly traded asset and wealth management firms trended upward with the broader market during the first quarter of 2024. Alternative asset managers continued to outperform the market and other RIAs, ending the quarter up about 12.6%. On a year-over-year basis, all sectors of RIAs experienced growth as the markets rebounded from the 2022 slump. RIAs directly benefit from improving market conditions as they result in a stronger asset base on which to collect fees.

Performance by Sector

The market uptick in Q1 translated to increased share prices for most public RIAs. Prices for alternative investment managers experienced a stronger increase than the S&P 500, increasing by 12.6% compared to the S&P’s 10.6%. Both larger RIAs (AUM over $250 billion) and smaller RIAs (AUM under $250 billion) lagged the S&P 500, seeing price increases of 4.3% and 10.3%, respectively, during the quarter.

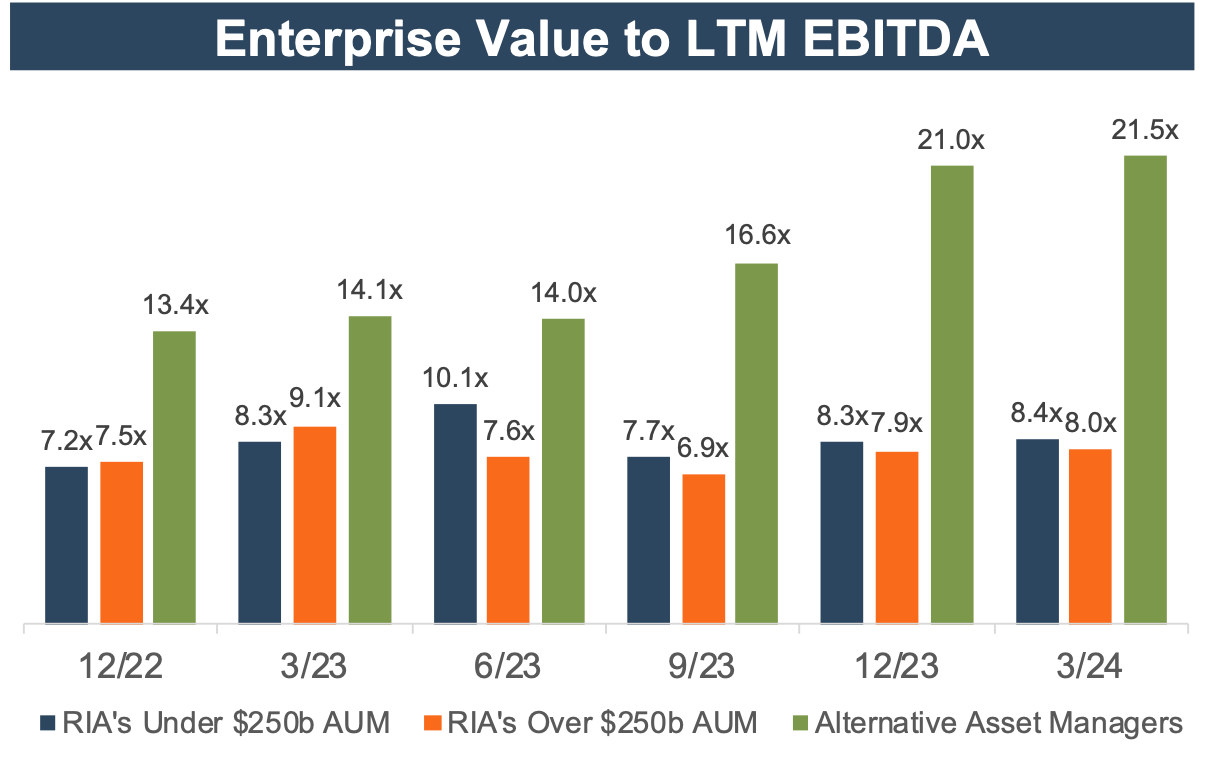

Pricing Trends

The median Enterprise Value to LTM EBITDA multiples for public RIAs increased modestly during Q1. Smaller RIAs had the strongest increase at 5.4% during the quarter. Alternative asset managers saw a 2.4% increase and larger RIAs saw an increase of 0.3%. After trending downwards for the first three quarters of 2023, multiples began to increase during the fourth quarter of 2023 and into the first quarter of 2024.

