RIA Stocks Post Mixed Performance During 2Q18

Over the last several years, asset managers have benefited from global increases in financial wealth driven by a bull market in asset prices. However, favorable trends in asset prices have masked some of the headwinds the industry faces, including increasing consumer skepticism of high-fee active products and regulatory overhang.

Traditional active managers have felt these pressures most acutely, as undifferentiated active products have struggled to withstand downward fee pressure and at the same time, have been a major target of regulatory developments. To combat fee pressure, traditional asset managers have had to either pursue scale (e.g. BlackRock) or offer products that are truly differentiated (something that is difficult to do with scale). Consumers have been more receptive to the value proposition of alternative asset managers and wealth managers, and these businesses are better positioned to withstand fee pressure as a result.

Second Quarter Performance

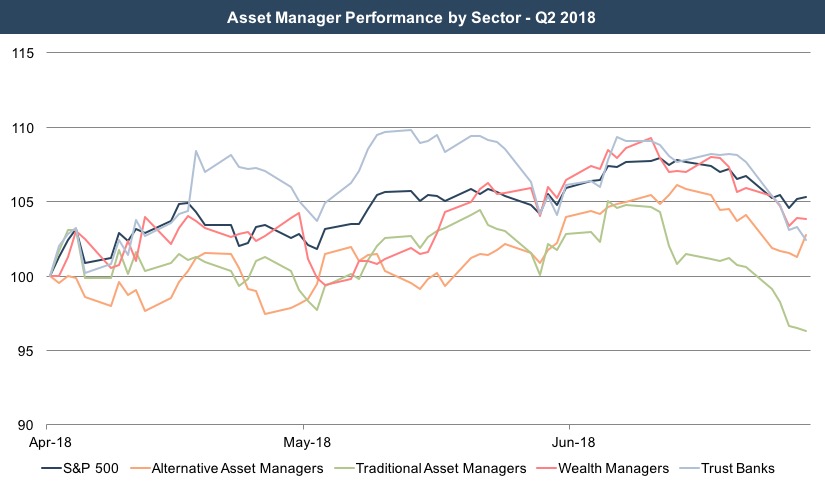

Perhaps reflective of the headwinds that the industry faces, asset managers generally underperformed broad market indices during the second quarter. While major indices regained traction during the second quarter, the returns for asset managers were generally more muted even though these businesses generally benefit from rising markets. The operating leverage inherent in the business model of most asset managers suggests that market movements tend to have an amplified effect on the profitability (and stock prices) of these businesses, and in recent quarters that has been the case. The reversal of that trend last quarter may be indicative of investors’ increasing focus on the headwinds the industry faces and the general uncertainty that arises late in the economic cycle.

Taking a closer look at recent pricing reveals that traditional asset managers, which are perhaps the most affected by fee compression trends, ended the quarter down 3.7%, while other categories of asset managers generally saw positive returns. Trust banks were up 2.4% during the quarter, buoyed by a steadily rising yield curve which portends higher NIM spreads and reinvestment income. Alternative asset managers were up 2.8% during the quarter as this product segment is less impacted by fee pressure than traditional active products. Wealth managers were up 3.8% during the quarter, buoyed by market-driven increases in AUM, although these businesses face challenges with new client acquisition and maintaining pricing power.

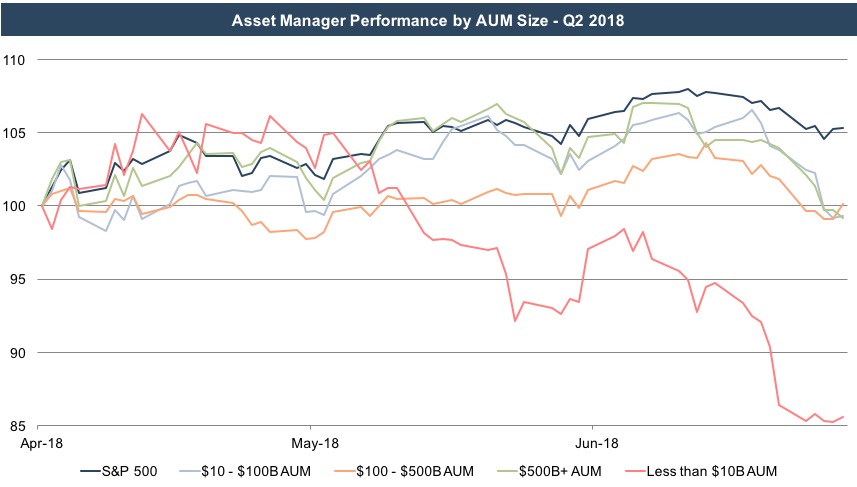

The RIA size graph below shows a similar trend for most of its categories. The smallest category of publicly traded RIAs (those with less than $10 billion AUM) was down nearly 15% during the quarter, although this is the least diversified category of RIAs with only two components. Due to the lack of diversification, the smallest category of RIAs is subject to a high degree of volatility due to company-specific developments. Most of our clients fall under this size category, and we can definitively say that these businesses (in aggregate) have not lost nearly 15% of their value since April as suggested by this graph.

Market Outlook

The outlook for these businesses is market driven – though it does vary by sector. Trust banks are more susceptible to changes in interest rates and yield curve positioning. Alternative asset managers tend to be more idiosyncratic but still influenced by investor sentiment regarding their hard-to-value assets. Wealth managers and traditional asset managers are more vulnerable to trends in active and passive investing. The outlook for the industry during the rest of 2018 ultimately depends on how the industry headwinds continue to evolve and (as always) what the market does on the back half of the year.

RIA Valuation Insights

RIA Valuation Insights