RIA Stocks Post Mixed Performance During 3Q18

During the recent market cycle, asset managers have benefited from global increases in financial wealth driven by a bull market in most asset prices. These favorable trends in asset prices have masked some of the headwinds the industry faces, including growing consumer skepticism of higher-fee products and regulatory overhang.

Traditional active managers have felt these pressures most acutely, as poorly differentiated active products struggled to withstand downward fee velocity and at the same time, have been a prime target of regulatory developments. To combat fee pressure, traditional asset managers have had to either pursue scale (e.g. BlackRock) or offer products that are truly differentiated (something that is difficult to do with scale). Investors have been more receptive to the value proposition of alternative asset managers and wealth managers, and these businesses are (so far) better positioned to maintain pricing schedules as a result.

Third Quarter Performance

Reflective of the headwinds that the industry faces, asset managers generally underperformed broad market indices during the third quarter. While major indices posted solid gains during the second quarter, the returns for asset managers were at best muted even though these businesses generally benefit from rising equity markets. The operating leverage inherent in the business model of most asset managers suggests that market movements tend to have an amplified effect on the profitability (and stock prices) of these businesses, and in recent quarters that has been the case. The reversal of that trend over the last two quarters may be indicative of investors’ increasing concerns about the headwinds the industry faces and the general uncertainty that arises late in the economic/market cycle.

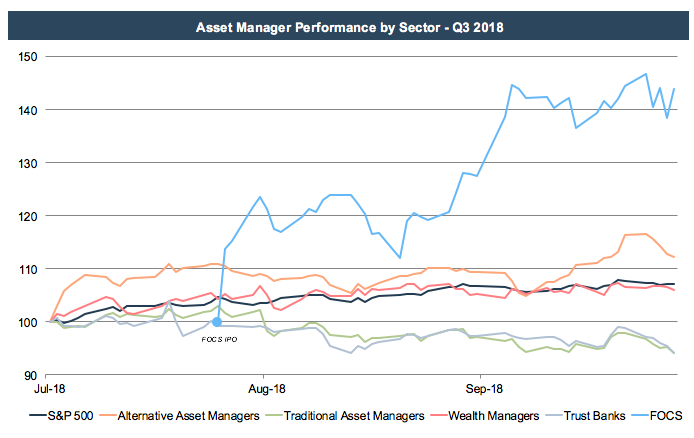

Taking a closer look at recent pricing reveals that traditional asset managers, which are perhaps the most affected by fee compression trends, ended the quarter down 5.9%. Trust banks were also down 5.9% during the quarter, driven by poor performance at State Street and BNY Mellon – the index’s two largest components – after both companies reported weak Q2 performance and STT announced that it would acquire financial data firm Charles River Systems at a poorly-received valuation of $2.6 billion (9x revenue). Alternative asset managers were up 12.2% and were the only sector to outperform the S&P 500. Alternative managers have generally performed well in recent quarters as the product segment is less impacted by fee pressure than traditional active products. Wealth managers were up 6.0% during the quarter, buoyed by market-driven increases in AUM, although these businesses face challenges with new client acquisition and maintaining pricing power.

While wealth managers performed well during the quarter, they were outpaced by wealth management firm aggregator Focus Financial Partners (“FOCS”), which closed out the quarter up 44% since its noteworthy IPO in late July. FOCS, of course, is not an RIA, but since FOCS is an aggregation of RIA cash flows, some comparison between FOCS and RIAs is inevitable. FOCS is not necessarily a proxy for the performance of RIAs since the success of the FOCS business model depends on more than just the performance of its partner firms. This is particularly true now as FOCS is growing rapidly and investors are arguably more attuned to FOCS’s ability to string together acquisitions at attractive deal terms than on the performance of the partner firms post-acquisition. Over time, FOCS’s performance should bear some resemblance to that of the underlying partner firms, but right now the performance of FOCS might not be telling us much other than affirming the market’s conviction that it will continue to grow rapidly through acquisitions.

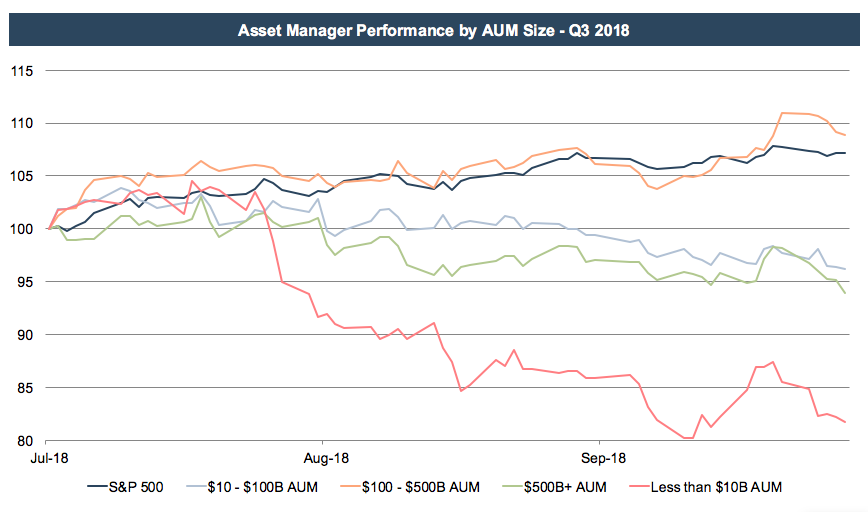

Looking at the RIA size graph reveals that the mid-size public RIAs ($100-$500B AUM) were the clear winners over the quarter, up nearly 9%. RIAs with $10-$100B in AUM were down nearly 4.0%, while the largest category ($500B+ AUM) was down just over 6%. The smallest category of publicly traded RIAs (those with less than $10 billion AUM) was down over 18% during the quarter, although this is the least diversified category of RIAs with only two components. Due to the lack of diversification, the smallest category of RIAs is subject to a high degree of volatility due to company-specific developments. Most of our clients fall under this size category, and we can definitively say that these businesses (in aggregate) have not lost over 18% of their value since July as suggested by this graph.

Market Outlook

The outlook for these businesses is market driven, though it does vary by sector. Trust banks are more susceptible to changes in interest rates and yield curve positioning. Alternative asset managers tend to be more idiosyncratic but still influenced by investor sentiment regarding their hard-to-value assets. Wealth managers and traditional asset managers are more vulnerable to trends in active and passive investing. The outlook for the industry during the rest of 2018 ultimately depends on how the industry headwinds continue to evolve and (as always) what the market does during the fourth quarter.

RIA Valuation Insights

RIA Valuation Insights