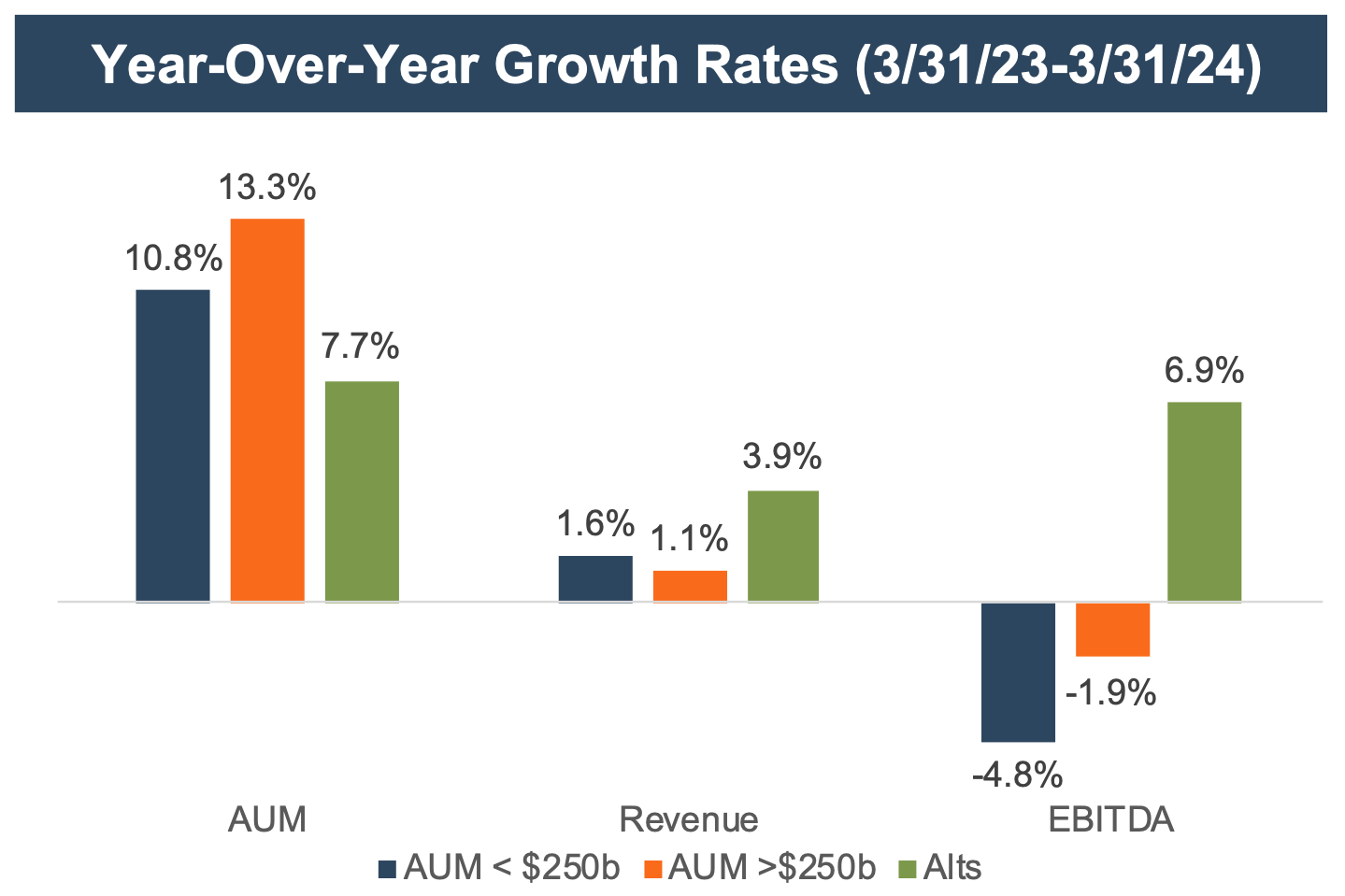

Growth Trends

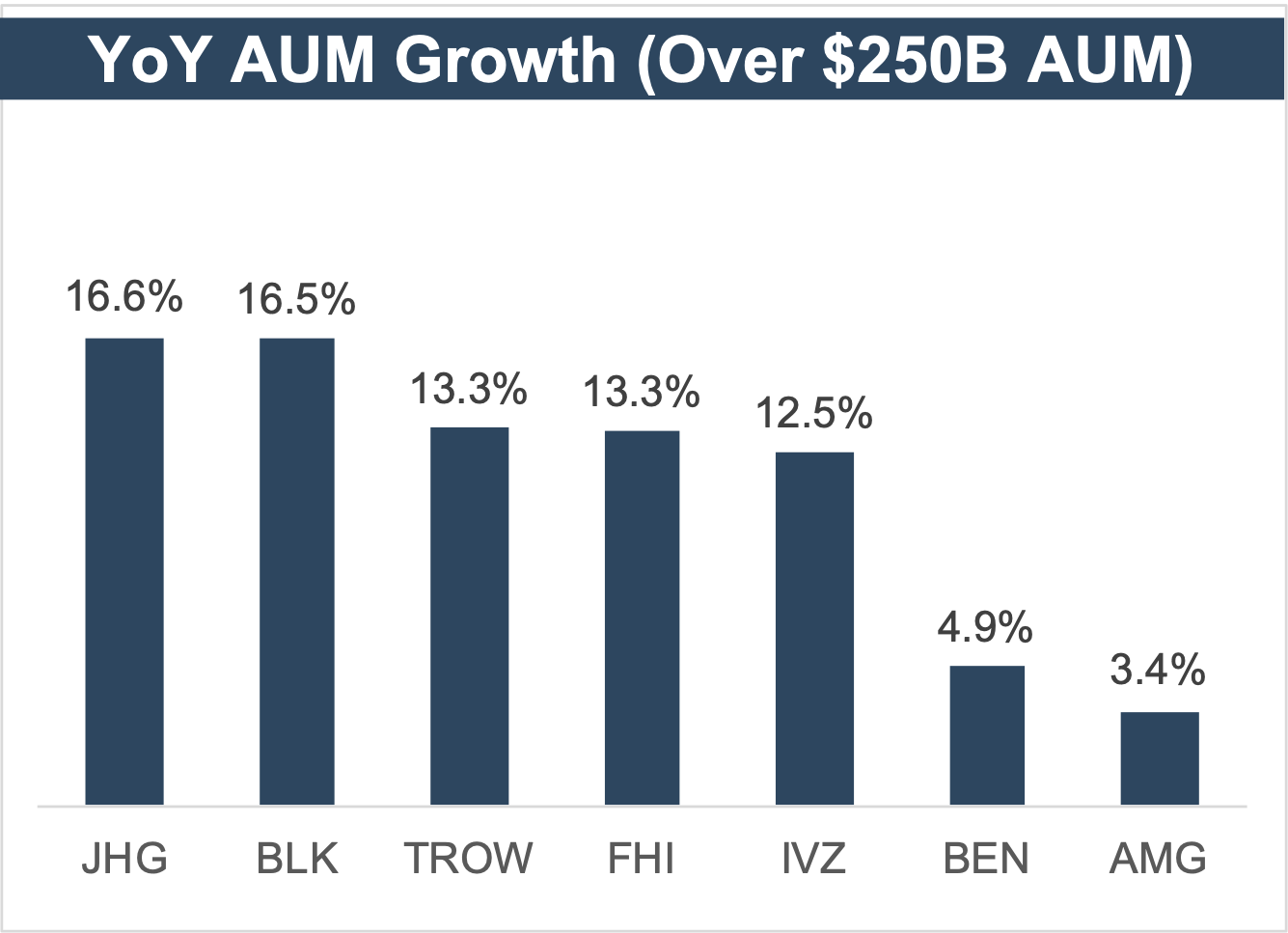

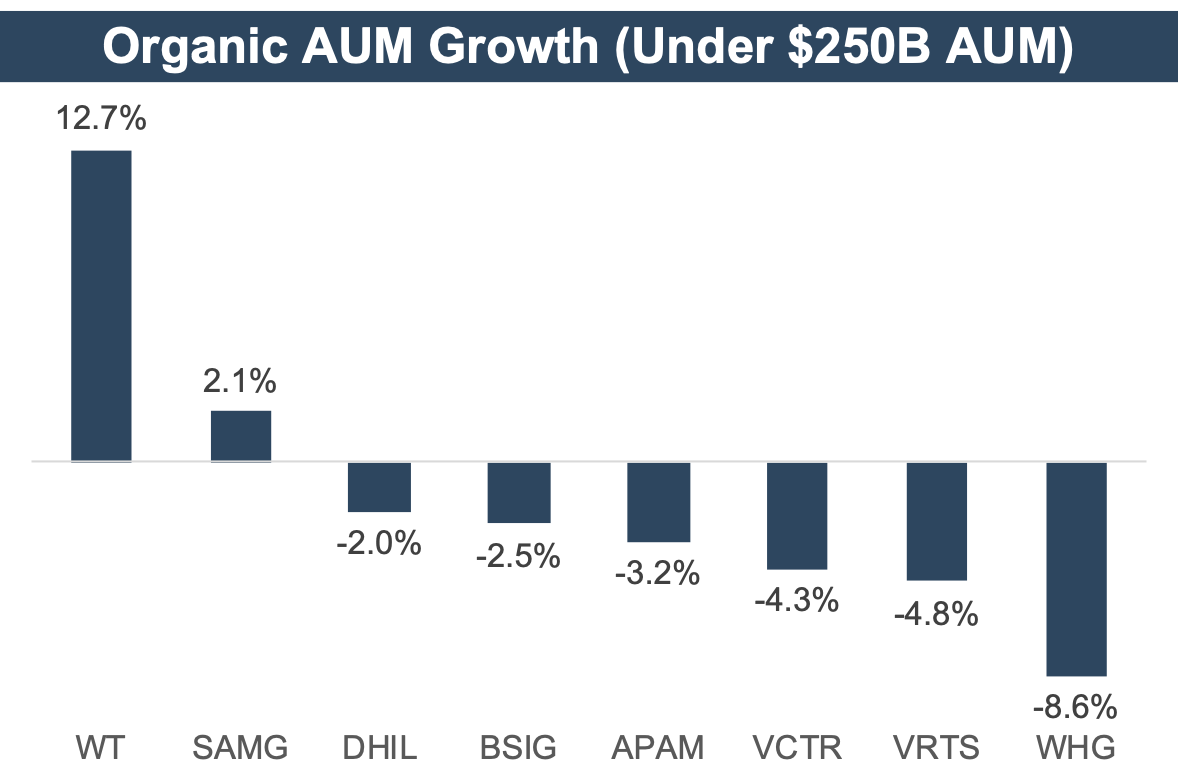

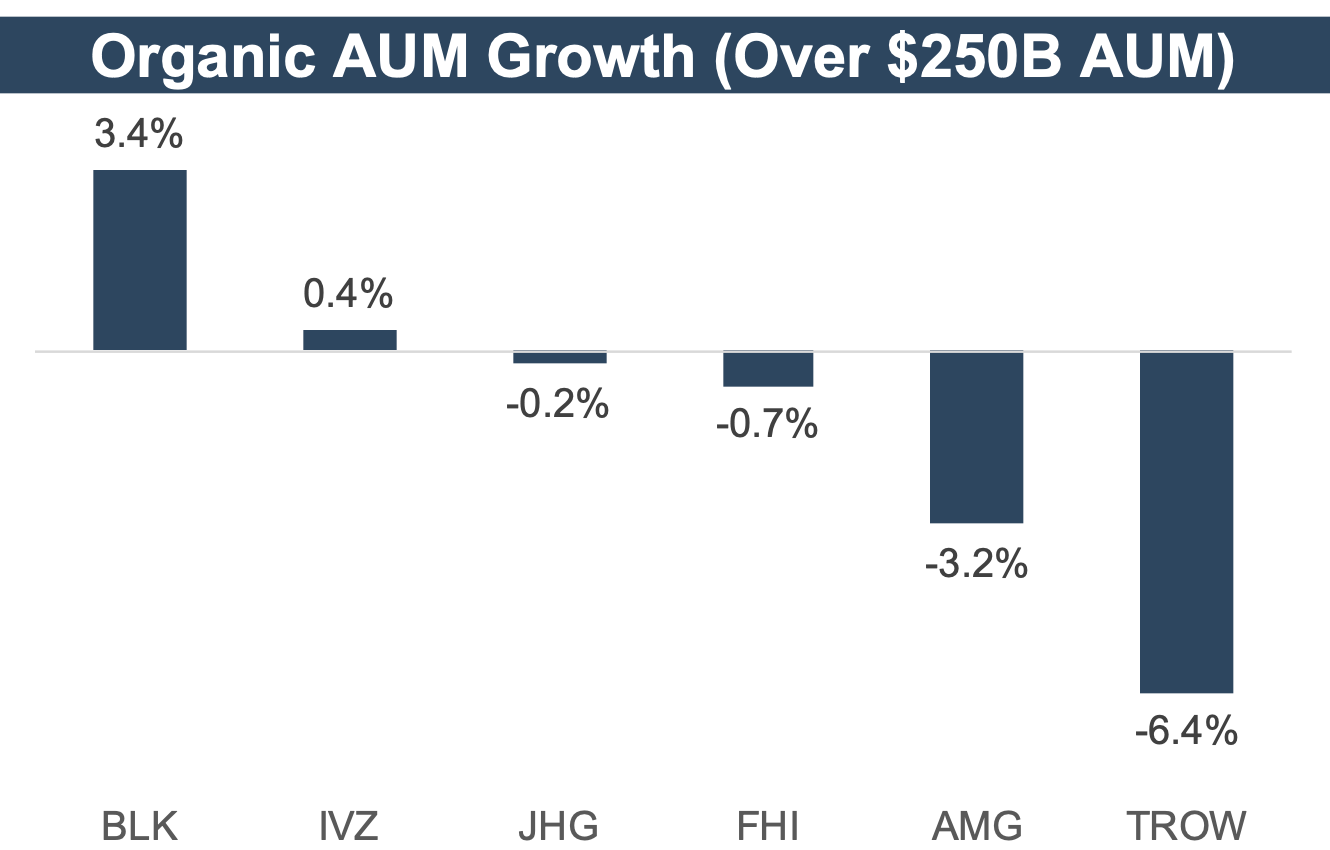

