RIAs Are a Value Investment in a Growth Obsessed World

Maybe That’s Okay

Something for (almost everyone): The Lamborghini Urus | Source: Lamborghini.com

The holy grail for automotive producers is a high-margin (i.e., high priced) product that they can sell in volume. After watching Porsche revive its failing fortunes with a pair of sport SUVs, Lamborghini jumped into the fray with the Urus. Despite an unfortunate name and a face only a Lamborghini driver could love, the Urus has a top speed of 200 miles an hour, seats four comfortably, and has a hatch large enough for a weekend Costco run (just don’t attempt all three at once). Most importantly for Lamborghini, the Urus sold 20,000 units over the first four years of its production run, a number previously unthinkable for the boutique Italian automaker.

That unit volume didn’t happen because the Urus is anybody’s idea of a low-cost solution. At $225K plus per copy, the Lambo is proof that there is substantial demand for that kind of all-around product – whether it’s necessary or not.

Are RIAs Growth Stocks or Value Stocks?

We think of investment management firms as a “growth and income” play. The space has attracted capital specifically because RIAs produce a reliable stream of distributable cash flow with the upside coming from market tailwinds and new clients. For all the trade press touting interest in RIAs, investing trends over the past fifteen years have had a mixed impact on the investment management community.

For asset managers, cheap capital makes stock picking less important. Persistent alpha is harder to prove. Passive and alternative products are more competitive. Investment committees are surly. Fee pressure is rampant.

For wealth managers, cheap capital has made diversification look kind of pointless and bordering on stupid. In the rearview mirror, owning anything other than the S&P 500 has, since the credit crisis, looked like a mistake. While this may not have had an immediate impact on revenue and margins, it does nothing to cement advisor/client relationships.

But what about valuations? Where do RIAs fit in an environment that favors growth stocks?

Can RIAs Be Considered Growth Stocks?

If you think of growth stocks as companies producing super-normal increases in revenue – double-digit upside that might even exceed their cost of capital – then it’s difficult to put investment management firms in that category. Growing revenue requires growing AUM. Even with favorable markets, consistent AUM growth greater than single digits is difficult to achieve.

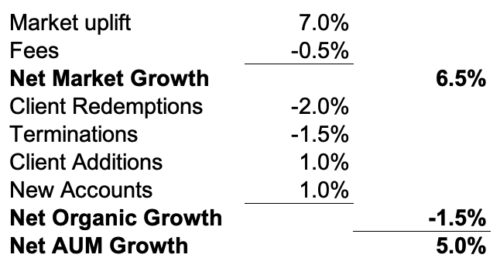

Breaking down AUM growth into its constituent parts is revealing. A typical client of ours might enjoy significant market returns, even net of fees. But seasoned firms have seasoned clients, and seasoned clients draw income from their accounts and leave for various reasons. Client additions to existing accounts are sporadic, and new accounts can be hard to win.

Even with AUM growth, pressure on realized fees can inhibit revenue growth – and increases in realized fees are rare indeed. So, growing profitability faster than AUM requires margin expansion. Margin expansion at an RIA generally requires managing labor costs. In this labor market, that’s difficult.

Margin Matters to Value Investors

So maybe RIAs aren’t a growth stock, so what about value?

Publicly traded RIAs tend to be priced at a discount to prevailing market multiples. IPOs are backed up this year, with several waiting in the wings. The heads of these companies won’t come right out and say it, but most, if not all, are loathe to go public at the six or seven times EBITDA the market is currently offering. Instead, the public investment management space has been characterized by consolidation and buy-back programs aimed at creating shareholder value in the face of increasingly competitive markets.

The private market appreciates the promise of strong and consistent streams of distributable cash flow, which has attracted investment dollars in the hopes of building value through scale, enhancing returns with leverage, and multiple arbitrage. An accommodative Fed has made leverage attractive, and the hope of one day selling to a willing public or an aggressive PE firm has kept transaction activity robust. As interest rates march higher and public markets sag, this narrative may become harder to support. Even so, the play on RIAs as a value investment has endured through strong and weak markets for decades, because consistent cash flow margins appeal to certain types of investors.

Growth versus Value

One of the longest running trends in public equities is the persistent outperformance of value stocks versus growth. For nearly 70 years, from the start of World War 2 until the credit crisis of 2008-09, value stocks usually outperformed growth with the exception of brief periods like the dotcom run of the late 1990s. But for a decade now, quality of earnings hasn’t mattered as much as quantity of growth.

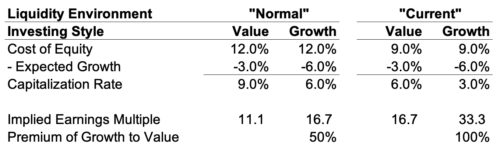

The recent growth over value phenomenon is easily explained by unprecedented market liquidity, starting with the credit crisis and extending through the pandemic, that provided ample excess capital to fuel demand for financial securities. A quick glance at equity pricing in a low versus a more normal cost of capital environment reveals the impact of cheap money on equity multiples, vis-à-vis expected growth.

The specific impact of an accommodative Fed and massive policy stimulus on the cost of equity capital is debatable, but the impact on equity valuations is not. A lower cost of capital leads to multiple expansion, and directly favors growth stocks relative to value. In this rate environment, it’s hard for investment managers to get noticed in the public markets.

Everything Has a Place

If the automotive market has a place for Lamborghini SUVs, then surely the investor community has a place for RIAs. As it is, the space tends to get ignored as a value play and oversold as a growth opportunity. It’s a bit of both. Those familiar with investor behavior in the SaaS community know about the Rule of 40, in which the sum of revenue growth and cash flow margin are summed (or portioned in a formula) and “better” models produce growth plus margins in excess of 40%.

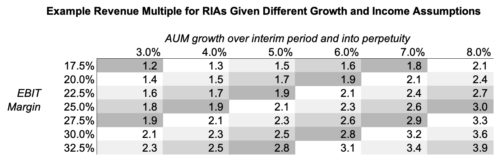

This blended measure of growth and income doesn’t exactly translate into the RIA space, but if we run a sample DCF with some common assumptions about the cost of capital (mid-teens), fee schedules (50 basis points and flat), and margin sustainability (also flat), then we can see implied valuations (measured as a revenue multiple) remaining fairly consistent if you look at a percentage point of AUM growth being worth about the same as 2.5% in margin (say, 25% margin and 5% AUM growth produces about the same revenue multiple as a 30% margin and 3% revenue growth).

This example isn’t meant to be probative of anything, except to say that trading some margin for growth can enhance valuations in the RIA space, but it’s not an all-or-nothing proposition. Striking a balance between profitability and upside provides more value for investors, and, ultimately, more value for the investment.

RIA Valuation Insights

RIA Valuation Insights