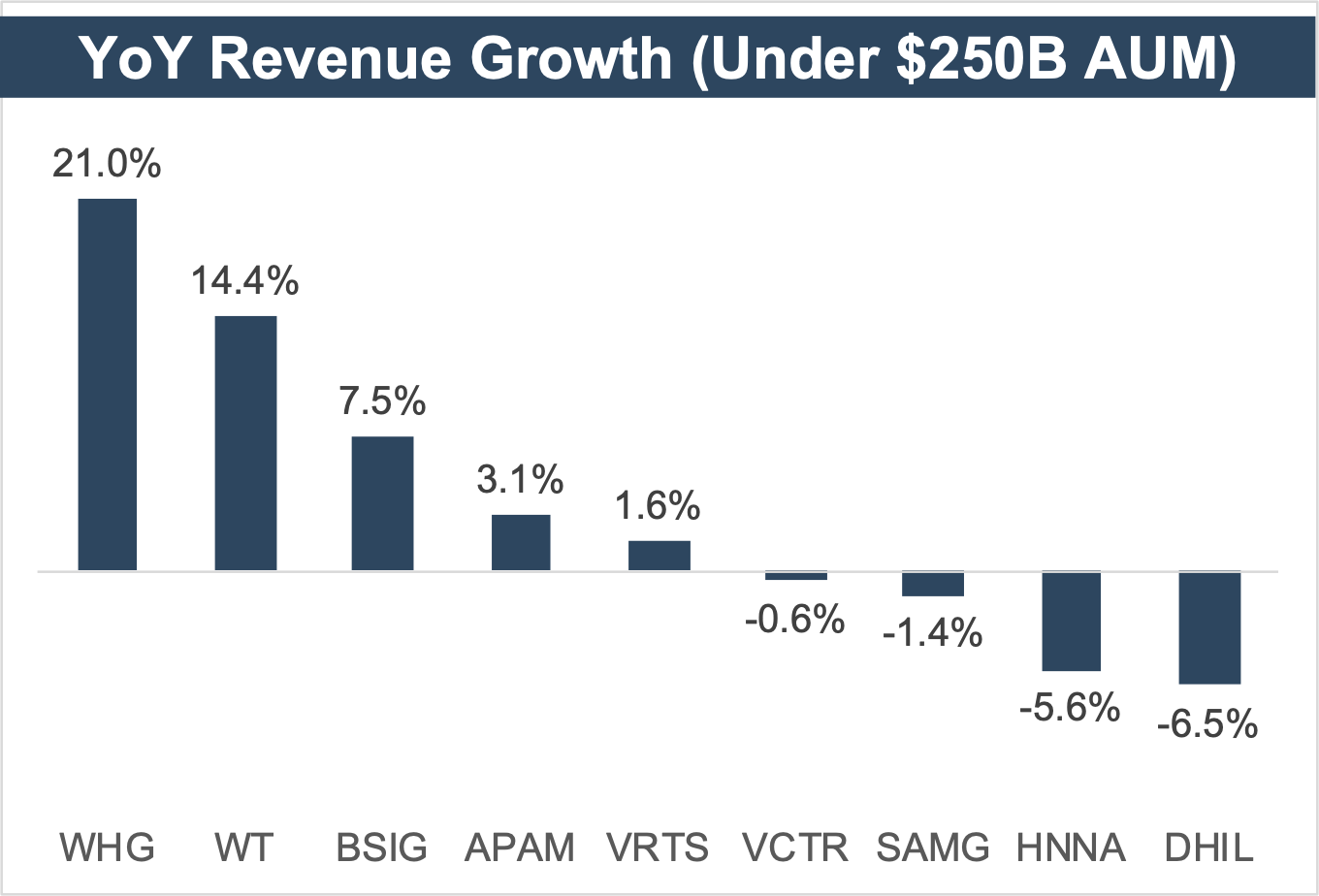

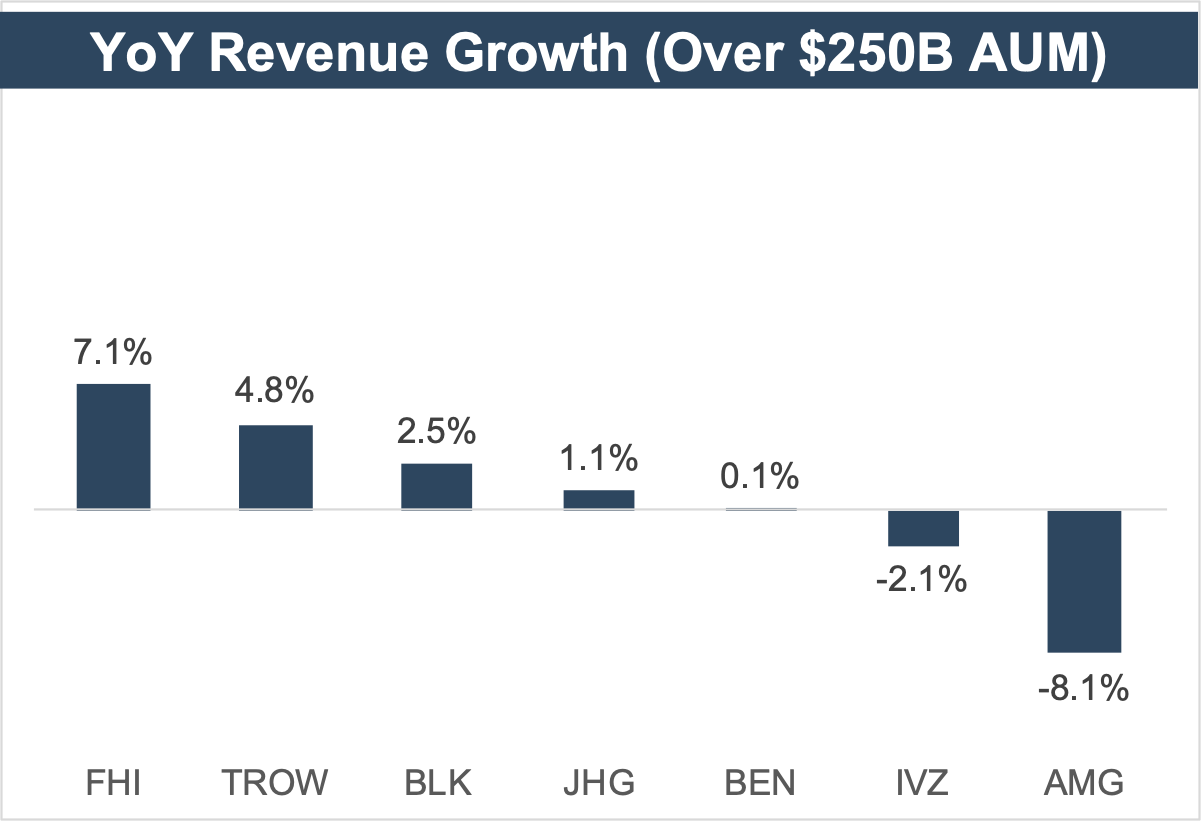

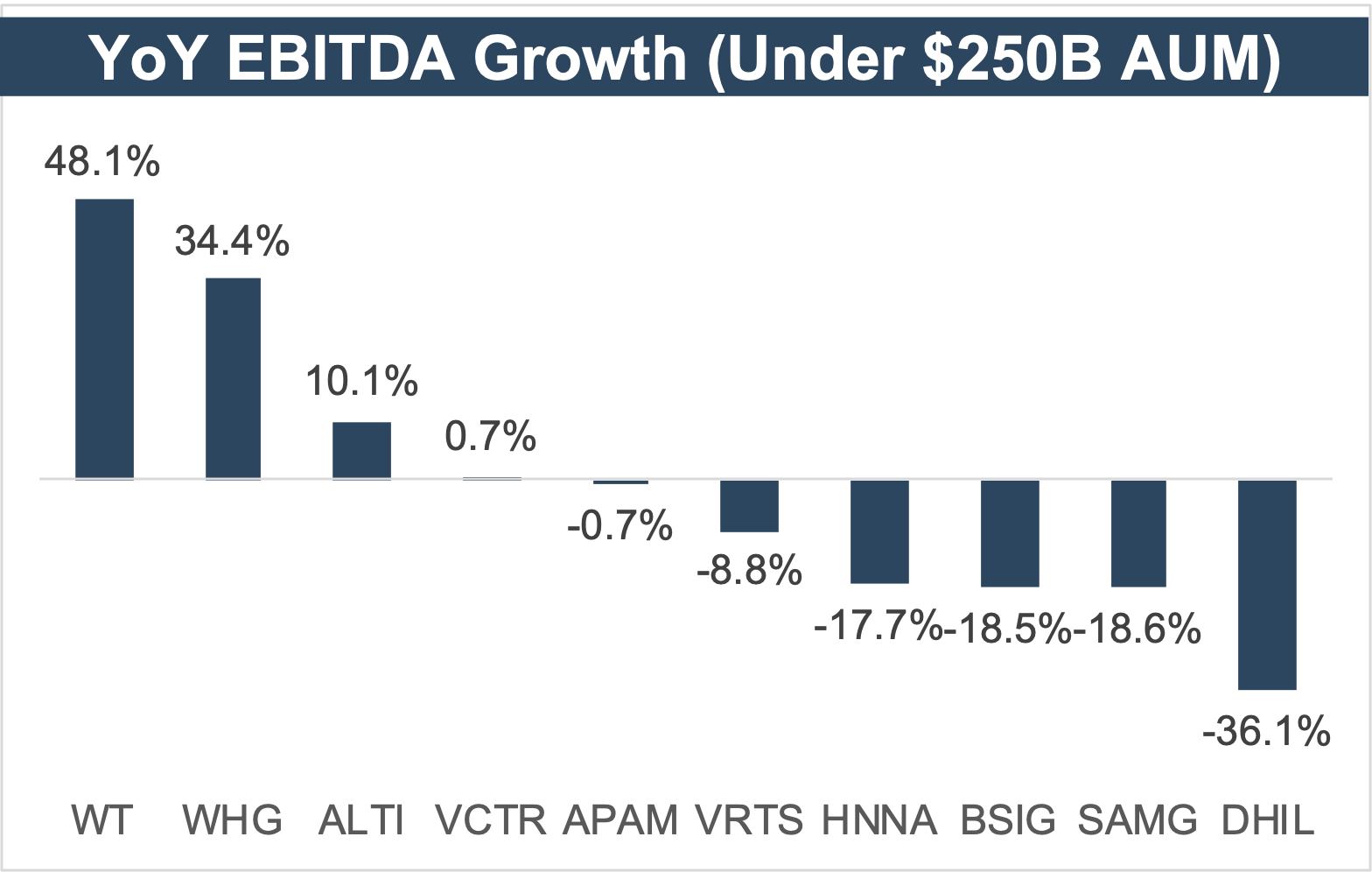

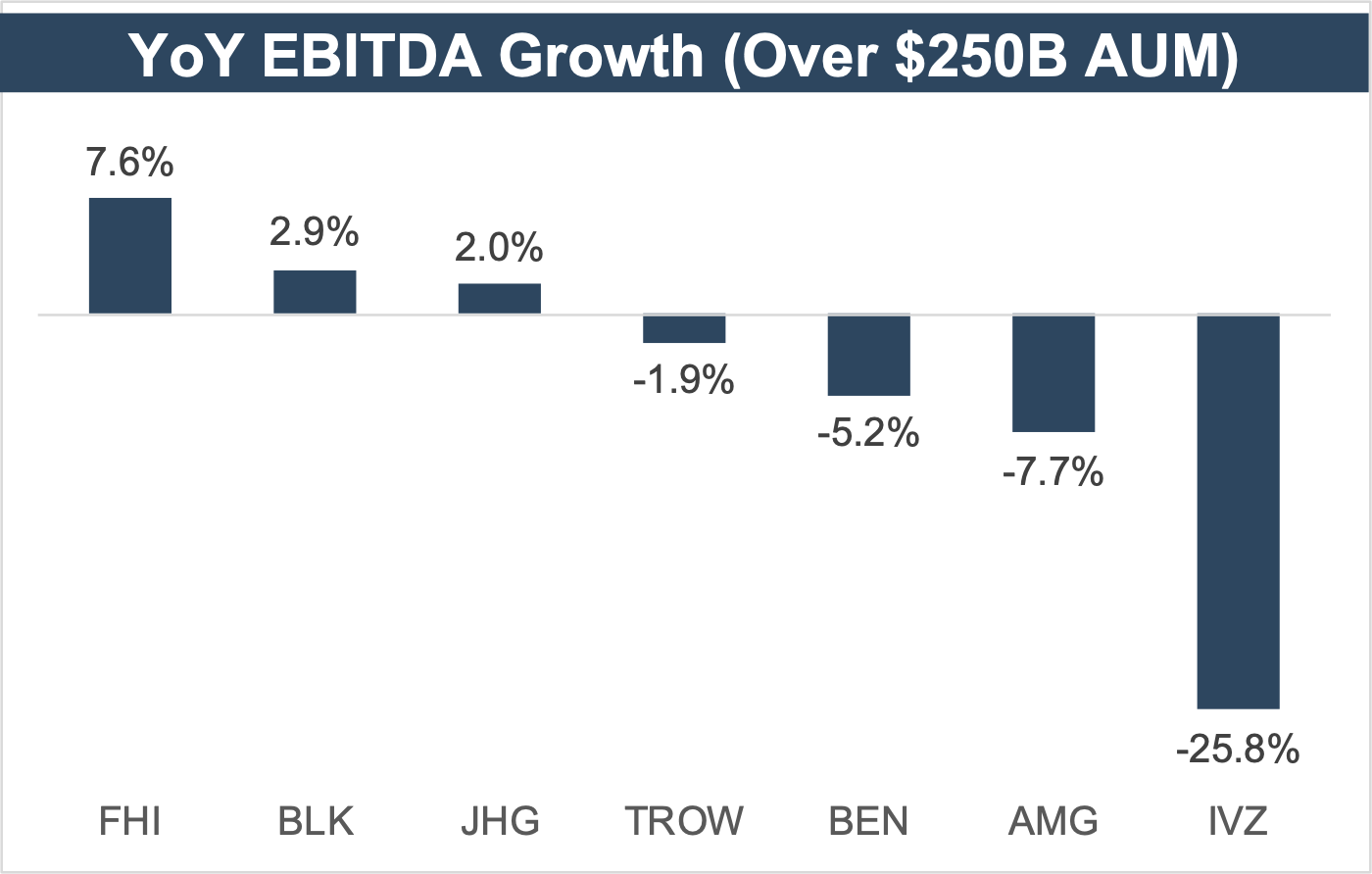

On a year-over-year basis, all sectors of RIAs experienced growth in AUM as the markets rebounded from the 2022 slump. The largest increase came from larger RIAs, which had a median increase in AUM of 13.3% over the past year. The second largest increase in AUM came from smaller RIAs which had a median increase in AUM of 10.8%. This was followed by alternative asset managers, which had a 7.7% increase in AUM over the past year. Revenue growth lagged AUM growth for all groups, reflecting lower effective realized fee levels. Both the larger (>$250B AUM) and smaller (<$250B AUM) groups of traditional asset managers reported negative EBITDA growth.

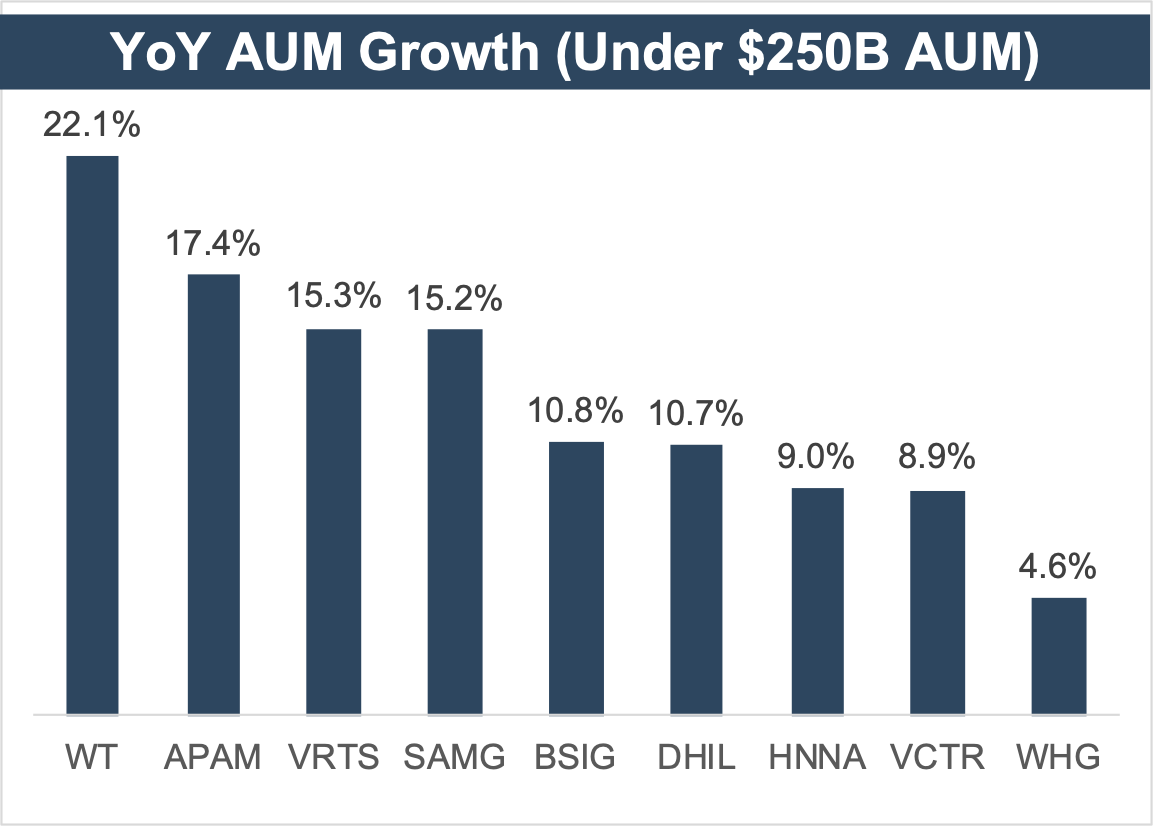

Growth in AUM for the smaller RIA group ranged between 4.6% (Westwood Holdings Group) and 22.1% (Wisdom Tree). For the Larger RIA group, AUM growth was between 3.4% (Affiliated Managers Group) and 16.6% (Janus Henderson Group).

Most RIAs experienced organic AUM outflows during the twelve months ending March 31, 2024. These organic outflows were offset by market growth, which led to a net AUM increase for all RIAs we measured.

For the smaller RIA group, revenue growth ranged from negative 6.5% (Diamond Hill) to 21.0% (Westwood Holdings). Revenue growth for larger RIAs was between negative 8.1% (Affiliated Managers Group) to 7.1% (Federated Hermes).

For the smaller RIA group, EBITDA growth ranged from negative 36.1% (Diamond Hill) to 48.1% (WisdomTree). EBITDA growth for larger RIAs was between negative 25.8% (Invesco) to 7.6% (Federated Hermes).

RIA Valuation Insights

RIA Valuation Insights